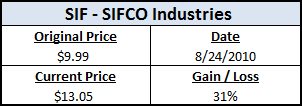

SIFCO Industries Inc (SIF) is engaged in the sale of various metalworking products and services, and has been in business since 1916.

The stock price has been volatile over the past three years, touching $24 back in 2007, falling to $4.30 in 2008, and recovering to $17 earlier this year.

The company is heavily dependent on the fortunes of the commercial airline industry (similar to SVT, a Value Uncovered holding), causing a cyclical revenue pattern – the stock price has dropped almost 40% from its yearly highs as the company struggles with weak short-term demand in the airline industry.

Despite the price volatility, the company has improved its financial condition by producing solid operating income and cash flow.

Overview

The company is organized into three different business segments.

Aerospace Component Manufacturing Group

“This segment of the Company’s business consists principally of the manufacture of forged components for aerospace applications.”

This segment is the primary driver for the company’s future growth, producing $68.6M in sales during fiscal 2009, or 73% of total revenues – a percentage that has been increasing each year. The segment also benefits from the highest operating margins of any of the business segments.

Two customers, Rolls-Royce Corporation and United Technologies Corporation account for 18% and 13% of sales respectively. Usually, this type of customer concentration poses a major risk to the business.

However, SIFCO works off of multi-year agreements and has had long-standing customer relationships going back over ten years. That is an incredibly long track record for such a small company, and shows that they provide integral services to some of the world’s largest industrial conglomerates.

Turbine Component Services and Repair Group

“This segment of the Company’s business consists principally of the repair and remanufacture of small aerospace turbine engine components.”

Over the past three years, the Repair Group has contributed between 12-14% of company sales. Although SIF owns several proprietary repair techniques and has to undergo extensive approval processes, the Repair Group segment appears to be turning into a commodity-like business.

Operating margins back up this view, averaging 0.22% over the past three years.

Applied Surface Concepts Group

“The Company’s Applied Surface Concepts Group (“ASC Group”) provides surface enhancement technologies principally related to selective electrochemical finishing and anodizing…the Company believes that the ASC Group is the world’s largest selective electrochemical finishing company”

The ASC Group benefits from a base of over 1,000 customers. Metal finishing products have much shorter lead times and smaller contract values, providing a nice balance to the long-term contracts in the ACM group.

Financials

Revenues hit a high of $101.3M in 2008 before falling to $93.8M last year. Based on fiscal 3rd quarter results, sales have dropped another 15% or so in 2010 as the company continues to deal with weak demand in the aerospace market.

Revenue decreases have also impacted the bottom line, with profits slipping 38%.

The economic downturn has taken its toll on SIF’s customers, who have delayed or reduced build rates for the company’s aircraft. Despite the short-term sales drop, the outlook remains very bright for the industry – sales should return as global demand picks up.

Despite the financial hit, the company remains solidly profitable and has continued to throw off cash. Debt to equity has dropped every year since 2004 (140.9%), and is now down to 41.5%.

Capital expenditures have increased – estimated cap-ex will end up between $5.5-5.6M, much higher than the long-term average of $2.3M – as the company expands production capabilities for its ACM group.

CROIC was a very respectable 16.5% and 18.3% over the past two years. 3-yr ROE is 17.8%, a substantial improvement over the company’s long term average.

Positive Catalysts

Industry Outlook

According to the latest report from the Aerospace Industries Association’s (AIA), the outlook for the aerospace segment is bright:

“A game changer such as the Boeing 787 airliner, as well as pent up demand for environmentally-friendly and fuel efficient aircraft will reinvigorate the aerospace industry and drive demand for years to come.”

While the pace will slow in 2011, it is an optimistic report that bodes well for the long-term success of SIFCO’s business. It also validates the company’s decision to focus on the ACM segment and should lead to higher margins in the future.

Strategic Divesture

In Jan 2009, the company announced that it was exploring strategic alternatives for the Repair Group in order to enhance shareholder value. This is a positive move, as the segment has only been mildly profitable over the past few years.

While there has been no news since the announcement, a sale to a 3rd party would allow SIFCO to concentrate on its core competency and potentially unlock value for shareholders.

Share Buyback

In June 2010, the board of directors announced a share buyback program for up to $1M. At current prices, the buyback could retire approx 2% of the company’s outstanding stock.

While not a huge amount, the buyback would boost EPS, as management believes that the current stock price does not reflect the company’s true value.

SIFCO has built up its cash position to $24.7M, so a special dividend might be a possibility as well.

Negatives

Cyclicality

Obviously, the company needs to stem the bleeding on the sales front and return to top-line growth. The business model is heavily dependent on the fortunes of the airline industry, a notoriously difficult and cyclical business.

Until revenue and profits return, the market will continue to keep the stock price depressed.

Insider Selling

Several insiders, including the corporate controller and CFO, were heavy sellers back in March and April of this year. At the time, the stock was trading at over $17, after gaining over 300% in a little over a year.

The insider trading also forewarned the drop in sales/profits in the subsequent quarter.

While I’d much prefer to see insider buying, there are certainly valid reasons for insiders to sell stocks (the timing was right around income tax season).

Trust Ownership

Currently, two trusts hold over 50% of common shares. Approx 37% is held by a Voting Trust that was entered into in 2007 as a way to

“continue the investment of the signing shareholders in SIFCO and to continue to maintain the stability of SIFCO through the Trustees’ exercise of voting control over the SIFCO Shares in the Voting Trust”

This Voting Trust looks to be at least partially setup by Mr. Smith (Director) and Mr. Gotschall (CEO) for their dependents/descendents.

The other trust seems to be for investment purposes, as most shares were purchased near the stock price lows back in 2008.

Together, they make it very difficult for a merger or acquisition to unlock shareholder value unless it is expressedly approved and in the best interest of these trusts – potentially putting them at odds with the rest of the common shareholders.

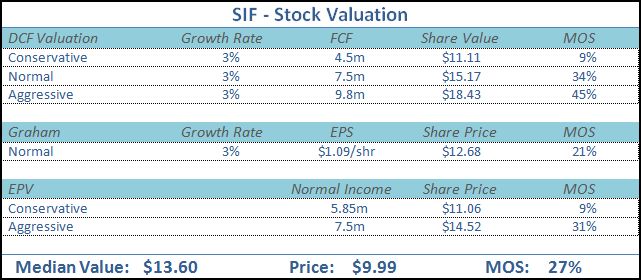

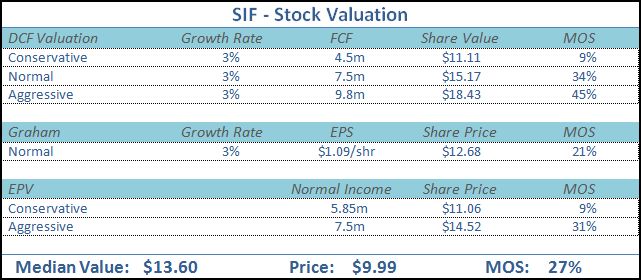

Valuation

These valuation assumptions are very conservative as FCF for 2009 was 9.8M, and TTM is $7.8M. I used a 15% discount rate for the DCF calculation.

These valuation assumptions are very conservative as FCF for 2009 was 9.8M, and TTM is $7.8M. I used a 15% discount rate for the DCF calculation.

Conclusion

The stock is a contrarian play based on the short-term numbers, as many investors will avoid a stock that has reported such poor comparables over the past two quarters.

Short-term, the company will probably suffer through another rough quarter to close out the fiscal year.

Long-term, my normal/aggressive valuation assumptions assume that sales will stabilize as the aerospace market turns around. There are several potential catalysts to help move the stock price along as well.

If the turnaround occurs, the last few quarters could be just a bit of turbulence on the flight towards future long-term gains.

Disclosure

No current positions.