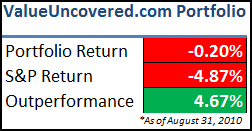

The equity markets continue to be rocky as August finished up, with the S&P 500 dropping 4.5%. The Value Uncovered model portfolio followed the market down as well, dipping into the red for the first time since inception.

Stock Positions

August was another very busy month on the earnings front, as many stocks reported their results for the quarter ending June 30th.

After turning in a great second quarter (including a nice special dividend of $1/shr), SPAN followed by reporting tough 3rd quarter results. The stock was the biggest loser in August, dropping below my initial entry point back in October of last year.

With dividends included, the position in SPAN is still positive and I expect a big fourth quarter.

Both APNC and TPCS reported solid results, with TPCS reporting a huge jump in revenue while APNC chugged along with another increase in quarterly net income. ADVC continues to hum along as the tiny software company that nobody is talking about.

CHBU reported a ridiculous 300%+ growth in sales, and the stock still trades for less than net cash.

NOOF was the biggest gainer in August, up over 16%, as the stock finally rebounded from its 52-week low. Another bout of insider buying helped add credibility, and the company finally seems to be turning a corner – NOOF is too cheap to remain below $2 for long.

Despite going through hundreds of financial statements, only one stock met my criteria for investment, as I added DIT to the model portfolio. The stock is a great turnaround story, and I believe management will continue to consolidate and grow in a very competitive business.

Special Situations

FIS was another successful special situations investment that took advantage of a major recapitalization plan and self-tender offer. The position netted a 4.69% gain in a little less than a month, for an APY of 81.8%.

However, another special situations investment is in big trouble – EMMS. Jeff Smulyan, the company’s CEO, has run into all sorts of problems with taking the company private.

Details are still very sketchy, but the deal looks to be in serious jeopardy. I find it hard to believe that Smulyan would let this same situation happen to him again (he tried to take the company private a few years ago and failed), but it looks like the market expects it to fall apart.

I will be monitoring the situation closely and may be forced to sell at a substantial loss.

Performance

The portfolio slipped into negative territory YTD, but is still ahead of the S&P benchmark. Check out my holdings page for a full rundown.

As all of these investments are in micro-cap stocks, often with little or no liquidity, the market fluctuations can have significant impact on the portfolio’s return over a given month or even quarter.

Although I’m disappointed in the monthly results, it is more important to look at the portfolio over a longer time period. I am constantly reevaluating my positions and will make changes as needed.

Final Thoughts

Also, I am considering slightly modifying the structure of the Value Uncovered portfolio to keep track of cash balances (see an example here from the wonderful blog, the SINLetter)

For a model portfolio, this new structure should provide a more accurate portrayal of real investment returns while allowing me to accurately represent position sizing.

I hope to make the changes soon.

Disclosure

Long SPAN, TPCS, APNC, ADVC, CHBU, NOOF, DIT, EMMS