Company Overview

UMS United Medical (ETR:UMS) is a medical equipment service provider, focused on mobile service solutions – think “medical equipment on wheels”. Customers include hospitals, ambulatory service centers and physicians’ offices.

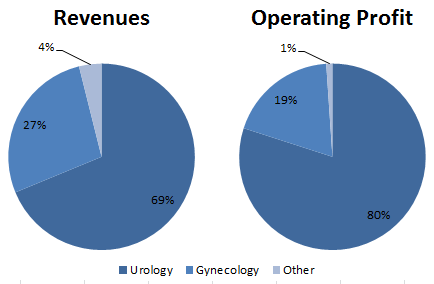

The company is broken out into three business segments, focused on different service areas: Urology (kidney stones), Gynecology (breast biopsy), and Other (namely Radiology services)

The most important division is Urology, which accounts for approx. 70% of revenues and 80% of operating profit:

Medical Technology Overview

The Urology segment primarily focuses on a technology called extracorporeal shock wave lithotripsy (ESWL), a non-invasive treatment of kidney stones using an acoustic pulse.

The technology has been around for almost 30 years and is considered a standard of care for treatable kidney stones.

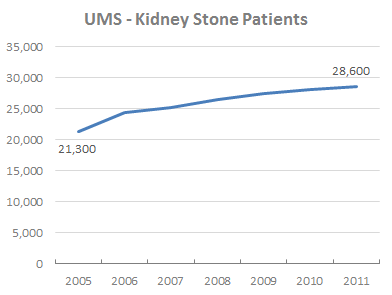

However, ESWL isn’t a high-growth industry (at least in UMS’ niche), with the number of UMS patients growing each year roughly in line with inflation:

UMS targets medical services where the capital expense for the technology (which can range into the millions of dollars) cannot be justified by the volume of expected patients.

Corporate Structure

UMS International is a German-based company, but the majority of operations occur in the U.S via wholly and partially owned subsidiary companies.

A crucial part of the business model is the formation of partnerships with physicians, creating a shared ownership around the success of the mobile initiative and an economic incentive for both parties to maximize utilization of UMS’ machines.

UMS has over twenty of these partnerships spread across the country, with most rolling up into the U.S. subsidiary.

UMS usually takes a 10-25% ownership stake in these partnerships but retains management control, and therefore consolidates the subsidiaries on its own financial statements.

The portion of earnings attributable to the physicians (paid out as dividends) is included on the financials as non-controlling interests (NCI), which represents a significant portion of the overall balance sheet.

However, the parent company is the entity that purchases the machines, pays for gas to transport them to each location, accounts for the depreciation, etc.

This means that each partnership on its own right is extremely profitable relative to capital invested, since its costs are essentially just management/rental fees back to UMS.

Approximately 60-70% of UMS’ total earnings go towards paying out NCI.

Ownership

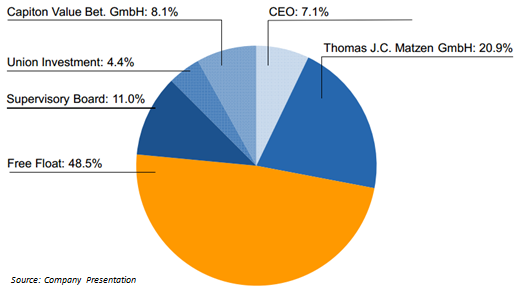

Board members and management hold 39% of shares, up quite a bit from the IPO due to share repurchases over the last several years.

In 2011, less than €300k was spent on compensation for the management and supervisory boards, a number which is dwarfed by their ownership stake in the company (worth tens of millions).

Therefore, management should be incentivized to allocate capital in the most effective way for all shareholders. The presence of two investment funds, Union Investment and Capiton Value, should also ensure that management continues to grow shareholder value.

Investment Thesis

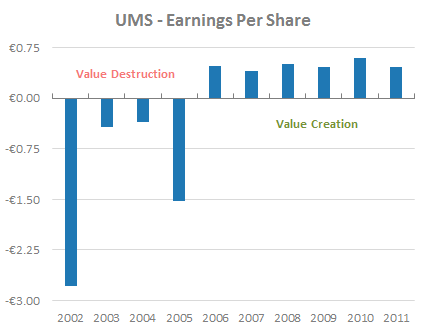

1. UMS is a ‘broken IPO,’ as losses from a failed international expansion led to frustrated selling, obscuring the value created over the past five years

UMS went public back in July 2000 for almost €25 per share, but fell to only €1/share by early 2003, a loss of 95%:

In the first four years as a public security, UMS reported net losses of €16.7M, €2.5M, €2.1M and €9.7M.

While most of the losses occurred below the operating line – consisting of restructuring charges, asset writedowns, and goodwill impairments – it was not exactly the best start to its public company life, likely scarring its original shareholder base.

During this time, UMS attempted to expand business operations across Europe, making heavy investments in new technologies (such as PET scans) and new offices in foreign countries.

Unfortunately, the company ran into challenges due to the “non-reform of “encrusted” state-run healthcare systems & lack of insurance coverage.”

By 2007, UMS had sold off its European operations and divested non-core business segments, and subsequently started focusing exclusively on the U.S.

While revenues were cut almost in half by the divestitures, profitability improved:

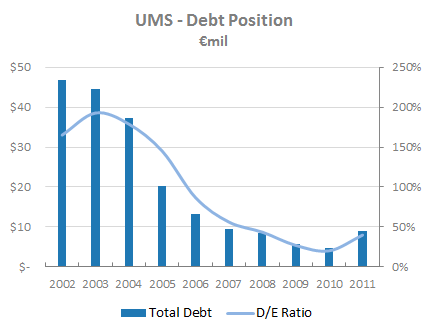

And the balance sheet was strengthened dramatically:

While the share price is up significantly over the past year, the market still seems to be ignoring the cash generation ability of the refocused business.

2. Economics of transportable medical procedures business model is attractive for patients, physicians, hospitals and UMS shareholders

These medical machines are expensive, and major hospitals often cannot justify the capital expenditure based on the projected patient volume – the usual alternative is to send the patient to another facility.

UMS transportable model allows hospitals to ‘rent’ the medical device for a daily rate (say on every 3rd Thursday), providing the needed services to patients in a cost-effective way.

UMS receives management and equipment fees from the hospital and its physician partnerships. Since UMS’ mobile units are able to serve multiple sites, the company is able to drive up the overall asset utilization of the machines.

Everyone benefits:

- Hospitals avoid major capital expenditures

- Patients receive required treatment at lower cost/procedure and without traveling to another location

- Physicians create a new revenue stream by offering additional services

- Shareholders participate in the earnings stability afforded by long-term contracts and steady patient volume

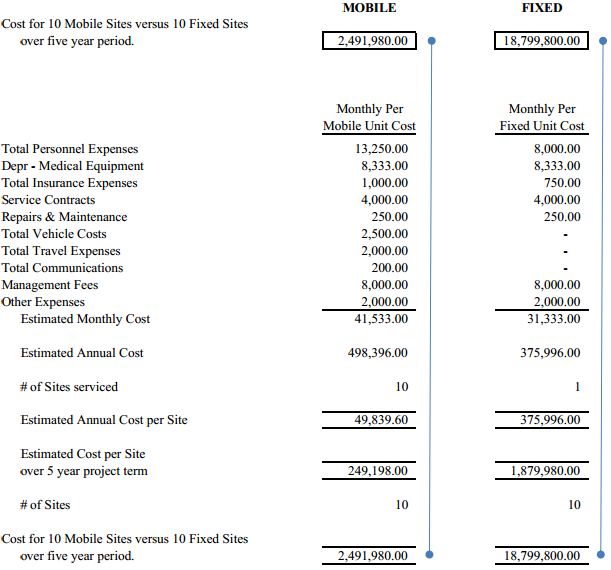

According to the company’s research, the economics of the mobile units are attractive, providing services at a fraction of the cost over a five year period:

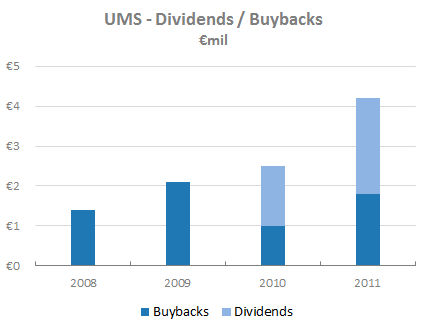

In the last five years, UMS has shifted its capital allocation policy from ill-fated growth initiatives to a strategy of returning cash flow to shareholders via aggressive stock buybacks and dividends

From 2002-2006, the company spent an average of €5.9M per year on acquisitions in attempt to expand around the world. After years of losses, UMS curtailed the acquisition-fueled growth strategy to focus instead on returning cash to shareholders, with small tuck-in acquisitions along the way.

This shift is represented in management’s new capital allocation record – the company spent €0.9M/yr on acquisitions in the past five years, with the bulk of the remaining FCF being returned to shareholders.

This represents a marked shift from ‘empire building’ to a focus on shareholder returns.

The change in policy coincides with Union Investment Funds (a large European asset management firm with €180B+ in AUM) taking a 5% stake in the stock in 2007/2008.

Since that time, UMS has aggressively bought back shares via open market repurchases and tender offers. Total shares outstanding have fallen from 6M to 4.8M, or more than 20%.

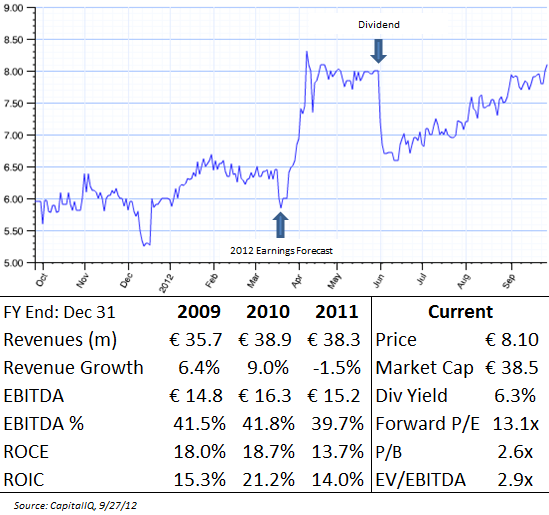

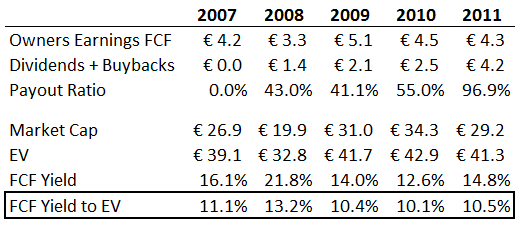

UMS paid its first dividend to shareholders in 2010, offering an average dividend yield of over 6% – if share repurchases are included, total cash returned to shareholders yields greater than 10%.

Valuation

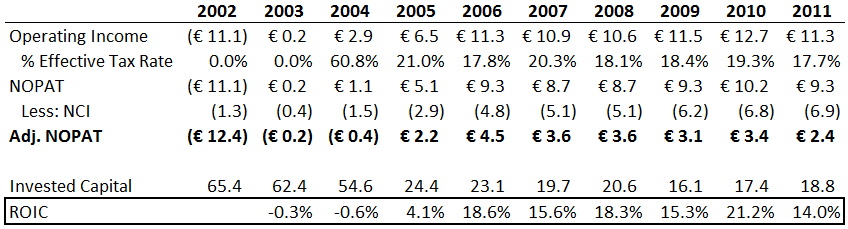

Looking at the company’s ten year financial track record, there is a clear delineation pre and post-2006, representing the shift in business strategy.

Even after adjusting for the payments due to NCI, the core business is solid, with sustainable ROIC in the mid-teens.

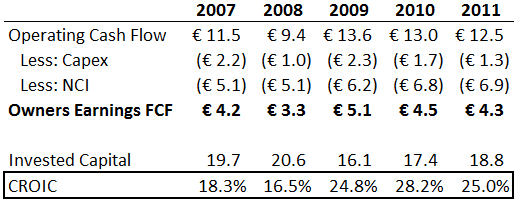

Looking at the past five years, the business becomes even more attractive on a cash ROIC basis, as D&A is higher than maintenance capex:

And over that time, the company has provided a double-digit FCF yield, with a significant (and increasing) portion of that cash returned to shareholders:

So why is the company trading at an EV/EBITDA < 3x? (Added: See comments below)

Lack of growth. (Added: And due to the fact that the majority of the EBITDA goes towards NCI)

The company has struggled to grow its business organically (or at least grow faster than the rate of inflation). 2011 sales of €38.3M were up only 11% from the 2004 number – that’s just 1.3% per year.

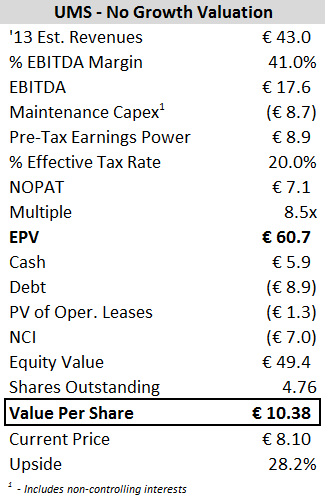

Due to a recent acquisition and stronger organic growth, 2012 sales should reach the €42-43M range, but this is definitely not a fast-growing business, so let’s value it as a ‘no-growth’ stock:

Despite a share price that is up 33% in the past year, UMS is still trading at a 28% discount to its EPV valuation.

Not only does this provide a margin of safety, but any growth (if it ever materializes) is free.

Conclusion

UMS has carved out a niche for itself within this mobile medical services space.

If the recent run-up in share price is any indication, maybe some investors are starting to take notice of the new shareholder-friendly strategy, as the stock continues to offer a steady double-digit yield (not bad in today’s rate environment).

The company is not exciting, and many investors seem to pass over such steady cash flow generating stocks in a pursuit of growth. However, as evidenced by UMS’ past, growth – if done for growth’s sake – can destroy value.

Finally, I think it’s important to point out the mission of Capiton Value, which continues to hold a sizable stake in the business:

“[Capiton Value’s] objective is to purchase significant shares in noticeably undervalued medium-sized enterprises as well as offering when suitable the respective management support for the implementation of value-creating measures…CVM combines capital market know how of many years with sound private equity expertise”

“CVM can offer support ranging from e.g. enhancement of capital market communication up to divestments (sometimes combined with a cash out) or Buy & Build strategies as far as assistance during a Going Private”

It remains to be seen whether CVM’s involvement could be an eventual route towards closing this value gap for minority equity holders…

Disclosure

Long UMS