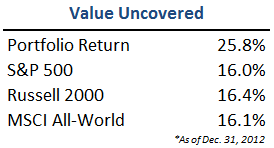

2012 marked another year of solid performance, especially given an average cash balance of ~20%:

The total number of positions in the portfolio has crept upwards, with 29 stocks at year-end. The majority of trading activity occurred in existing holdings, with just 6 new additions. Two stocks (APNC, NOOF) were acquired during the year.

As mentioned in my last review, 2011 was the first time I branched out into international stocks and it has been a major point of emphasis over the last twelve months. Today, 47% of my portfolio is now outside of the U.S., and I continue to look for opportunities overseas.

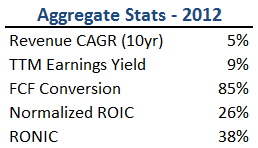

With a hat-tip to the blog at the red corner for the idea of mimicking Buffett’s ‘look-through earnings’, here is how the portfolio would stack up as a mini-conglomerate (on a weighted average basis):

A few comments on these numbers:

– 5% sales CAGR. This definitely won’t be mistaken for a growth portfolio. However, the majority of holdings are trading below a conservative ‘no-growth’ value, so anything beyond inflation is upside. I rarely have confidence in forecasting future growth, so I try to avoid paying for it.

– 9% trailing earnings yield. Since companies within the portfolio are generally net cash positive (in the case of the net-nets, in a rather extreme way), this trailing figure is actually understated as the yield to enterprise value would be much higher.

– 85% FCF conversion. Over the last ten years, the holdings have converted 85% of earnings into free cash flow. Little reinvestment is required to support growth, so FCF is available for share repurchases or dividends.

– 26% normalized ROIC. Outside of 1 or 2 exceptions (a net-net and a turnaround or two), all of the businesses are earning acceptable returns. As a group, normalized ROIC is substantially higher than the cost of capital, indicating that many positions have some sort of a competitive advantage or at least a leadership position in a niche market.

– 38% RONIC. Incremental returns on capital are higher than current returns, so growth is adding to shareholder value.

Final Thoughts

As some of you might have noticed, I took a hiatus from the blog for several months, as I continue to pursue investing as a full-time career. My prospects are shaping up even better than I could have hoped, but it has taken time away from posting on the blog.

But the main reason for the lack of posts is the strong market in 2012 (followed by another ~5% upswing in January alone), which has pushed up valuations on many stocks outside of my comfort zone, especially in the U.S. Viewing the market on a bottoms-up basis, stocks within my circle of competence look expensive – basically, not much looks interesting right now.

Therefore, I have been spending time reexamining each position within the existing portfolio, while building a watch list of high-quality businesses. While sitting on cash and showing patience does not make for very good blog reading, it will hopefully be rewarded on the inevitable pullback.