Yesterday, Access Plans (APNC.OB) announced a definitive merger agreement to be acquired by AON Affinity, a subsidiary of AON Corporation (AON), for $70.1m in cash.

Here is the press release and merger document.

The purchase price is subject to a downward adjustment based on the net cash position of APNC at the closing of the merger, but is currently estimated at $3.30 per share.

This $3.30 consideration was an 18% premium to the latest closing price, and a 24% premium to APNC’s average price over the past 30 days.

In my view, AON is getting a steal with this transaction.

A $3.30 purchase price on $0.30 in diluted EPS (ttm), translates into a P/E of 11x or a rough EV/EBIT of 4-5x.

These are very low multiples for a business whose remaining two segments are generating 30%+ operating margins and steady revenue growth (and throwing in a $15m pile of cash as well).

According to Danny Wright, Access Plan’s Chairman and CEO:

“This sale represents a natural step for us. Becoming a part of the leading risk advisory firm translates into a positive outcome for our shareholders, greater options and value for our clients and increased opportunities for our employees.”

The negotiations are private, so it’s useless to speculative on how the final price was determined, but the management team and insiders hold 66% of shares outstanding, giving them effective control over such merger decisions.

APNC is in a unique business, so maybe the pool of suitors was limited for such a niche offering? Or maybe the management team just wanted to cash out and therefore took the first deal available?

It’s hard to say, though I’d be interested in hearing what RENN Capital (the largest institutional investor, with 11.5% of shares) thinks of the sale price…

Investment Review

It is hard to complain however, as my investment in APNC has turned out well:

I decided to sell some after the initial spike back in February 2011, but held on to a significant amount of my initial holding – APNC is the second largest position in my portfolio.

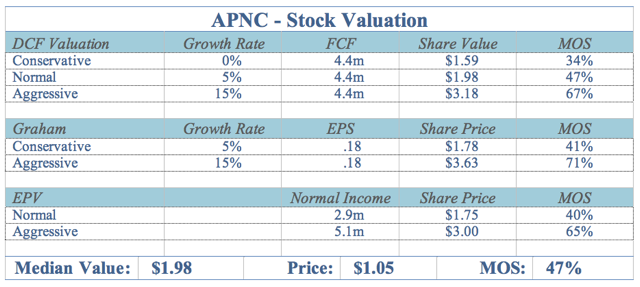

Although I have substantially changed my investment process and valuation methodology over the past two years, I thought it was interesting to look back at my initial forecasts from two years ago (February 2010):

Averaging the aggressive valuations yields a price target of $3.27 – pretty darn close to the $3.30 merger price.

Final Thoughts

I do think there is a some possibility (15-20%?) that another offer emerges or the merger price is raised before the deal closes in the second quarter.

AON is a $15B company, and swallowing a $70m acquisition has relatively little risk, so I think that it’s unlikely the deal falls through outside of drastic circumstances.

However, APNC is a microcap and liquidity can be a concern, so I’ll look for an opportunity to reduce my position if nothing appears soon.

In a similar circumstance, I made the mistake of selling AMLJ after its buyout offer of $2.15, and missed out when another offer came through at $2.50.

Disclosure

Long APNC, for now