Company Overview

UMS United Medical (ETR:UMS) is a medical equipment service provider, focused on mobile service solutions – think “medical equipment on wheels”. Customers include hospitals, ambulatory service centers and physicians’ offices.

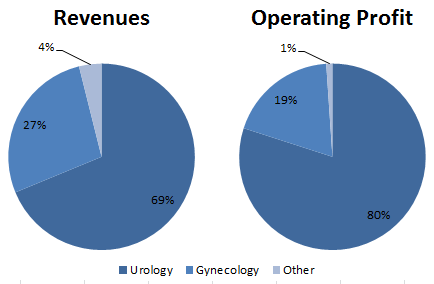

The company is broken out into three business segments, focused on different service areas: Urology (kidney stones), Gynecology (breast biopsy), and Other (namely Radiology services)

The most important division is Urology, which accounts for approx. 70% of revenues and 80% of operating profit:

Medical Technology Overview

The Urology segment primarily focuses on a technology called extracorporeal shock wave lithotripsy (ESWL), a non-invasive treatment of kidney stones using an acoustic pulse.

The technology has been around for almost 30 years and is considered a standard of care for treatable kidney stones.

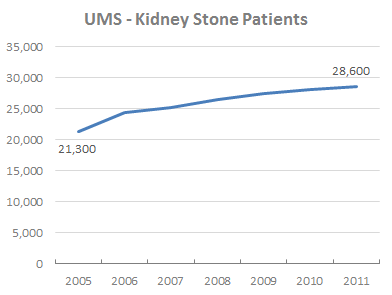

However, ESWL isn’t a high-growth industry (at least in UMS’ niche), with the number of UMS patients growing each year roughly in line with inflation:

UMS targets medical services where the capital expense for the technology (which can range into the millions of dollars) cannot be justified by the volume of expected patients.

Corporate Structure

UMS International is a German-based company, but the majority of operations occur in the U.S via wholly and partially owned subsidiary companies.

A crucial part of the business model is the formation of partnerships with physicians, creating a shared ownership around the success of the mobile initiative and an economic incentive for both parties to maximize utilization of UMS’ machines.

UMS has over twenty of these partnerships spread across the country, with most rolling up into the U.S. subsidiary.

UMS usually takes a 10-25% ownership stake in these partnerships but retains management control, and therefore consolidates the subsidiaries on its own financial statements.

The portion of earnings attributable to the physicians (paid out as dividends) is included on the financials as non-controlling interests (NCI), which represents a significant portion of the overall balance sheet.

However, the parent company is the entity that purchases the machines, pays for gas to transport them to each location, accounts for the depreciation, etc.

This means that each partnership on its own right is extremely profitable relative to capital invested, since its costs are essentially just management/rental fees back to UMS.

Approximately 60-70% of UMS’ total earnings go towards paying out NCI.

Ownership

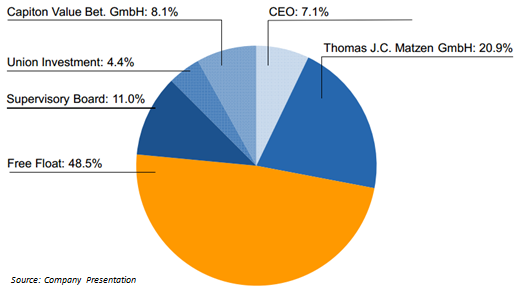

Board members and management hold 39% of shares, up quite a bit from the IPO due to share repurchases over the last several years.

In 2011, less than €300k was spent on compensation for the management and supervisory boards, a number which is dwarfed by their ownership stake in the company (worth tens of millions).

Therefore, management should be incentivized to allocate capital in the most effective way for all shareholders. The presence of two investment funds, Union Investment and Capiton Value, should also ensure that management continues to grow shareholder value.

Investment Thesis

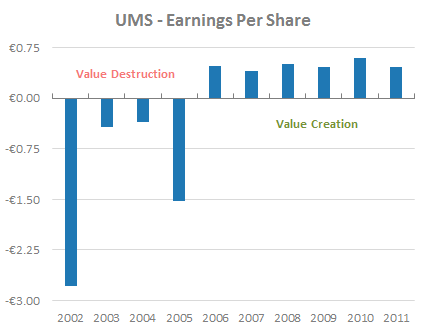

1. UMS is a ‘broken IPO,’ as losses from a failed international expansion led to frustrated selling, obscuring the value created over the past five years

UMS went public back in July 2000 for almost €25 per share, but fell to only €1/share by early 2003, a loss of 95%:

In the first four years as a public security, UMS reported net losses of €16.7M, €2.5M, €2.1M and €9.7M.

While most of the losses occurred below the operating line – consisting of restructuring charges, asset writedowns, and goodwill impairments – it was not exactly the best start to its public company life, likely scarring its original shareholder base.

During this time, UMS attempted to expand business operations across Europe, making heavy investments in new technologies (such as PET scans) and new offices in foreign countries.

Unfortunately, the company ran into challenges due to the “non-reform of “encrusted” state-run healthcare systems & lack of insurance coverage.”

By 2007, UMS had sold off its European operations and divested non-core business segments, and subsequently started focusing exclusively on the U.S.

While revenues were cut almost in half by the divestitures, profitability improved:

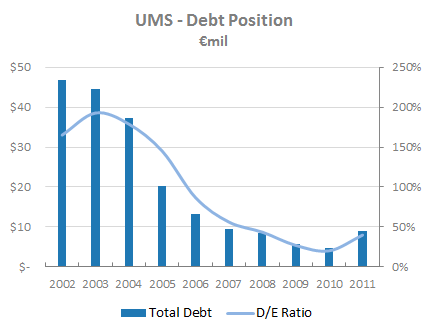

And the balance sheet was strengthened dramatically:

While the share price is up significantly over the past year, the market still seems to be ignoring the cash generation ability of the refocused business.

2. Economics of transportable medical procedures business model is attractive for patients, physicians, hospitals and UMS shareholders

These medical machines are expensive, and major hospitals often cannot justify the capital expenditure based on the projected patient volume – the usual alternative is to send the patient to another facility.

UMS transportable model allows hospitals to ‘rent’ the medical device for a daily rate (say on every 3rd Thursday), providing the needed services to patients in a cost-effective way.

UMS receives management and equipment fees from the hospital and its physician partnerships. Since UMS’ mobile units are able to serve multiple sites, the company is able to drive up the overall asset utilization of the machines.

Everyone benefits:

- Hospitals avoid major capital expenditures

- Patients receive required treatment at lower cost/procedure and without traveling to another location

- Physicians create a new revenue stream by offering additional services

- Shareholders participate in the earnings stability afforded by long-term contracts and steady patient volume

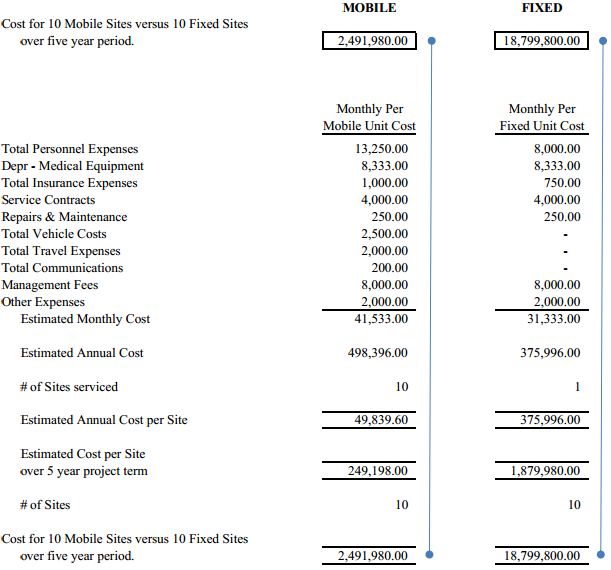

According to the company’s research, the economics of the mobile units are attractive, providing services at a fraction of the cost over a five year period:

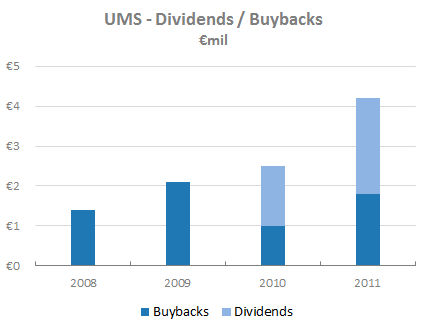

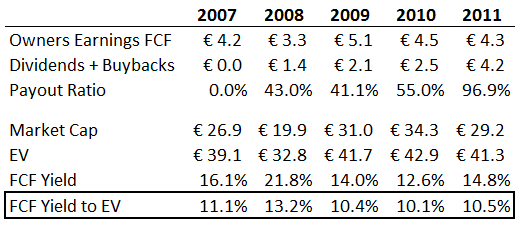

In the last five years, UMS has shifted its capital allocation policy from ill-fated growth initiatives to a strategy of returning cash flow to shareholders via aggressive stock buybacks and dividends

From 2002-2006, the company spent an average of €5.9M per year on acquisitions in attempt to expand around the world. After years of losses, UMS curtailed the acquisition-fueled growth strategy to focus instead on returning cash to shareholders, with small tuck-in acquisitions along the way.

This shift is represented in management’s new capital allocation record – the company spent €0.9M/yr on acquisitions in the past five years, with the bulk of the remaining FCF being returned to shareholders.

This represents a marked shift from ‘empire building’ to a focus on shareholder returns.

The change in policy coincides with Union Investment Funds (a large European asset management firm with €180B+ in AUM) taking a 5% stake in the stock in 2007/2008.

Since that time, UMS has aggressively bought back shares via open market repurchases and tender offers. Total shares outstanding have fallen from 6M to 4.8M, or more than 20%.

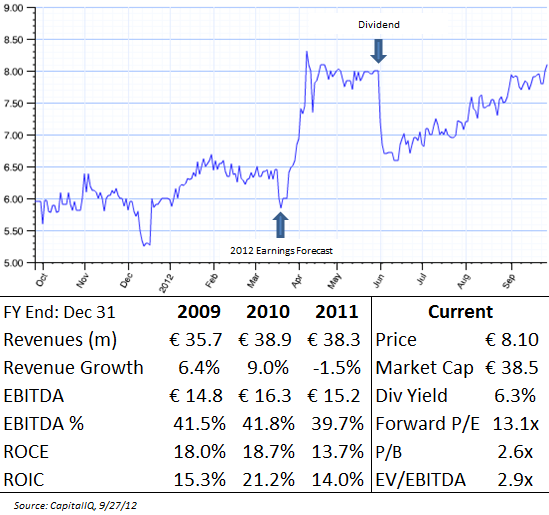

UMS paid its first dividend to shareholders in 2010, offering an average dividend yield of over 6% – if share repurchases are included, total cash returned to shareholders yields greater than 10%.

Valuation

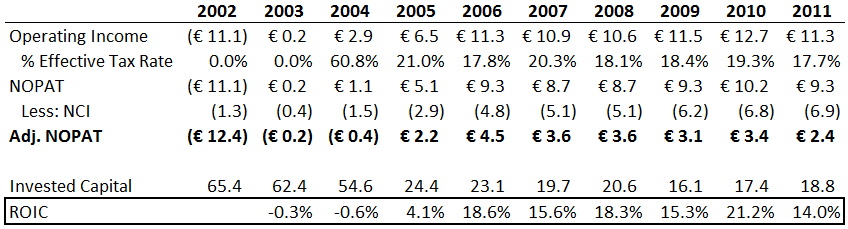

Looking at the company’s ten year financial track record, there is a clear delineation pre and post-2006, representing the shift in business strategy.

Even after adjusting for the payments due to NCI, the core business is solid, with sustainable ROIC in the mid-teens.

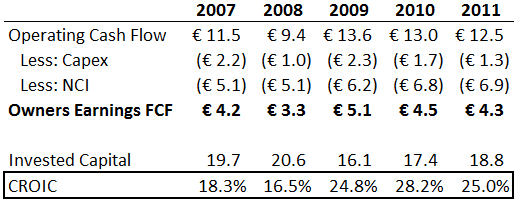

Looking at the past five years, the business becomes even more attractive on a cash ROIC basis, as D&A is higher than maintenance capex:

And over that time, the company has provided a double-digit FCF yield, with a significant (and increasing) portion of that cash returned to shareholders:

So why is the company trading at an EV/EBITDA < 3x? (Added: See comments below)

Lack of growth. (Added: And due to the fact that the majority of the EBITDA goes towards NCI)

The company has struggled to grow its business organically (or at least grow faster than the rate of inflation). 2011 sales of €38.3M were up only 11% from the 2004 number – that’s just 1.3% per year.

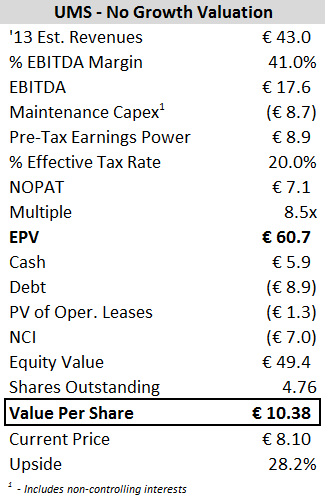

Due to a recent acquisition and stronger organic growth, 2012 sales should reach the €42-43M range, but this is definitely not a fast-growing business, so let’s value it as a ‘no-growth’ stock:

Despite a share price that is up 33% in the past year, UMS is still trading at a 28% discount to its EPV valuation.

Not only does this provide a margin of safety, but any growth (if it ever materializes) is free.

Conclusion

UMS has carved out a niche for itself within this mobile medical services space.

If the recent run-up in share price is any indication, maybe some investors are starting to take notice of the new shareholder-friendly strategy, as the stock continues to offer a steady double-digit yield (not bad in today’s rate environment).

The company is not exciting, and many investors seem to pass over such steady cash flow generating stocks in a pursuit of growth. However, as evidenced by UMS’ past, growth – if done for growth’s sake – can destroy value.

Finally, I think it’s important to point out the mission of Capiton Value, which continues to hold a sizable stake in the business:

“[Capiton Value’s] objective is to purchase significant shares in noticeably undervalued medium-sized enterprises as well as offering when suitable the respective management support for the implementation of value-creating measures…CVM combines capital market know how of many years with sound private equity expertise”

“CVM can offer support ranging from e.g. enhancement of capital market communication up to divestments (sometimes combined with a cash out) or Buy & Build strategies as far as assistance during a Going Private”

It remains to be seen whether CVM’s involvement could be an eventual route towards closing this value gap for minority equity holders…

Disclosure

Long UMS

Nice write up, interesting business, just had a few questions.

Isn’t it trading at ~3x EBITDA because the EBITDA figure of ~16.6mm includes the amount that will ultimately be distributed to NCI? If we gross up the LTM NCI distribution of 7.6mm for taxes we get 9.5mm, shouldn’t we deduct this from the 16.6mm to get the EBITDA that will only go to shareholders of UMS? On that basis EBITDA is 7.1mm and EV/EBITDA is 7.1x… which is not as cheap.

On the EPV calculation wouldn’t it be more representative to value NCI at a multiple of the annual cash outlfow vs. by the balance sheet figure (In the same way you would value the NOPAT stream at a multiple). Because if we only use the balance sheet figure then the NCI liability is only being valued at ~1x cash flow.

Also if we look at 2011 Adj. NOPAT of 2.4mm then the company trades at ~20x NOPAT (this assumes that all debt and cash are held at the parent company, which may not be the case), which doesn’t appear extremely undervalued.

Again, liked the write up and past write ups a well but just a few thoughts I had.

Thanks for the comments, all good points.

Just for some background: I’ve held onto the stock for more than a year, but only got around to writing about it now, since I went round and round on how to analyze its unique structure. It was a clear decision under €6 – at €8, it requires a bit more nuance.

But here goes on your points:

– I don’t think the EV/EBITDA calculation should be modified, as TEV is trying to capture the total worth available to all stakeholders. This is backed up by the fact that high debt firms trade at low EV/EBITDA multiples, since much of the EBITDA goes towards interest payment – In UMS’ case, much of the EBITDA goes to NCI. Basically, I shouldn’t have highlighted that question, since the answer is pretty clear: it deserves to have a low multiple, since the equity market is only getting a small piece of the profits (although just how low is a matter of debate).

– Went back and forth on how to account for NCI, since they are very profitable. If it’s valued at fair value, then pretty quickly the resulting value for the parent company is less than zero, which doesn’t seem to make much sense to me? Or this could back up why the parent should be worth more? Open to thoughts.

– 2011 was a down year, as 2012 NOPAT will €3M+. Still not screaming cheap, but I think that cash flow is a much better metric, due to how much depreciation & amortization results from the business model. Sustainable FCF to equity holders is €4-5M for a 10%+ yield, with almost all of it returned to shareholders. 10% is usually my minimum criteria for investment.

Thanks for the response.

I would say that I don’t necessarily think the business is overpriced or underpriced but admittedly I don’t know anything about the company outside of your write up. And I think the discussion on valuation methods is interesting either way.

I wouldn’t necessarily agree that high debt firms trade for lower EV’s. Theoretically debt should increase the EV multiple because the interest rate (cash flow allocated to debt) a company can borrow at is going to be lower than the FCFE yield demanded by equity investors. Because of this the cash stream to debt holders will be capitalized at a higher multiple (due to a lower yield) than would otherwise occur had the entire capital structure been funded with equity.

I think the reason the EV/EBITDA appears so low is because the NCI balance sheet figure values that cash flow stream at 1x cash flow. The debt and equity components of the EV calculation are market (or quasi market in the case of debt) figures whereas NCI is a historical balance sheet figure (whereas the NCI flow is a current market figure). This creates an EV (and thus an EV/EBITDA multiple) that is artificially low. If the NCI holders were to IPO their claim for those cash flows they would likely trade for more than 1x cash flow and thus would be include in the EV calculation at a much higher value. Which is why I believe the adjusted EV (valuing NCI at something near market)is much higher than the typical EV calculation would imply. The “market EV” to EBITDA multiple would also be higher than the current level.

Regarding alternative approaches I did have one question on the maintenance capex figure of 8.7 mil; isn’t the NCI capex fully consolidated in the company’s financials? (reported LTM capex is ~1.6 mil according to CapIQ).

Without knowing the capex answer at this point I’ll back in to the valuation from the equity side. Valuing the equity at the same 8.5x multiple (12% equity yield) that you used for the NOPAT EV calculation, using the midpoint of your normalized FCF figure of 4.5 mil, equates to a 38 mil equity value and a share price of ~8 (just below the current price). If a 10% yield was used it would give a 16% bump in equity value vs. the 12% example. That is certainly not terrible in today’s environment.

Anyway thanks again for the post and response.

I guess I should qualify my comment on EV/EBITDA multiples to mean

highly

levered companies, i.e. those that are levered past the optimal capital structure. In those cases, debt raises the cost (and possibility) of financial distress, and equity holders will demand a higher risk premium that overcome the benefits of the tax shield and lower interest rate from debt.

I included the dividend payments to NCIs in the capex figure, as that is money that must come out of EBITDA (just like capex) in order to continue running the business in its current state.

By doing that you are double counting NCI. You are penalizing the equity valuation for the NCI flows and the balance sheet amount.

It would be the same as saying that interest expense must come out of EBITDA (just like capex) to keep the business running at the current state (i.e. you would have to sell assets in order to pay back debt).

By including the dividend payments in capex you are effectively capitalizing the NCI at the same 8.5x multiple. Which explains why, under the current valuation, if you deduct the market value of NCI you ended up with a negative value for the parent. Its because you already accounted for the market value of NCI through the flows.

That makes sense. Basically, I was double penalizing the equity for NCI, both on the earnings power side and on the balance sheet. A better way would be to account for the NCI at FMV at the last step.

Without subtracting NCI from earnings, pre-tax EP is 15.9M -> NOPAT of 12.7M -> @ 8.5x multiple is 108M.

EPV – 108M

Less:

Net Debt – 3M

PV of O Leases – 1.3M

FMV of NCI @ 8.5x – 52.7M

Equity Value – 51.3m or 9.31 per share

However, it could probably be argued that NCI should be capitalized using a lower multiple, given its minority nature, lack of marketability, buyer cannot gain control, etc. Maybe a 6x multiple is appropriate, which would increase the equity valuation to 13/share.

Seems like this only increases the margin of safety.

Now you know why I wasn’t a big fan of DTRL at $1,000. 🙂

Good write-up. What brokerage do you use to buy shares of foreign cos. IB?

Yes, Interactive Brokers. It’s unbelievably cheap to trade shares directly on foreign exchanges (for example, would cost me $5-6 to buy a Japanese stock there vs. $70+ at a more mainstream broker). Execution and short sales are also amazing at IB.

But overall I hate IB – the interface is confusing / needlessly complex, customer service is awful / non-existent, and they nickel and dime you with additional fees. My frustration level is ridiculously high…

But with all of that said, it’s so cheap that it probably makes up for it. I plan to stay with them, but I would think hard about making the change if I had to do it over again (would probably still switch though, but reluctantly).

To the recent comments about NCI / Debt distorting the EV/EBITDA multiple, I do not believe this to be the case. Debt will distort the P/E multiple (higher interest expense) but not EV/EBITDA as that is capital structure neutral or like you say, captures the value to all stakeholders. Thus when you say that high debt firms trade at “low” EV / EBITDA multiples I don’t believe that statement is true (i.e. you saw some buyout in 07/08 at huge multiples because lots of debt was available).

As for the pitch, this is a very interesting company – great find.

I wonder if you can comment on their market share and the alternatives available (i.e. where most people get their kidney stones treated? Do most people use these ESWL treatments?)

Also, do you see this being dead money for awhile? Will this company ever get multiple expansion? And why is 8.5x Nopat the right no growth multiple?

Thanks so much in advance!

Yes, see my comments below on EV/EBITDA, as I was referred to

highly

levered firms (past point of optimal capital structure), where investors demand a higher cost of capital.

I’m not a doctor, but in my research ESWL treatment is a standard treatment option for kidney stones, as the alternative is invasive surgery. However, many do not require treatment at all, as they are able to be passed without any treatment except for waiting. Busy hospitals in urban areas can likely justify the capex spend for their own ESWL machines, as they have sufficient patient volume. Hospitals in more rural areas (like Michigan, where UMS has a significant presence) would benefit from a shared or rental system (accomplished via transportable technology like from UMS).

I wish I could predict when firms will see multiple expansion. In this case, the recent acquisition should help boost revenue in the 10-15% range, which is significant given the company’s recent growth profile. Combined this with higher EBITDA margins (due to higher utilization and less integration costs), and I think that FY2012 results will be very good, with potential for material upside above management’s current guidance of 0.60-0.70 EPS. Even just matching the high-end EPS number of 0.70 would be ~50% EPS growth YoY, which would likely gain investor’s attention.

But in any case, trying to forecast quarterly results isn’t my strong suit. I’m happen to collect my 10% yield while waiting to see what the market wants to do. I still think an eventual going private transaction is the most likely way to unlock value.

8.5x was the multiple Ben Graham used for no-growth companies, so it was good enough for me. I would typically just capitalize @ 10% but felt this deserved a more conservative multiple given its operating structure.

Can you comment more on this recent acquisition? What did they pay? Do you think they can get >10% ROIC on this acquisition or would have preferred that they just continue to return that capital to SHers.

Do you have any information on the contracts they sign with hospitals (duration, escalators)?

Does it make you nervous that these treatments are discretionary and that the kidney stones can be passed naturally? With these tough economic times, is it more likely that people will just forgo these treatments?

Also, I get nervous that it’s a 30 year old technology – any chance it could be disintermediated by something new?

I don’t mean to be critical – i think it’s a very interesting pitch, I just enjoy fleshing out these ideas. Thanks!

They paid 2.7M for Mobile Biopsy, with the main asset being 50 customer contracts for breast biopsy in the SE part of the U.S. It reported a net loss in 2011, but the Q2 report says that it had a “positive effect on the segment,” so I’m assuming it has turned positive. ROIC remains to be seen, as the economics of this segment are not as clear (or likely as high) as the Urology segment. I’d usually prefer to see cash returned to shareholders, but this seems different than the previous acquisition binge – something to monitor closely though.

Details of the contracts weren’t disclosed in the annual reports, although the company says it has over “650 long-term contracts.” The most profitable one, with Great Lakes Lithotripsy, goes back to at least 2003.

From witnessing people with troublesome stones, I don’t think the natural reaction is to forgo treatments – the pain can be debilitating/excruciating. Many can be passed naturally however, so growth is limited. Always a chance of something new coming out, but I think the risk are limited by the facts you already mentioned (discretionary, usually non-life threatening, slow growth) which limits the investment/innovation in this field.

Interesting name. Do you mind sharing how you came across it?

I’ve held the stock for more than a year, so I honestly don’t remember. If I had to guess, probably just screening for international microcaps trading at low EV/EBITDA multiples.

Great analysis! Can you disclose how you derive invested capital? In 2011, I take shareholders’ equity of $22.2 million, less NCI of $6.5 million, add non-current liabilities of $7.28 million, less cash of $5.9 million to get to $17.159 million.

Total equity + Debt + PV of Oper. Leases – Cash. I used total equity (not just common equity) since the income from the NCI was included in the NOPAT number.

Thanks! I apologize as I have another technical question. I can’t seem to be able to recalculate your ROIC numbers. Let’s look at 2011 again. With €2.4 of Adj. NOPAT and €18.8 of ROIC, I calculate 12.8%, not 14%. I even tried using the average invested capital for 2010 & 2011 as the denominator, but that didn’t seem to do the trick. Can you take me through your calculation?

I just used Adj. NOPAT / beginning invested capital, so 2.4 / 17.4 = 13.79% -> 14%.