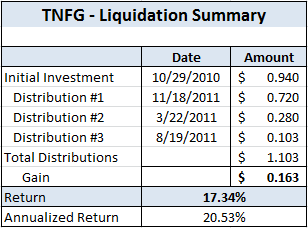

Last week marked the successful conclusion of my first liquidation investment – Terra Nova Financial (TNFG).

I originally picked up the stock back in October 2010, when the stock was trading below the lower bound of the director’s estimated liquidation range.

On August 15, the company distributed a press release announcing a final liquidation distribution of $0.103 per share payable on August 19, 2011.

This was a pleasant surprise, as TNFG’s March press release had estimated a final stub payment in the range of $0.04 – $0.07 per share.

Here are the final results of the workout:

Not stunning, but a nice result for my first attempt at this type of investment.

Joe Ponzio at F Wall Street summed up a good maxim for investing in workouts:

“The question is: Upon thorough analysis, do they offer safety of principal and a satisfactory return. To answer the first part, you must know the deal; to answer the last part, you must know the timeline.”

If you have followed the series of posts on TNFG, the one constant is my utter inability to predict the timing of the various payments – but I at least had a timeline and worst-case scenario in mind.

The lesson here is to always be extremely conservative when estimating the timing and return possibilities for these type of investments.

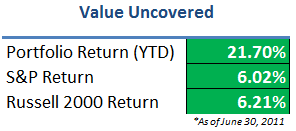

While the returns are certainly welcome, the best part about these types of opportunities is that they are largely uncorrelated with the rest of the market.

In these volatile times, I’d be very happy putting a much larger percentage of my portfolio into these types of scenarios, and will be actively searching for similar situations.