I’ve gotten a great response from my AIT stock pitch, and wanted to provide some additional commentary.

My goal for the presentation was to provide a clean look-and-feel, and not clutter the slides with tons of bullet points (the finer details would come out during the discussion).

Here are some talking points which loosely translate to my actual presentation. Hope it provides some further explanation/clarification.

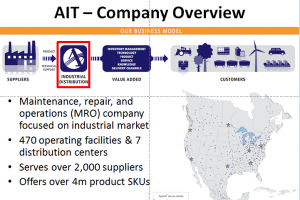

Company Overview

- AIT provides distribution, repair, and value-added services for industrial customers

- Distribution network provides a competitive advantage (if machinery goes down, customers need to get it up and running ASAP. more distribution centers – > faster response time)

- Growing part of business is fluid power (~20% of sales). Higher margins than traditional industrial distribution

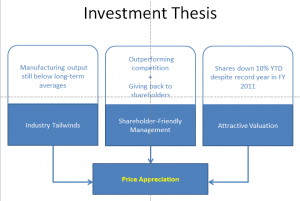

Investment Thesis

- Catalyst in the form of industry tailwinds

- Exceptional management team ensures company meets those targets (history of outperforming competition)

- Market volatility provides an entry point. Valuation is attractive considering hidden value on balance sheet and temporarily depressed earnings due to ERP installation

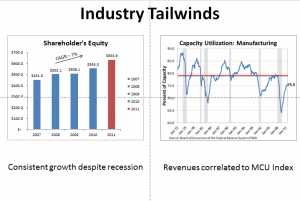

Industry Tailwinds

- Consistent increase in book value even through a severe recession

- AIT’s revenues are correlated with the MCU index, usually on a 6 month lag. Should benefit as industrial capacity continues to expand

- MCU index is still below long-term average (LT avg: just shy of 80%)

- Other economic indicators (i.e. PMI) show expansion as well, albeit at a slower pace than the last several quarters

- Company is forecasting industrial growth of 5% in 2012, and 4% in 2013

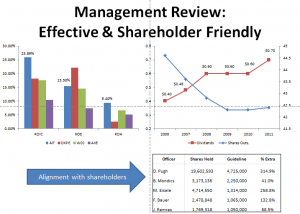

Management Review

- AIT is substantially outperforming competition on most efficiency metrics

- Outperformance is being achieved with no leverage. Just paid off last of outstanding debt in 2011 (at unattractive interest rates). Competitors debt-to-equity ratios average 65-75%

- Dividends increasing 10% per year, while share outstanding are trending downwards (great situation). Management expects to be more aggressive in the buyback market going forward.

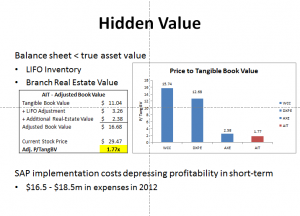

Hidden Value

- AIT already significantly cheaper than competitors on P/TangBV basis, but even more so after making several adjustments to book value

- LIFO reserve of $138m – old inventory on books for below replacement cost

- Unlike competitors, AIT owns a significant number of its distribution centers (134 owned branches), many of which were purchased prior to 1980. Adding 750k per location nets an additional $100.5m in additional value.

- Market view is focused on ERP/SAP implementation and its short-term effect on earnings. Significant capex and operating expenses in 2012, but AIT is still expected to grow margins and earnings by 10-15%. Project should provide significant operating improvements starting in 2013.

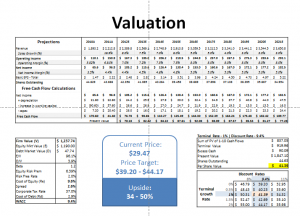

Valuation

- Conservative assumptions: 8% growth in next fiscal year, ratcheting downward to steady state of 3% by 2019

- Margin expansion of 100 basis points by 2016 due to increased fluid power business and effects of ERP implementation (by comparison, competitor’s ERP implementation helped to increase margins by 300 basis points over several years after installation)

- Approx 1% per year reduction in share count, due to management signals of increased buybacks

- Capex returning to normal levels after ERP installation is complete in 2012/2013

- Plenty of room to optimize capital structure and lower overall cost of capital by taking on conservative amount of debt

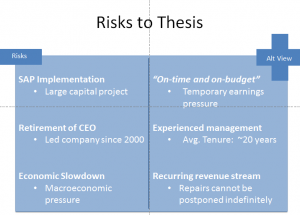

Risks

- ERP implementation is a big project ($71m over 4 years), but management seems confident in its current progress

- David Pugh retiring in October (has lead company to compound annual return of 18.1% over past 10 years). Expects to remain significant shareholder in company

- Threat of double-dip recession is still out there, although 24 out of 30 target markets were showing growth on the latest conference call

- Some business is insulated slightly from recession (i.e. AIT’s customers can put off buying large piece of capital equipment, but harder to put off hydraulic fluid to run existing machines).

- Business held up pretty well during latest recession – sales down only 8.5% in 2009 and 1.5% in 2010 before recovering significantly in fiscal 2011