Electronic Systems Technology (ELST.OB) is the maker of the ESTeem line of wireless modems.

It has been a public company since 1984, and filed several patents (since expired) around wireless modem technology.

The company has built a nice cash pile on the balance sheet, and continues to trade at a discount to book value and only slightly above net cash despite being profitable in 8 out of the last 10 years.

Financial Overview

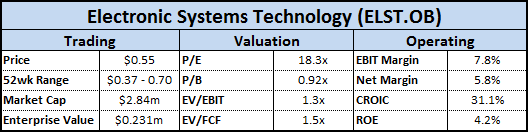

ELST reported results for the 2010 fourth quarter and full year. Annual revenues were up 18%, to $2.24m from $1.89m in 2009.

Sales dropped sharply during the 2008/2009 recession – they are still down 26% from the 2007 high water mark – but are showing signs of improvement across all product lines and geographic regions.

The domestic business increased 20% to $1.68m, and continues to make up roughly 3/4 of total sales.

Foreign revenues increased 17% at a much higher operating margin (42% margins vs. 16.5% for the domestic side).

Mobile data computer terminals (MDC) applications are marketed to public safety agencies such as police stations and now make up only 5% of total sales. The company is shifting its product mix towards more industrial automation projects, both domestic and internationally.

ELST’s strategy is to maintain low levels of inventory to provide maximum cash liquidity, as the company’s products do not require much lead time. The latest inventory balance of $421k is the lowest in the last ten years – hopefully this shows that management is prudently monitoring the available inventory.

Operating expenses increased slightly to $1.18m from $1.09m due to higher bad debt expense, professional services, and salaries. The company expects to cautiously lift wage reductions put in place in 2008/2009 due to improved revenues and profitability.

Operating profits came in at $174k, up from a slight loss last year.

Net income was $129k, up 437% from 2009, albeit from a very low comparable. EPS was $0.03.

Business Ratios

ROE was 4.18%, a number that is depressed due to the large cash balance sitting on the company’s balance sheet.

There are many different methods for calculating excess cash, but I use this formula:

Excess Cash = Total Cash – MAX (0, Current Liabilities-Current Assets)

While most companies need to keep cash on the balance sheet for day-to-day operations, it is probably a nominal amount for ELST – capex requirements are very low and the company does not keep a large amount of inventory on-hand.

Since the company has so much excess cash, ROIC and CROIC provide a better picture, coming in at 25.84% and 31.10% in 2010 respectively.

5-year average ROIC and CROIC are 17.16% and 33.41%.

ELST’s business is definitely in a niche market with capped upside, but it appears that the company remains a solid choice within this niche.

Excess Cash

Unfortunately, the large cash balance is earning very low returns due to the current interest rate environment.

The company paid a small dividend from 2003-2008, so that is the most likely course of action – the current cash balance is the highest in the last ten years.

Paying a small dividend would at least serve to return some of this excess cash to shareholders.

Valuation

On an asset basis, there is no doubt that the company remains cheap. Market cap is currently $2.8m, meaning the company is selling at a discount to its working capital.

NCAV is $0.57 per share, while NNWC is $0.54. At these prices, you are basically picking up a profitable business for free.

With the stock price at $0.55, current EV/EBIT is 1.3x and EV/FCF is 1.5x, or 1.85x and 1.65x using the 5-year average EBIT and FCF numbers.

Conclusion

While still cheap, the stock has appreciated since my original entry point. The biggest risks are product obsolescence or increased competition, as the world of technology can change very rapidly.

The company is certainly not in hyper-growth mode, as 2010 sales numbers were roughly even with 2004.

If the business is in a steady decline (meaning management cannot open up new markets), then the most important consideration is what will happen to the cash balance.

Unless management can find ways to re-invest the capital into the business at acceptable rates of returns – which does not appear to be the case – then excess cash should be returned to shareholders.

More likely, another way to unlock value would be at the hands of an acquirer. The company’s president, T.L. Kirchner, founded the company in 1984 and is now in his early 60’s.

The cash balance would be very attractive in any deal, but the question remains is the ELST’s niche worth pursuing by a larger company? Or is Kirchner thinking about parting with his legacy?

Not sure, but I think I’ll hold to see what happens.

Disclosure

Long ELST