As usual, here are a few value investing ideas from the past few weeks:

Retail Holdings (RHDGF)

This is an outstanding and well-researched writeup from the SumZero analyst community. RHDGF is an undervalued stock on a sum-of-parts basis, with significant near-term catalysts to unlock shareholder value.

It seems to be a favorite of many prominent value investors and bloggers and was recently featured by Jae Jun of Old School Value.

Aberdeen International (AABFV.PK)

Although technically from a few weeks ago, I just came across this post from Baskerville Capital on Aberdeen International, a Canadian investment company traded at more than a 50% discount to its Net Asset Value.

The company has initiated a stock buyback program, a possible catalyst for increasing the share price.

While the stock has appreciated since the original article, the author’s valuation spreadsheet is included, allowing investors to make their own calculations with new assumptions.

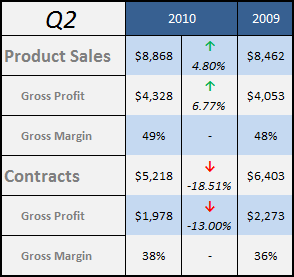

The GSI Group (LASR.PK)

A mainstay on Weekend Values, AAOI has another well researched post on a post-bankruptcy reorganization with The GSI Group.

The market is valuing the business based on historical sales figures, even though recent results show a marked improvement in most operating metrics.

The equity committee has done a tremendous job of increasing its ownership in the company post-reorg, and new management will have an opportunity to right the ship going forward.

Mirant Corp. (MIR)

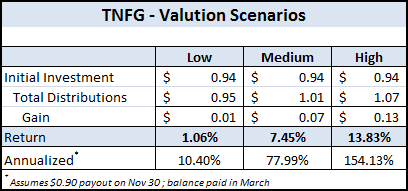

The Manual of Ideas publishes well-research investor newsletters, and recently posted a potentially undervalued stock in Mirant (MIR).

Using industry metrics such as EV / Generating Capacity, the article argues that both companies are selling for substantially less than similar competitors.

Investing Papers of Benjamin Graham

In addition to their always impressive stock analysis and valuation work, Valuehuntr has put together a very impressive compilation of original Benjamin Graham papers. The father of value investing, Graham’s writings and books have influenced most of the great value investors.

These papers were not published in either of Graham’s well-known books and will make for awesome reading for any serious value student.

Disclosure

No positions.