Servotronics reported Q1 results two weeks ago, and the market certainly reacted favorably! Almost 44k shares traded hands – average volume is around 2k – and the stock jumped almost 30% during intraday trading before closing at $10.04, a 19.54% gain. The stock has dipped since then but it’s rising back towards $10.

Back in March, investors will remember that the stock took a 25% hit after reporting a large decrease in net income, as the Consumer Product division barely broke even for the year. I certainly felt like the March drop was an overreaction and the company’s press release seemed to back up this sentiment:

Notwithstanding the reported reduction in year to year net income, the net income for 2009 was the 3rd highest net income reported by Servotronics during the past 25 years. Also, the 2009 reported net income was approximately 50% higher than the reported net income for the Company’s 4th best year during the same 25 year period. The Company’s 3 best years, as measured by net income during the past 25 years, occurred during the last 3 years (i.e., 2009, 2008 and 2007).

Q1 Financial Numbers

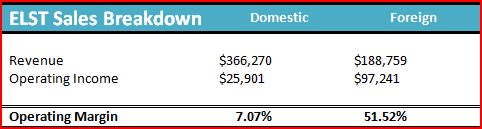

Total revenue increased by 4.6%, with a 13.2% increase in the Consumer Product division. Net income increased a staggering 397.6%, as margins improved across the board due to a better product mix. Although these are obviously very positive results, the company’s product mix constantly shifts from quarter to quarter, especially since a large percentage of sales come from governmental contracts, so it is important to keep these numbers in perspective.

Outlook

The most exciting part of this quarter is management’s cautiously optimistic report on the future of the aerospace industry. Several major aircraft manufacturers have announced plans to increase production in late 2010, 2011, and 2012. As a supplier of ‘servo-control components,’ a necessary part of airplane hydraulics, SVT is well positioned to capitalize on this growth.

I expect the company to continue to deliver impressive operating results as they ramp up production to meet this increased demand.

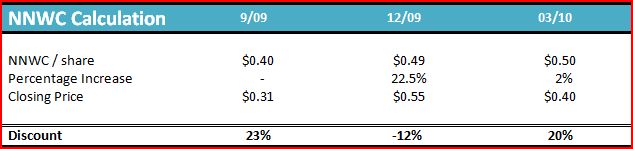

Valuation

I calculate an intrinsic value between $15 and $17 per share, providing substantial upside at the current price.

Disclosure

Long SVT