The recreational vehicle (R/V) market was absolutely crushed during the recession of 2008 and 2009, as customers put off major discretionary items.

Coastal Distribution System (CRV), a part maker and distributor of over 12,000 RV and boating parts, supplies and accessories, was hit especially hard, with sales dropping more than 40% between 2006-2009.

Despite the company’s struggles, the industry appears to have hit rock bottom and the future outlook has started to show signs of improvement.

While CRV probably won’t see 2006 levels anytime soon, the stock should rally as the company and industry ‘revert back to the mean.’

Financials

2009 revenues were $103.2m, well off the peak of $179.1m in 2006. However, the company has managed to streamline operations during that time period.

In 2009, management’s cost cutting measures reduced SGA expenses by $8m, or 30.2%, over 2008.

Gross margins have remained steady throughout the downturn, around 18-19%, with a slight uptick as the company moves towards self-designed products (for the most recent quarter, approx. 33% of sales were from Coast’s own brand).

Both operating and net margins are extremely tight, averaging 2.6% and 0.9% over the past five years.

Quarterly Results

Through the first six months of the year, revenues were up an encouraging 4.3%, but with an even stronger improvement on the bottom line.

Operating income jumped 141.8% compared to the same period last year, as the company even managed to squeeze out a slight profit in the 1st quarter (usually the seasonal low period for R/V sales).

FCF so far in 2010 has been $1.2m, a big improvement over 2007-2009 (average of $0.43m), but still a ways off from 2003-2006 (average of $3.4m)

Industry Trends

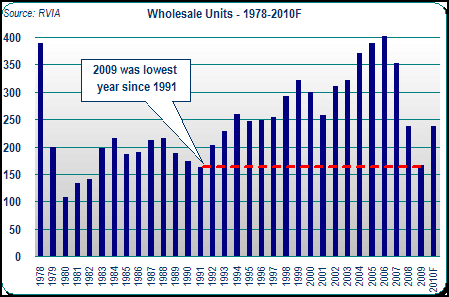

As the chart shows, R/V sales took a dramatic dive during the recession to a low of 165.4k units in 2009, a level last seen in 1991.

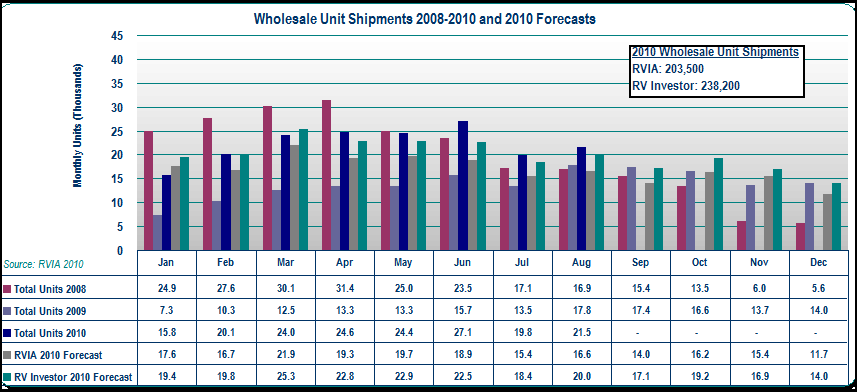

However, after four consecutive annual declines, industry trends are starting to show significant improvement, with wholesale unit shipments up more than 71% YoY so far in 2010.

While this torrid growth will slow, the higher end of 2010 forecasts show total annual wholesale shipments of 238.2k, a 44% increase.

2011 estimates expect a further increase in wholesale shipments to 256.9k units, an 8.2% increase from the projected 2010 total.

While the increase is impressive, a portion can be attributed to dealer’s re-stocking their inventory after cutting back significantly during 2008 and 2009.

On the retail front, the latest surveys show that retail sales of motorhomes increased 8.8% in May 2010, with towable sales up 10% in the same period.

Although there is a lag in new purchases vs. the requirement to purchase parts, this data is welcome sign for CRV, as the company is well positioned to take advantage of these trends as sales improve (for another cyclical play, check out Vicon Industries – VII).

Demographic Trends

The U.S. population is positioned for a large increase in the number of baby boomers that will be nearing retirement, the prime age for R/V purchases.

According to the RVIA, in 2010, the number of consumers aged 50 to 64 will be 57m, 38% higher than 2000 – one-in-ten consumers within this age group own at least one R/V.

Other factors such as the potential for higher fuel costs and more weekend getaways will also help spur the demand for R/Vs, as studies have shown that traveling by R/V is significantly less expensive than other forms of travel.

Both of these factors will combine for increased R/V purchases and greater demand for the corresponding parts.

Risks

While management has done a good job of paying down debt and reducing operating costs, CRV’s long-term efficiency averages are less than ideal.

5 year averages:

- CROIC – 5.6%

- ROE – 5%

- ROA – 2.3%

Compare these numbers to Drew Industries (DW), the company’s closest competitor:

- CROIC – 12.6%

- ROE – 15.5%

- ROA –10.4%

CRV’s cash flow has also been inconsistent over the past decade, falling into a ‘boom-bust’ cycle every 3-4 years.

So despite the very positive macro-trends, management must still prove they can capitalize on the opportunity.

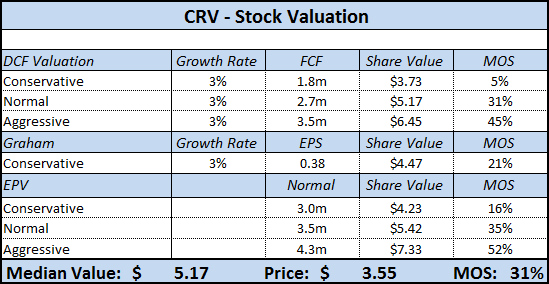

Despite these risks, the company appears to be cheap on several measures.

Valuation

The stock trades at less than half of book value and a 35% discount to NCAV – as a profitable company that is aggressively paying down debt and stockpiling cash, CRV appears to be undervalued at current levels.

Historically, the stock has traded with a P/B of 0.8 – applying this multiple to the current stock price, and the value would be $5.50, in-line with the above estimates.

Conclusion

Overall, Coastal Distribution System (CRV) is an interesting play on the strength and speed of the recovery in the R/V market.

According to the Recreation Vehicle Industry Association’s (RVIA), the summer/fall survey shows that:

“46 percent of RV owners are considering another purchase. Twenty-two percent said that they’re looking to buy in the next year, while 44 percent said within the next two years.”

Buoyed by strong demographic trends and a positive outlook for the industry, CRV has the potential to capitalize on this opportunity to grab market share and grow.

While I wouldn’t consider CRV for a long-term holding, the stock price should appreciate as the entire industry recovers, and could make for a strong investment, especially if the stock happens to fall under $3.

Disclosure

No positions.