Buying companies at a discount to their net asset value is a strategy that has outperformed the markets for decades.

2008/2009 provided an amazing opportunity for net-net investing in the U.S., but most of the bargains have now disappeared, and the current qualifying stocks are unattractive, ugly businesses.

After making the switch to Interactive Brokers, I now have access to the world’s stock markets, and have actively been trying to diversify my holdings internationally.

Investing abroad provides a host of challenges – accounting variations, currency risk exposure, language barriers, etc. – so sticking with a proven, mechanical strategy such as net-net investing is the easiest pathway into new markets.

And there is no other place in the world with more quality net-nets than Japan.

Fuji Oozx (7299:TYO)

Fuji Oozx is a Japanese maker of engine valve components used in the auto industry. It has been in business for almost 60 years.

I came across the stock using a new screener, Screener.co, that is the best global stock screener on the marketplace (note: affiliate link)

Fuji has several operating subsidiaries and is partially owned by Daido Steel, one of the world’s largest manufacturers of specialty steel ($2b market cap).

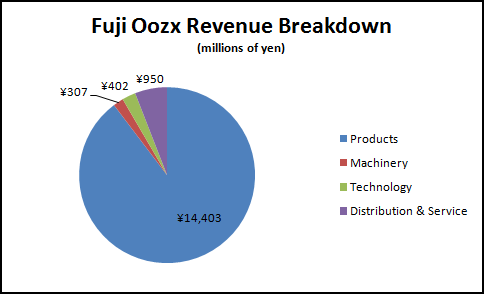

The company operates in four business segments:

“The Product segment manufactures and sells engine valves and others, as well as manufactures molds through one of its subsidiaries. The Merchandise (Machinery) segment sells mechanical equipment and jigs. The Technology segment is involved in the licensing of technology to its associated companies. The Distribution and Service and Others segment is involved in the transportation of its products, as well as the provision of employee welfare services. “

The Products segment makes up the majority of revenues and profits.

Financial Information

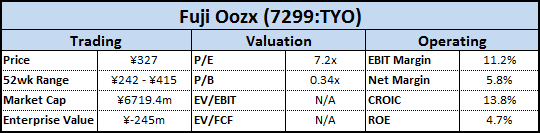

Results for the year ended March 31, 2011 were reported a few weeks ago. Revenues jumped 18%, to ¥16,062 million, as Fuji was one of the few net-net stocks showing significant revenue improvement.

These results were driven largely by a 17.2% sales increase in the Products segment, although all four operating units reported gains for the year.

Historically, the business is capable of producing revenue in the ¥20,000-22,000 million range (as evidenced by 2006-2008 results), leaving additional room for top-line growth.

Operating income jumped to ¥1,803 million, an increase of 141% from ¥746 million in the previous year.

Profits were down significantly in 2009 and 2010 as Fuji faced reduced demand from auto manufacturers during the worldwide recession.

The strong increase in operating profit led to operating margins around ~11%, a sharp increase from the 6% average margins from 2008-2010, but consistent with the company’s margins in the boom years of 2005-2007.

Operating cash flow is strong at ¥2,314 million, and the company has generated positive free cash flow for at least the past six years.

For fiscal year 2011, free cash flow (using owner earnings) was positive ¥998 million, for a FCF yield of almost 15%.

Balance Sheet

While the positive operating results are a great sign, the investment thesis relies heavily on the balance sheet.

At current prices, Fuji Oozx is trading for less than net cash, meaning the operating business is available for free.

The most recent year shows a cash balance of ¥6,964 million, compared to a market cap of roughly ¥6,719 million, meaning the market is assigning a negative value to the operating businesses.

This translates into an enterprise value of negative ¥245 million yen…for a business that has produced an average operating income of ¥1,728 million for the past ten years.

Net Current Asset Value (NCAV) is ¥11,254 million, so the stock is currently trading at only 60% of its NCAV value.

It just so happens that Ben Graham’s original rules on investing in net-nets called for at least a 33% discount to NCAV, so Fuji Oozx qualifies under even the strictest definition of net-net investing.

Book value is ¥965.75 per share, translating to a ridiculously low P/B of 0.34x.

Over the past 6 years, book value has grown at 4.15% while shares outstanding has remained constant at 20.5m.

Valuation

For a Japanese company, Fuji Oozx actually has decent operating ratios. TTM ROE is 4.7%, held back by the excess cash balance, but CROIC was 13.8%.

A traditional multiple-based valuation metric (such as EV/EBIT or EV/FCF) doesn’t provide much insight since the stock currently has a negative enterprise value.

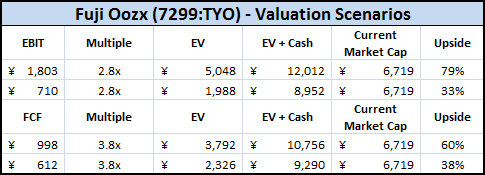

But looking at the past 6 years of financial results, Fuji Oozx’s EV/EBIT and EV/FCF multiple has averaged 2.8x and 3.8x respectively.

Here are several valuation scenarios, using both 2011 results and 2009 results (Fuji’s recession-low):

It doesn’t make sense to spend a great deal of time on valuation scenarios – at these prices, Fuji Oozx is ridiculously cheap.

Risks

Even so, there are certainly risks to investing in Fuji Oozx.

Earthquake

Obviously the Japanese earthquake has caused severe disruptions throughout the region, with an economic cost in the hundreds of billions of dollars.

It doesn’t appear that Fuji’s Oozx locations were damaged in the quake, but it has caused problems with some of the company’s major customers.

The full financial outcome of the quake probably won’t be known for several months, as it occurred too late in the quarter to impact the most recent results – there is a chance that Fuji’s results could be materially lower.

At this time, the company is not making any predictions, as results are still uncertain and difficult to predict.

Fuji USA Liquidation

The latest annual report also shows that the company decided to close down its USA subsidiary, which has been in operation since 1994.

I couldn’t get a good sense of why the decision was made, but the company already took a ¥130 million charge related to the liquidation.

Subsidiary Problems

Fuji also announced a ¥221 million charge related to bad loans in the company’s Shinhan Valve subsidiary. I was unable to determine whether this charge has already been taken or if it will apply to next period’s results.

While this revelation is a yellow flag around the company’s internal controls, Fuji has several subsidiary companies, the backing of a major steel corporation, and a long track record in Japan.

I view this revelation as an isolated incident which doesn’t materially affect the investment thesis – it hardly makes a dent in the company’s cash balance.

Currency

Finally, I invested directly in the stock on the Tokyo stock exchange, meaning I had to convert US dollars into Japanese yen. The exchange rate between the dollar and yen is roughly 1 USD = 82 yen.

The historical exchange rate is probably closer to 1 USD = 110 yen.

If the exchange rate moves closer to its historical average, it would cause a loss on the currency part of the transaction.

Conclusion

Even with an overvalued currency, Fuji Oozx and other Japanese stocks are substantially cheaper than their U.S. counterparts.

Fuji Oozx could likely see results suffer in the next period or two, as the auto manufactures and the rest of Japan suffer from power outages and lower output as a result of the earthquake.

Full productivity is unlikely to return until later this year.

But the company has been in business for 60 years and, despite the short-term setbacks, will likely remain in business going forward.

Some value should be assigned to a profitable operating business.

This is a great example of Mr. Market mispricing a public security – no rational seller would ever let go of a piece of a profitable operating business for free.

As for the currency, there are several options to hedging this risk, but I’ve decided to let mine ride for now.

All of my assets, as well as my retirement savings, job, car, household possessions, etc are all based in U.S. dollars and I’m not very bullish on the dollars prospect’s going forward.

Therefore, some currency diversification is prudent.

From a portfolio perspective, I’ve set aside 10-15% of my portfolio to invest in Japan, and will likely spread that money over 3-4 companies.

Investors have been losing money in Japan for 20+ years, but as a value investor, you just don’t get too many chances to pick up profitable businesses at these prices.

Disclosure

Long Fuji Oozx (7299:TYO)

Is there any catalyst or event-driven item that might cause value to be revealed here?

Thanks!

Carolyn

Carolyn,

Historically, the company has generated annual sales figures of 20,000-22,000m yen and the latest year saw a 18% increase in sales, so I believe that further top-line growth will help with returns. The company is tied closely to the auto industry, and latest global figures show marked improvement in auto manufacturing after the steep dropoff during the recession in 2008/2009 (although it remains to be seen how the earthquake will affect results for 2011).

In any case, the company does pay a dividend that currently yields over 3% – add that to the book value growth and it’s not a bad return, even if the discount to NCAV doesn’t close at all.

I’m looking for top-line growth, increased book value, dividend yield, and closure of the net asset discount in some combination to lead market-beating returns – the actual breakdown of the returns is much harder to guess.

What is your rationale behind leaving the currency risk unhedged? Wouldn’t it be a shame if your thesis played out and the stock moved, but your gains were all but eliminated due to an adverse currency move?

What are some ways that you might hedge the currency risk, were you so inclined?

Peter,

I’ve been going back and forth on the currency risk. IB actually offers the ability to purchase international stocks using a low-cost margin loan that eliminates any currency fluctuations. Even so, I chose to convert my dollars to yen before buying.

Outside of my new positions, every single asset I own is based in US Dollars, so I like the idea of diversifying my currency. I have no idea where the dollar is going to go in the future, but if I had to choose a side, I don’t think I would be very bullish. So I believe that diversifying my holdings into other currencies is a prudent move, even if the chosen currency is relatively overvalued

I’ve seen different calculations for how overvalued the yen is compared to the dollar – a ‘normal’ rate is probably closer to 100 or 110 USD:JPY. However, the most recent big mac index for PPP shows only a 4% overvalution – http://www.oanda.com/currency/big-mac-index

I’m definitely not a currency expert, so definitely appreciate input here.

In any case, with the current numbers, I believe that the basket of Japanese stocks I’m holding is significantly cheaper than anything I could find in US dollars, much more than just 20% cheaper, so I feel like my upside is still substantially even if the currency moves against me.

There are several liquid currency ETFs that can be purchased as a hedge, but I’ve only begun to do initial research on the various options. If someone has ideas, I’m open to suggestions.

Interesting writeup, thanks for taking the time to research this company.

In an issue of Grant’s Interest Rate Observer, Jim Grant mentioned that he had attempted a strategy of investing in undervalued Japanese small cap stocks about 20 years ago, but it was unsuccessful due to a management and investing culture that isn’t very focused on profitability and unlocking value.

I noticed that you said Fuji’s operating ratios were decent “for a Japanese company”. What is your view on the cultural factors here and how it might impact your investments?

I’m taking a very mechanical approach to Japanese investing, as net-nets have been a proven source of market-beating returns (see the article here), even in a culture like Japan where management is notoriously conservative and even shareholder-unfriendly.

I screened for all Japanese stocks trading for less then NCAV, and found that many were ‘stalled companies’ – revenues and book value had remained flat for the past 5-6 years, yet the companies continued to throw off net cash and just got cheaper and cheaper on an EV basis. – ROE < 1% and ROIC < 3% were common in many of these stocks, certainly not numbers that jump off the page. When picking my investments, I tried to stick with those that showed some elements of growth potential and decent operating metrics, with Fuji being one of them. Without intimate knowledge and understanding of the Japanese language, it's hard to determine those with shareholder-friendly practices - but I felt that the stocks were cheap enough to warrant an experiment with a portion of my portfolio.

Hello,

I did not had the time to check but did you checked also if the price of this stock changed a little in the last years and its liquidity?

Fuji’s stock price basically flat from a year ago. It was in the mid 500 yen range in 2005 and 2007, almost touching 900 yen in 2006, so the market has shown signs in the past of pricing the company higher. I’d say average volume is roughly the same, although I don’t have the specific numbers to back it up – just eyeballed the historical quotes on Google Finance.