After a steady decline from mid-February, the S&P bottomed out on March 16 – roughly break-even for the year at that point – before rallying strongly to close out the first quarter of 2011 up 5.9%.

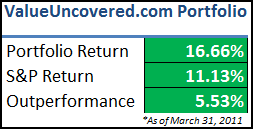

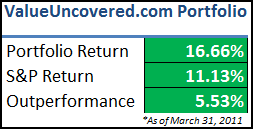

The ValueUncovered model portfolio has continued to fare well, outperforming the S&P by 5.53% since inception.

While I am pleased with this performance, it is becoming harder to track this model portfolio – see additional thoughts below.

Holdings

I’ve updated the Holdings page to reflect the current positions and prices as of March 31, 2011. The portfolio currently holdings 12 standard positions, along with 2 work-outs (TNFG, NEXC).

Nine out of the twelve long positions are currently in positive territory, but only seven of those nine are outperforming the S&P.

Interestingly enough, the laggards in the portfolio are primarily my oldest positions, going back to late 2009 and early 2010.

My investment philosophy has changed a great deal since starting this blog, and hopefully my analytical skills and business sense have improved as well, reflecting in the better performance for newer positions.

(That’s what’s I tell myself at least, even though it’s probably just random!)

Lowlights

New Frontier Media (NOOF) is currently the biggest loser in the portfolio, down 12.81%, although the price is up slightly since 12/31.

NOOF reported a significant revenue increase in the fiscal third quarter, and should benefit from an upcoming office move and equipment investment.

Not to be outdone, APT fell sharply during the quarter after reporting an 85% decrease in annual earnings. I knew the company would be facing difficult QoQ comparables as it made the transition to the lower-margin building supply segment, but the market reacted more strongly than I thought to the news.

APT’s balance sheet remains strong.

In January, NEXC surprisingly reported a substantial restatement of its estimated liquidation distribution, from the initial $0.12 – $0.16 per share to no more than $0.09 per share.

I am shocked by the news, as I thought that incentive arrangement would be a catalyst for the company to rapidly and efficiently wind down operations.

This was my first liquidation work-out, and it doesn’t appear like it’s going to work out very well.

Highlights

Access Plans (APNC) and Techprecision (TPCS) continue to lead the way, with gains of 109% and 72% since the original write-ups.

APNC reported a whopping 69% increase in first quarter earnings, and continues to explore strategic alternatives. While the stock is up significantly, earnings should continue to improve throughout the year and further potential exists to unlock shareholder value.

TPCS is one of my favorite stocks, and the company continues to execute superbly at the hands of the new CEO. The new Chinese subsidiary has already contributed millions of dollars in new sales and appears to just be getting started.

AML Communications (AMLJ) was bought out at $2.10 per share, allowing for a 60 day turnaround and a 64% gain.

Pink Sheets Project

During the quarter, I completed a major research project, going through 3,698 pink sheets stocks individually in the search of bargains.

It has been the most commented post so far on ValueUncovered, and I received quite a few emails from readers praising the accomplishment.

I learned a great deal during the experience, and now have a nice watchlist of stocks for further review.

While all of them are cheap, I’m really trying to understand the business models, and determine if there are any upcoming catalysts to quickly reach intrinsic value – many of them have been cheap for years, so I’ve been selective with my purchases so far.

Portfolio Tracking

Due to the Pink Sheets project and a general focus on even more obscure and illiquid securities, I’m having second thoughts about continuing to track my positions in the Value Uncovered model portfolio.

Many of the stocks I’m currently buying are extremely small, and it is not uncommon for prices to change by dozens of percentage points with a single trade.

For example, one of my largest (still undisclosed) positions dropped nearly 50% on a $99 trade. Only a few days ago, ELST fell 16% on a 369 share purchase (the total volume for the day!) before recovering several days later.

Other stocks require patience over weeks or months to pick up enough shares for a decent-sized position.

All of these factors combine to make tracking in my current format very difficult, and causes the model portfolio to significantly trail my personal performance.

Suggestions

I’m definitely open to suggestions regarding the current model portfolio.

Should it be scrapped all together? Is it better to just announce my average entry points for particular positions rather than using a specific close price?

Or should I just post my actual portfolio results, even though some positions are not disclosed?

I initially started the tracking portfolio as a way to keep a public record of my stock selections. As I continue down the path, I’m finding that this disclosure (at least in the current manner) might not be the best route.

What do you think?

Disclosure

Long all stocks in this article, except closed positions.