Advant-E Corp (ADVC) is a tiny software company that has flown under the radar during 2010 despite outstanding financial performance and near term catalysts in the form of a special dividend.

The stock remains significantly undervalued at current prices.

Financial Highlights

ADVC reported a 6% improvement in second quarter revenues compared to the second quarter of 2009.

Net income also jumped by 28% in the quarter, due to a pickup in sales on the Merkur side of the business, along with strong cost controls across the board.

Merkur Group – Enterprise Software

The traditional software side of the business has struggled throughout the recession, posting revenue declines over the past several quarters. Impressively, the company has managed to squeak out a profit over that time period due to lower commission rates and cost controls.

The latest release shows the first glimpses of a turnaround for Merkur.

Quarterly revenues increased 2% from the same period last year, and 54% compared to the first quarter of 2010. This is an encouraging sign that ADVC’s customers are returning after pushing off purchases throughout 2008 and 2009.

Edict Systems – SaaS (Internet-Based)

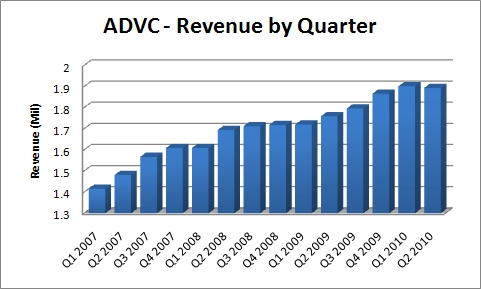

The steady growth in the Edict Systems business has been amazing, considering the economic climate over the past 2-3 years.

Going back the past 14 quarters, this is the first quarter where the company didn’t produce sequential quarterly revenue increases:

The company has no debt and an unused $1.5m credit line. ROE and CROIC come in at 21.6% and 25.6% respectively, both outstanding.

Overall, the company reported record quarterly income, the 28th consecutive profitable quarter, and is on track for the highest FCF year in company history.

Special Dividend

In November 2009, the board of directors voted to approve a 10-for-1 stock split and corresponding special dividend of $0.03 per share, a 21% ROI based on the stock’s closing price at announcement.

The dividend would be paid in 3 quarterly installments due in December 2009, June 2010, and December 2010.

Although I missed out on the Dec ’09 dividend, $0.02 per share in dividends during the course of 2010 is an 11% return at current prices.

Valuation

Even with the near term catalyst and impressive financials, the stock is trading well below its normal multiples in a number of categories:

Current vs 5 yr Averages

P/E – 9.7 vs 13.7

P/B – 3.0 vs 3.8

P/Sales – 1.4 vs 1.9

Based on both DCF and EPV valuation methodology, ADVC should be trading closer to $0.30, providing substantial upside (and dividend) at its current price.

Conclusion

So, we have a stock that is paying a cash dividend, setting record net income & cash flow levels, increasing revenues each quarter during the worst economic downturn since the Great Depression, and yet is trading well below its 5 year averages?

Seems cheap to me – what do you think?

Disclosure

Long ADVC

The grocery business is becoming saturated. It is uncertain to me whether they replicate success in other industries. Any opinions?

Frank,

There is no doubt that the grocery business remains the dominant portion of ADVC’s revenues – but what data shows that the market is becoming saturated?

GroceryEC grew 11% in the past year, continuing a remarkable run of quarterly growth. The Automotive division reported decent growth as well, despite the troubles that many of the automakers/suppliers have been going through in the past 2-3 years.

While I’d love to see the “Other” category grow (to show that the company has alternatives outside of these two spheres), the 2 segments appear to be contributing and growing.

Always looking for additional sources of info however..

Hi Adam,

I might have to re-look at this company. I too was impressed. They clearly have some kind of edge in the grocery segment.

Concerning my thought the market was becoming saturated, it was an assumption of mine. If I find where I might have inferred this, I’ll let you know.

While I am here, in reply to your email, I don’t have any cash flow statement for MAAL. Where are you getting yours?

Thanks!