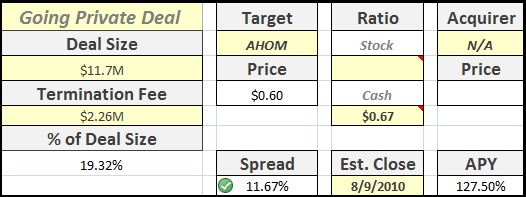

American Homepatient, Inc. (AHOM), announced on April 28th that it will be bought out and taken private by its largest shareholder, Highland Capital Management. This is another example of a special situations investment (see my writeups on the CHDN/UBET merger and VR tender offer as well)

History

The Company has been in financial straits since August 2009, when it effectively breached the covenants for repaying its senior debt. Since that time, the Company has been acting under short-term forbearance agreements with its lenders.

If the going private transaction is approved, the lenders have agreed to a substantial restructuring of the existing debt, allowing the Company to avoid bankruptcy.

According to this article, Highland Capital offered to buy the company in 2006 for $3.40 per share but was unsuccessful. Now, with the Company’s continued struggles, it doesn’t look like shareholders have much choice but to approve the offer.

Why the Attractive Spread?

Even though this looks like the only option if shareholders want to avoid being wiped out in bankruptcy, the merger still offers attractive an arbitrage opportunity. Why?

The transaction seems more complicated on the surface than a typical going private transaction. I’ve broken down the steps below:

Steps for Merger Completion

1. “This repurchase would not be possible if the Company remained incorporated in Delaware. A Delaware corporation is prohibited from repurchasing its own shares if after giving effect to such purchase its net assets would be less than its capital. Nevada law differs and would permit such a repurchase. Reincorporation in Nevada is, therefore, a necessary step in carrying out the repurchase as contemplated by the Restructuring Support Agreement.”

Under the terms of the merger agreement and restructuring, AHOM cannot legally repurchase its shares as a Delaware corporation. The vote on reincorporation will occur at the company’s annual meeting of shareholders on June 30, 2010.

2. “Conditioned upon approval of the reincorporation by our stockholders, we agreed to carry out the reincorporation.”

Highland owns 48% of outstanding shares and has voted to approve the transaction. With this in mind, the reincorporation is almost guaranteed.

3. “If the reincorporation is approved and carried out as described above, we agreed that AHP Nevada will then commence a self-tender offer to you at $0.67 per share.”

The tender offer will expire after 20 business days.

4. “In the event the self-tender offer is accepted by a number of our stockholders other than Highland and its affiliates holding shares that together with the shares owned by Highland and its affiliates represent at least 90% of the number of its outstanding shares, and subject to other customary closing conditions, AHP Nevada agreed that it would repurchase all of the tendered shares.”

The voting numbers from the shareholder meeting should be watched closely, but I’m assuming this will pass as well.

5. “If the self-tender offer is completed, Highland has agreed to initiate a follow-on merger at the conclusion of the self-tender offer pursuant to which shares of common stock in AHP Nevada not tendered and not held by Highland and its affiliates would be cancelled in exchange for $0.67 per share.”

Any additional shares not tendered will be cashed out at $0.67 per share.

Timeline

The annual meeting of shareholders will occur on June 30, 2010. If shareholders vote to approve the reincorporation, the tender offer will be initiated within 5 business days, and remain open for 20 business days.

Assuming the votes are approved, I’m estimating the transaction should close the second week of August – consistent with the terms of the merger agreement: “if the Merger Closing shall not have occurred on or before August 10, 2010 (the “ Merger Deadline)”

Return

The stock has been trading under $0.60 over the past month, and as low as $0.56.

The stock has been trading under $0.60 over the past month, and as low as $0.56.

Final Thoughts

If the transaction is not completed, substantial risk remains, as the stock was trading under $0.20 before the merger announcement.

Although I’m sure some of AHOM’s long-time shareholders are disappointed by this result (especially when compared to the offer from 4 years ago), I think it is the only option for the Company. Several executives have been exercising stock options in the past month, a sign they expect the transaction to go through.

Update – 7-07-10

AHOM announced the launch of the tender offer today. The transaction seems to be on schedule, with the expiration of the tender offer on August 4.

The main condition that still needs to be satisfied is that >90% of outstanding shares actually tender their shares. Since 96% of shares voted to approve the merger, I think it’s likely that a similar number will tender their shares during the offer period.

Documents

[table id=4 /]

*Update – 8/05/10

Step 4 of the going private transaction – the self tender offer – was supposed to wrap up yesterday. Greater than 90% of shares needed to be tendered in order to complete the transaction.

Yesterday, AHOM announced an initial count, with 6,848,732 or 87% of shares validly tendered. Therefore, the company is extending the offer until August 25.

Although it is disappointing that the transaction won’t wrap up this week (from a time value of money standpoint), it seems pretty likely that the company will get the last 3% it needs.

Disclosure

Long AHOM

AHOM announced results of the shareholder meeting today, with ~96% of shareholder approving the reincorporation. The tender offer should be commenced shortly.

http://www.sec.gov/Archives/edgar/data/879181/000095012310062834/g23945e8vk.htm

Thanks for the update. Will be looking at this one as more conditions are met.

Nothing like hitting singles with mergers nowadays.

Jae,

Thanks for the comment. The tender offer should be commenced this coming week and last for approx 20 business days.

I’m hoping the transaction finishes up at the beginning of August.

At 64 cents, it’s still an attractive opportunity – 67 cent buyout means just under a 5% gain.

Ankit,

Agreed. The shares have bounced around in the past few weeks, dropping as low as $0.62 since the start of the tender offer.

Setting a standing limit order for an entry point between .62 and .64 will probably ensure you pick up shares before the offer ends.

So if 90% are tendered, the remaining shares not tendered will receive $.67 in the follow-on merger correct? The reason I ask is since I have a fee for tendering shares, scooping up some for a short-term holding would be more advantageous than having cash, but probably wouldn’t be worth it if tendering is absolutely necessary.

Vince,

Yes. From my understanding of the proxy documents, as long as 90% of shares are tendered, all remaining untendered shares will be cashed out at $0.67 per share.

You might want to confirm with your broker that they do not charge a fee for this type of transactions however.