A few weeks ago, I wrote about my first international stock – Fuji Oozx – a net net stock trading in Japan.

Japan has the highest quality net-nets of anywhere in the world, and despite the historic challenges of investing in the country, I’ve taken the plunge and allocated a small but not insignificant portion of my portfolio into a few of the most promising net-net stocks.

Company Overview

Dainichi Co. LTD (5951:TYO) manufactures and sells oil heating and environmental equipment such as kerosene heaters, air purifiers, fuel stoves, humidifiers, and coffee makers. Just like Fuji Oozx, Dainichi has been in business for decades, going back to the company’s start in 1964.

These are the businesses I like investing in, boring businesses that are often ignored by investors looking to capture the newest technology trend.

Financial Results

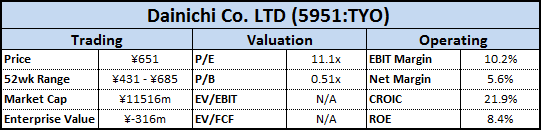

As with many Japanese companies, Dainichi reported its 2011 annual results last month, reporting sales of ¥18,738 million, up 2.18% over the prior year.

The company saw a steep drop-off in sales during 2008 (when sales fell to ¥14,712 million), but business has rebounded nicely since then.

Operating income came in at ¥1,904 million, with operating margins returning to double digits, a significant improvement over the ~4% margins during the depths of the recession.

Net income was ¥1,041 million, the best result since 2007.

Importantly, the company has remained profitable for the past 10 years, a rarity in the world of net-net investing.

In all likelihood, Dainichi will continue to report decent profits for the foreseeable future.

Balance Sheet

However, my investment in the company is due to the balance sheet rather than earnings power.

At recent prices, the stock trades with a market cap of roughly ¥11,500 million, yet carries ¥11,038 million in cash and cash equivalents on the balance sheet.

Combining this cash balance with the ¥792 million in “Securities” translates into a negative enterprise value, meaning the market is assigning a negative value to an operating business that is cash flow positive and profitable.

In addition, the company also holds ¥3,745 million in “Investment Securities”, which includes equity shares, company bonds, and municipal & government bonds.

Although these types of securities are usually not included in the cash balance, they represent relatively liquid securities which can be easily converted to cash.

This means that a large portion of Dainichi’s NCAV is made up of highly liquid assets, as opposed to other net-nets where the majority of assets are tied up in things like inventory (which are usually company-specific and often end up obsolete).

Book value is ¥22,374m, for a P/B value of 0.51. Book value has grown since 2006, but only at 1.43% CAGR, typical for many of the small Japanese companies I have researched.

While growth is low, the company has reduced shares outstanding at a decent rate, with shares falling from 19.1m in 2006 to 17.7m in 2011, for a net reduction of roughly 7%.

Valuation

For a Japanese net-net, Dainichi’s operating metrics are pretty decent: average ROE is 4.29%, ROIC is 8.42%, and CROIC is 8.2%.

FCF yield is currently 5.4% using 2011 owner earnings – however, capex in 2011 was 2x the average from previous years, a number that had traditionally been very stable.

FCF using the formula “operating cash flow – capex” is much lumpier, but at current prices, translates into a FCF yield of more than 23%.

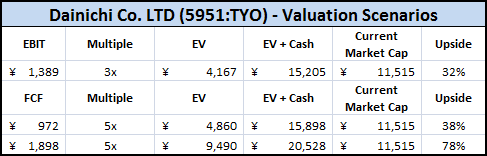

Here are several valuation scenarios after applying very conservative assumptions to the value of the operating business:

Both the EBIT and FCF figures (FCF is calculated using both owner earnings and traditional FCF) are using the company’s 5-year averages, which obviously take into account the global recession of 2008/2009 – Dainichi’s true earnings power is likely higher.

Conclusion

The recent Japanese earthquake did not affect Dainichi’s 2011 figures, but results could be impacted in the upcoming quarters.

There is also currency risk with the Japanese yen, a risk that I’m choosing not to hedge (read this post on currency and value investing for a good explanation of my position on currencies, along with my conclusion in the Fuji Oozx post).

While Dainichi is not ‘exciting,’ consistently profitable, cash flow producing companies should not be selling for less than net cash, and would never do so in the private market.

Despite Japan’s record of poor corporate governance and anemic investment returns, I think there is a substantial margin of safety in investing in these net-net situations. It will likely take a few years for the market to re-price these securities, but I don’t think they will stay ignored forever.

In the mean time, Dainichi pays a dividend, currently yielding 2.81%, cushioning the waiting game a little bit.

Disclosure

Long Dainichi (5951:TYO)

Check out another view on the company here.