As I’ve analyzed on Value Uncovered before with the UBET/CHDN deal, merger arbitrage (along with other special situations investments like going private transactions and tender offers) can provide solid returns during periods of market uncertainty.

Over the past several months, I’ve kept my eye on a merger opportunity between two small community banks in Pennsylvania, Tower Bankcorp (TOBC) and First Chester County Corporation (FCEC).

If structured correctly, these special situations investments can provide ‘risk-free’ profits, but investors must read the deal terms very closely or find their ‘risk-free’ position is exposed or incorrect.

Merger Background

On December 12, 2009, Tower Bankcorp, a community bank with a market cap of 134M, agreed to purchase First Chester National Bank with an all-stock transaction valued at $65M.

The stock transaction was structured using a floating exchange ratio based on FCEC’s performance until closing – at announcement, the deal was valued at $10.22 per FCEC share.

Together, the two banks would have a combined size of $2.7B in assets, with a strong presence in key markets around Philadelphia and Harrisburg, PA.

As originally planned, the merger was supposed to close in Q2 2010, subject to the necessary shareholder and regulatory approvals.

Merger Complications

During the second and third quarter of 2009, FCEC suffered from a sharp increase in the number of impaired loans, with non-performing loans jumping to 2.84% in Q3 2009.

Two days after the merger announcement, FCEC sold $52.5M in residential loans to TOBC in order to ensure the bank complied with minimum regulatory capital requirements.

Also, as part of an amendment to the merger agreement in early March, FCEC agreed to sell off its American Home Bank mortgage division, with TOBC provided a $2M line of credit as needed, once again to stay above capital requirements.

To further complicate matters, after a review by the bank’s audit committee in early March, FCEC found material weaknesses in its internal control procedures for identifying problem loans, forcing the bank to restate financials for all of 2009.

Finally, due to First Chester’s inability to file reports in a timely fashion, the NASDAQ put the stock on notice of delisting.

These complications pushed out the timeframe for closing the deal, and caused further uncertainty in the markets on whether the transaction would be finalized at all.

On the Road to Recovery

Despite the struggles at FCEC during the first quarter, the banks seemed to have made significant strides towards completing the merger:

May 24 – The banks received a first round of regulatory approvals from the FDIC and PA Department of Banking.

June 30 – Federal Reserve of Philadelphia approves the transaction, satisfying all regulatory requirements

July 27 – FCEC files restated quarterly reports for 2009, along with its annual 10-K

August 11 – FCEC catches up on its quarterly report for Q1 2010

August 18 – FCEC files a quarterly report for Q2 2010, announcing that the bank’s financials are up-to-date

Terms of the Merger Agreement

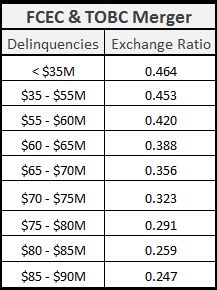

According to the merger announcement, the shareholders of First Chester would receive 0.453 shares of TOBC stock for each share of FCEC. The exchange ratio was variable, using the following table:

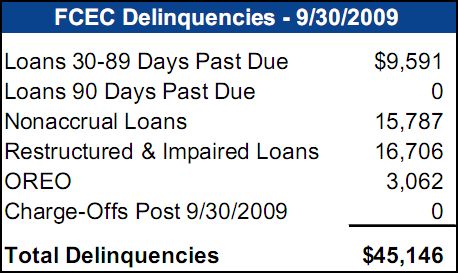

Delinquencies were calculated for purposes of the merger as follows:

Inflated Exchange Ratio?

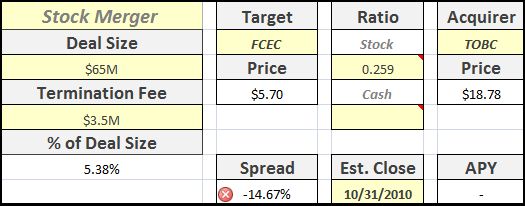

At first glance, the merger had a ridiculously high spread, leading to more investigation for a possible arbitrage opportunity.

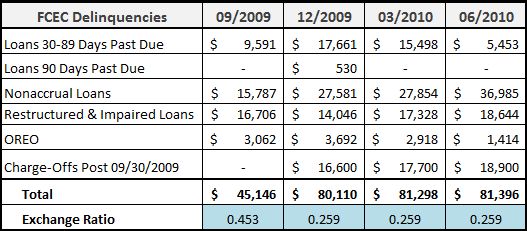

As recently as two weeks ago, FCEC stock was trading over $8. With TOBC trading around $19, the market was implying an exchange ratio of approx. 0.420, signifying delinquencies in the $55 – $60M range.

After digging through FCEC’s latest 10-Q, as well as detail from the bank’s FDIC call reports, my calculations show a different scenario:

Apparently, other savvy investors have caught on, as FCEC’s stock price has fallen almost 35% in the last month, with a sharp drop occurring this past week.

However, even with the lower prices and revised exchange ratio, the stocks still appear to be mispriced:

A purchase of FCEC’s shares will result in a loss of almost 15% post-merger (assuming no change in the stock price of TOBC), a significant difference.

Additional Risks

Outside of the exchange ratio issues, there remains significant hurdles to the completion of the deal. The transaction must still be approved by the bank’s shareholders – at current pricing levels, it would seem illogical for FCEC’s shareholders to approve the deal.

FCEC also announced that the outside date of the merger would be revised to November 20, 2010, potentially pushing out the completion even further.

Conclusion

As I mentioned at the beginning of this post, merger arbitrage can offer attractive annualized returns, but there remains definite risk for investors who aren’t diligent in their analysis.

In this case, a too-good-to-be-true return scenario led to a need for further digging, and revealed a transaction that the market continues to misprice.

*Hat tip to Cale Smith over at Islamorada Investment Management for sparking the discussion. And stealing my limelight with his post! 🙂

Disclosure

No positions at the time of this writing.

Glad to know I wasn’t the only one scratching my head on this deal. Thanks, Adam!

Cale,

Thanks for the comment. I’ve been staring at this merger for weeks, and couldn’t figure out how my expected returns were supposed to be 40%+ (using the original exchange ratio) – something had to be wrong.

It took me awhile to put all the pieces together, including finding the 30-89 day delinquency information.

There still seems to be a ways to go before the merger occurs. At this point (assuming prices stay the same), wouldn’t FCEC’s shareholders vote against the transaction?

Very interesting story !

Adam, your numbers were off leading to the incorrect exchange ratio (as of June 30th). How many of the SeekingAlpha readership were penalized to the tune of (.291-.259)* 21.62 = 69 cents per share on a $5.50 stock on the basis of your inaccuracy???

Per SEC doc: First Chester Delinquent Loans were $77.7 million as of July 31, 2010. (exchange ratio .291)

Whereas per your analysis: (exchange ratio .259)

This Friday (Oct 29th), the FCEC call report was released for quarter ended Sept 30th.

OREO worsened this quarter over this last to the tune of 2.667M

Recoveries were in excess of charge-offs i.e., a negative .315M

And past-due worsened by 3.604M

It does not appear restructured/impaired loans changed over the quarter.

Summing the above –> 6.586M + 77.7M = 84.286M

85M straddles two ratios: .237 & .259

If you listen to the TOBC CC of this past week, the CEO addressed analyst question as to what happens if they don’t complete the shareholder vote by Nov 20th. In looking at the TOBC loan agreement, I don’t readily see what kind of re-payment terms FCEC would be subject if they choose to tell TOBC to jump-in-the-lake. The TOBC loan covenant would seem to bear interest at 6% and perhaps like Jamie Dimon’s situation with Bear Stearns – the lawyers maybe screwed up by not addressing what should happen if the Bear Stearns shareholders tell Dimon to take a hike – i.e., FCEC might have free use of the capital going forward for a year or so at 6% rate of interest – hence Dimon’s willingness to revisit the Bear Stearns price raising from $2 (original offer) to $4 (wasn’t that where it went off?).

On last interesting point, the SEC doc would seem to indicate FCEC has tangible shareholder equity of 55M while yahoo reports current market value at 34M. This isn’t to say FCEC is worth 55M – only that they are trading at 61% of tangible book and for their current financial shape (improving with NPA not yet astronomical) and desirable location + wealth management division, perhaps worthy of 75% price to tangible book.

Finally, don’t believe FCEC was a TARP recipient (more valuable to a potential acquirer) and if they were able to participate in SBLF and take a loan from Uncle Sam at 1%, might conceivably save their bacon.

My numbers were calculated before the S/4 filing, and therefore were speculating on the loan results. As you mentioned, TOBC filed an S/4 in September showing the actual results of $77.7m, and therefore an exchange ratio of .291.

All investors should complete their own due diligence before entering into any transaction, whether posted on this blog or elsewhere.

[…] to the FCEC/TOBC merger from a few months back, small community bank mergers can provide a tremendous source for arbitrage […]