China Agri-Business Inc. (CHBU) has been holding in my Value Uncovered model portfolio since June, when the company was selling at a discount to its NNWC.

The company reported outstanding second quarter earnings 10 days ago, with the stock jumping over 20% on the news, before falling back over the last week.

CHBU remains in solid financial shape and is growing like crazy, and yet is trading for less than NNWC.

Financial Highlights

CHBU reported a huge increase in sales for the first half of the year on strength of the company’s “New Agriculture-Generator” initiative. Net revenues jumped an outstanding 325% to $4.99M compared to revenues of $1.17M in the prior year period.

For the second quarter, net income increased 206%, increasing quarterly earnings per share to $0.06.

Gross margin has dropped significantly compared to last year, from 73% to 35%, as the company undergoes a transformation to the new direct store sales model.

Despite the change in gross margin, both operating and net margin levels remain extremely high at 23% and 21.8% respectively (the company pays no taxes).

The company’s balance sheet is extremely solid, with a current ratio of 13.9 – with most of these assets being liquid.

Despite significant investments in equipment this year, CHBU continues to throw off cash, generating 757k in FCF for the year so far, more than doubling the amount from a year ago.

New Sales Model

Based on these results, the company is moving to an entirely new sales model going forward. Direct store sales now make up over 80% of the CHBU’s total revenues, as the traditional sales network becomes less of a focus.

Growth was largely driven by an expansion in the number of total stores, increasing from 250 to 346 in a single quarter. The company expects 500 stores by October 2010, several months earlier than previously forecasted.

Although the new model has much lower margins than the traditional network, the rapid growth like this is hard to ignore. Despite the impressive steps China has taken as a country overall, there remains a huge rural population that could benefit from the company’s products.

According to the press release,

“At the Company’s direct sales stores, farmers can purchase fertilizer products, including organic fertilizers made by China Agri, have access to the Company’s sales staff who are knowledgeable about the products offered, and receive services that include technical support. This will help farmers to increase their crop yields and productivity and, in turn, should encourage them to be loyal long-term customers for China Agri.”

Valuation

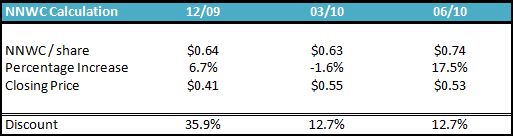

My original investment thesis was based on the fact that the stock was a Net/Net trading at less than net cash. Here are updated numbers for the past few quarters:

Based on the most recent closing price, the stock is currently selling at a 22% discount to NNWC.

Conclusion

It is not often that the market provides a growing, cash flow positive stock with a market cap less than the cash on the balance sheet. CHBU is a capital-light business with little debt and obvious growth potential.

As with many Chinese stocks, management and disclosure is always a concern. The company has limited experience running a retail operation and will assuredly run into growing pains as the torrid expansion eventually slows.

The company is also in line to purchase a large parcel of land to expand capacity, a transaction that will cut into the margin of safety on a NNWC basis.

However, if CHBU continues to report operating results like this quarter, the stock might be worth holding on to as an earnings/growth play, rather than just a value investment based on assets.

Disclosure

Long CHBU