Company Overview

TNRK designs, assembles, and sells batteries to a variety of industrial markets. The company purchases batteries from major and well-known manufactures such as Energizer or Sanyo, assembles the individual items into battery packs, and then maintains the inventory for sale and distribution.

The batteries are sold to OEM manufacturers, hotels/resorts, military, aerospace, and electrical wholesalers – TNRK even designs and assembles custom battery packs to customers’ specifications.

The company maintains two major distributions centers in Florida and California, and runs the websites www.batterystore.com and www.tnrbatteries.com.

Management & Ownership Structure

TNRK is family-held, with management and insiders holding 38% of the company. Wayne Thaw, the company’s Chairman of the Board and CEO, has been involved with the company since inception and held a management position since 1987.

His brother, Mitchell Thaw, serves on the board of directors and has an impressive Wall Street background, where he specialized in equity options and structured products, including running a $900M capital structure arbitrage fund.

The father, Norman Thaw, is a former director and still 17% of the company, giving the Thaw family effective control over the business.

Paul Sonkin of Hummingbird Capital Management, a micro-cap and nano-cap focused value investing fund, owns just over 65k shares, or 21% of the company, purchased in the 2007-2009 time period.

Financial Overview

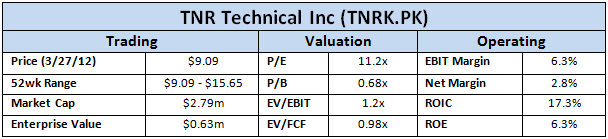

TNRK is profitable but growing its top-line at 1.47% over the past ten years, not exactly an exciting growth rate and lagging inflation.

While the overall prospects for the battery industry remain bright (as society becomes more and more electronic), TNRK will continue to face significant challenges in growing its core business. In the company’s own words:

Battery wholesale distributors face increased competition as offshore (specifically China) and U.S. manufacturers continue to sell directly into the marketplace alongside an increasing number of web-based operations and expanding local battery franchises. Competitors continue to price their products aggressively which has a direct impact on the Company’s overall sales and gross margins.

Revenues peaked in 2006 at $9.72m, only to fall to a low of $8.73m in 2009. The company did show signs of improvement in 2010 and 2011, but sales seem to have stagnated around $9m.

Gross margins have remained steady in a range of 30-32% over the past five years . However, despite the lower sales, SG&A expenses increased from 18-19% of revenues to 24% in 2010 before falling to 22.7% in the TTM period.

Much of the recent decrease in SG&A can be attributed to a revision of the rental agreement for the company’s HQ, payable to a holding company owned by the CEO Wayne Thaw (the conflict of interest was disclosed in the annual report).

The lease agreement was renewed in 2007 at the height of the bubble, which made the rent expense seem high – the revised agreement provides a 27% lower rent payment to reflect depressed market conditions.

Operating margins have declined for the past five years to 6.3%, but seem to be leveling off around the 6% mark.

Despite the struggles in the industry outlook, the company has remained profitable in each of the past ten years.

Investment Thesis

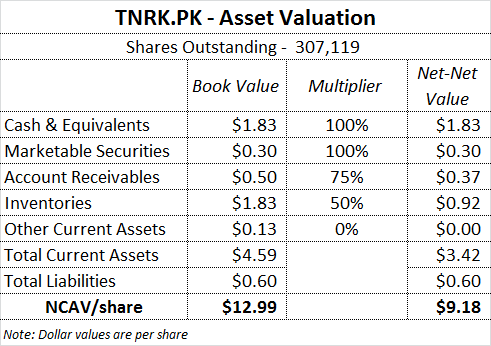

1. TNRK is a net-net stock and therefore extremely cheap on an asset basis – P/B is 0.68x, and at current prices, TNRK trades for less the value of the current assets on the balance sheet after subtracting all liabilities:

Even after taking downward adjustments for the A/R and inventory line items, adjusted NCAV (or liquidation value) is $9.18/share.

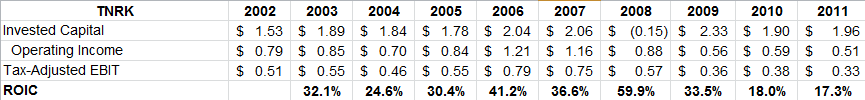

2. TNRK’s business fundamentals are actually decent – Many net-net stocks are in very ugly businesses with terrible capital allocation, high capex requirements, and inconsistent profits. While TNRK’s industry has its challenges, the core business requires little in the way of investment.

The company is overcapitalized (so ROE is low) but looking at the operating business itself reveals a decent fundamental picture:

ROIC has fallen from the 30-40% range but seems to have stabilized around 17-18%, which is very good for a net-net stock (remember, the market is basically assigning zero value to the operating business).

While TNRK isn’t a great business, it isn’t a terrible one either – management does not appear to be destroying value by keeping the lights on.

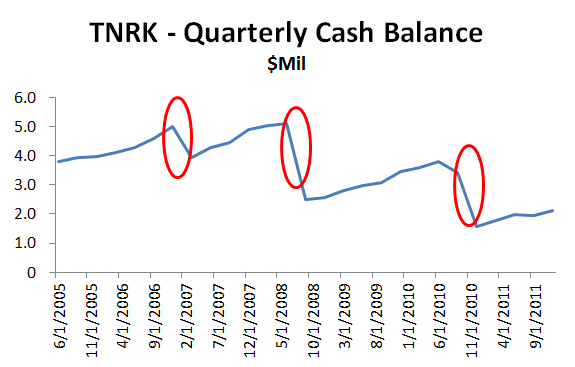

3. Management is paying out surplus cash to shareholders – Over the past several years, excess cash has been returned to shareholders.

Since 2006, TNRK has paid out $5.5m in three large special dividends, or roughly $18/share.

Too many companies with surplus cash balances try to diversify into other business lines, or (even worse), blow the cash on a bad acquisition.

These payments should continue to be a catalyst for unlocking value for existing shareholders, even if business conditions do not dramatically improve.

Return Scenarios

Despite the negative trends, TNRK continues to throw off a ton of cash.

TTM FCF is $640k, which equates to a 23% FCF yield – if you choose to calculate FCF yield as FCF/EV, the result is an absurd 97% yield.

At these prices, the market is not only assigning zero value to the company’s inventory, it is assigning zero value to a profitable operating business that should generate $250k-$500k in annual cash flow over the next several years.

Consider the picture of TNRK’s cash balance over the past few years:

A nice pattern emerges: A run-up of excess cash over several quarters, then a special dividend to shareholders.

Keeping this pattern in mind, let’s assume that TNRK will pay out a $1m dividend at the end of each year that the cash balance reaches $2.5m.

I also simplified the calculations so that the annual change in cash = net income, as FCF has closely tracked income over the past five years.

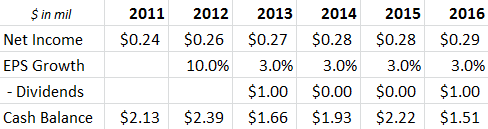

Here’s how the scenario might unfold:

Bull Case

In this case, two separate $1m dividends are paid over the next five years, returning ~70% of the purchase price – and leaving a cost basis of $700k for a profitable business with $1.5m in cash in the bank.

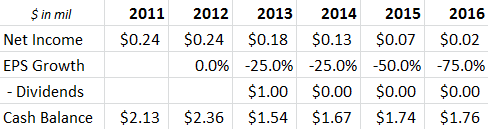

Bear Case

Even under a more extreme scenario where EPS falls rapidly over the next five years, the company still pays a $1m dividend, returning 36% of the purchase price – and leaving a breakeven business with $1.76m in cash, few liabilities, and a several million dollars in additional current assets that could be liquidated.

Risks / Negatives

Tiny illiquid stock – TNRK often seems to trade by appointment. Many days or weeks can go by without a single trade, and even small blocks can cause double-digit price swings.

Management compensation is high – The top three officers took down $550k in salary and bonus in 2011, which is a significant chunk for a company with $9m in revenue (it is even higher if you include the rent expense to the CEO’s holding company, although TNRK would have to rent the space from someone).

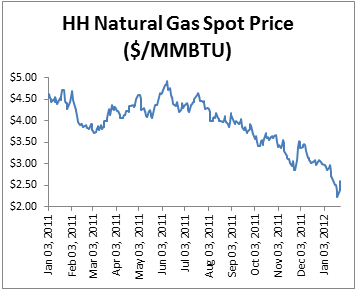

Material business decline and/or obsolescence – Theoretically, TNRK’s suppliers could choose a different distribution channel and cutoff TNRK. The latest report also mentions a potential supply disruption in China due to more stringent environmental standards for lead acid batteries. If sales fall and management is unable to cut costs, the business could decline at an even more rapid rate, potentially limiting dividend payments.

Conclusion

This is a relatively simple investment case, as TNRK trades below its liquidation value despite a history of profitably and no signs of radical disruptions in the business outlook.

Through the first six months of fiscal 2012, the business is showing small glimmers of a turnaround (or at least a stabilization), with ROE, ROA, Gross Margin, and Net Margin all up over the prior twelve months.

TNRK is part of my basket of net-net stocks. Going forward, either:

1. The business model is not obsolete and conditions improve. Management is able to rein in the cost structure. Earnings return near historic levels.

Result: TNRK’s share price goes higher on a more rational multiple of earnings. Shareholders benefit from share appreciation and dividends.

Or…

2. The business continues on a steady decline, and management is unable to reduce costs to compensate for lower sales.

Result: The business stockpiles cash flow for several years, pays out special dividends, and eventually liquidates or goes private.

Both options seem to offer attractive returns over the next several years with limited downside – therefore, I continue to hold TNRK as part of my basket of net-net stocks.

Disclosure

Long TNRK