A good portion of special situation investing, or ‘workouts’, involve transactions with limited upside and tight spreads, yet significant downside risk if the transaction is called off.

The drawn out situation with the Emmis Communications (EMMS) going private transaction is a prime example of the risks with these transactions.

Last week, the deal fell apart after the company failed to negotiate a deal with a group of preferred lockout holders and the company’s original financier, Alden Global Capital.

Transaction Background

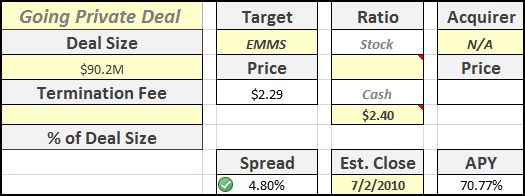

As I originally wrote back in back in June, the company’s CEO and Chairman, Jeff Smulyan, was trying to take EMMS private in a cash offer for $2.40/shr.

At the time, the deal was offering a spread of nearly 5%, with most conditions for the transaction all but guaranteed since Smulyan owned a controlling interest in the radio operator.

Preferred Shareholder Lockout

However, as I wrote several weeks later, the EMMS transaction was derailed when a group of preferred shareholders came together to collectively vote against the deal.

While the intentions were never disclosed, it is likely that lockout group was trying to get better terms as part of the transaction, as the company’s original offer priced the preferred shares at only 60% of face value.

After the lockout was announced on July 9, the parties engaged in a back and forth round of negotiations over the next two months.

Vote Delayed – Again and again and again…

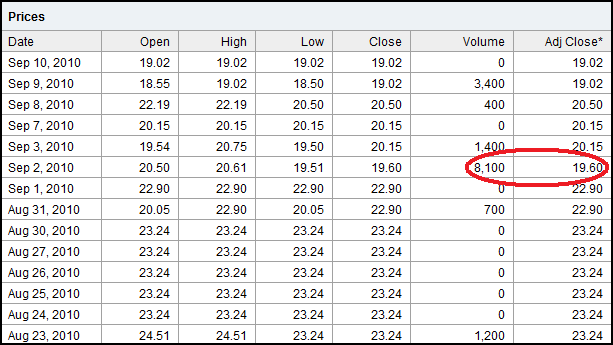

EMMS’s stock varied widely during the time period, generally falling during periods of no news before leaping back up after another extension.

On August 4th, the company put out a positive press release, saying that the company was seeking an alternative structure for the transaction, only to extend the offer again.

On August 30th, another extension was announced, but with new and dire language:

“Emmis, JS Parent, JS Acquisition, Mr. Smulyan, Alden and the representatives of the group of holders of Preferred Stock negotiated and agreed in principle on revised economic terms for the contemplated transactions that each indicated it would support. Subsequently, Alden has informed Emmis, JS Parent, JS Acquisition and Mr. Smulyan that it would no longer support the negotiated terms. Accordingly, although discussions are continuing, JS Acquisition believes it is unlikely that an agreement will be reached with either Alden or the group of holders of Preferred Stock.”

In total, the shareholder vote was delayed a staggering 9 times, as it looked increasingly unlikely that the transaction would be completed.

Deal Falls Apart

On Sept 9th, EMMS’s going private transaction officially collapsed. According to the company’s COO,

“I think Jeff and the entire Emmis team are bitterly disappointed that the transaction didn’t conclude successfully,” Patrick M. Walsh, Emmis’ chief operating officer, said Thursday morning. “We thought we had a deal, and it’s unfortunate that Alden backed away from the deal.”

The stock market reacted swiftly, and the stock dropped more the 33% over the ensuing week.

Exiting my Position

I held onto my stock through most of the long ordeal, counting on the fact it would be very difficult for Smulyan to walk away from the deal again if there was any way possible to complete the transaction.

In addition to the negative press release on August 30th, strange trading in the preferred shares caught my eye as well. I’d been closely monitoring the preferred shares throughout the ordeal, figuring they would give a better picture about the odds of success.

On Thurs, Sep 2, the preferred shares (EMMSP) dropped more than 14%, with a large sale of 8.1k shares. This was by far the largest sale in the previous 2 months, and significantly below the original purchase price of many of the lockout holders.

Combined with an increase in the common price (the common & preferred had traded mostly in sync since the lockout), it appeared that someone ‘in-the-know’ had sold out.

I sold my shares on Friday, August 30, at $1.70, for a loss of 26%.

Lessons Learned

These special situations investments are designed to supplement an existing portfolio, with many ‘easy’ transactions for small but guaranteed profits.

With these investments, it is very easy to feel committed to a position, even though the circumstances surrounding the deal can change drastically.

In hindsight, I should have sold my shares for a small loss as soon as the lockout was announced (knowing I could probably buy back in if a deal was reached again.)

I’m sure a similar situation will occur in the future, and next time I’ll be disciplined enough to sell when the guarantee is no longer there. No sense in being too risky while picking up nickels in front of a steamroller!

Disclosure

None