GPIC continues to dominate the casino chip market worldwide, and will benefit from the explosive growth in gambling in Asia.

The economics of this business are solid, as GPIC’s products are ‘sticky.’ Consider:

– all new casinos need chips

– casino chips must eventually be replaced

– most casinos will tend to stick with a sole supplier for their replacements.

This also allows for cross-sell opportunities among the company’s other product segments.

While the business will generally be variable due to the timing of new casino openings, GPIC has maintained profitability and just reported much improved results for the fourth quarter and 2010 fiscal year.

Financial Information

For the fourth quarter of fiscal 2010, revenues increased 5% to $16.6m compared to $15.8m in 2009. Net income for the quarter came in at $1m or $0.12 per share, compared to $1.7m or $0.21 per share in the previous year.

Full-year revenues jumped 20.9% to $59.9m, driven primarily by the record-breaking third quarter, which coincided with several major casino openings in the U.S. market.

The company benefited from improved gross margin, increasing from 32.1% to 36.2%, as the company’s product mix shifted towards higher-margin Paulson chips and plaques/jetons (which carry a much higher price point: $3 – $20 for these European-style chips compared to $1 – $5 range for normal chips).

With this momentum, reported EBIT was $6.4m, up significantly from the 2009 figure of $1.2m, a number which was negatively affected by a $1.5m goodwill impairment charge.

Net income for the full year was $4.4m, translating into EPS of $0.54.

Balance Sheet

While company appears undervalued on an earnings basis, the balance sheet is a key part of the investment thesis.

Book value has increased every year since 2006, and the company now sits on $29.7m in cash and marketable securities. Of this amount, $18.1m is held overseas by GPI SAS, with the balance of $11.7m at GPI USA.

Even if the $18.1m overseas cannot be returned to the U.S. because of tax implications, there still remains significant excess cash in the U.S. operations, while still allowing the company to reinvest money back into the business on the international side (where much of the growth is coming from).

The company has paid dividends in 3 out of the last 5 years, with the most recent announcement in Dec 2010 for a special dividend of $1.5m, or $0.1825 per share.

In an unusual transaction, the company actually borrowed the money in order to pay this dividend, with the loan secured by certificates of deposit due later in the year. The details:

“In December 2010, GPI SAS borrowed 5.0 million euros (approximately $6.7 million in December 2010) to be repaid by July 2011 without prepayment penalty and at an interest rate equal to 50 basis points over the three-month Euro Interbank Offered Rate (EURIBOR). We incurred this debt to fund the payment of the $6.6 million dividend to GPIC in order to avoid liquidating higher yielding marketable securities.”

I applaud this move as a creative way to return cash to shareholders in 2010 without prematurely sacrificing returns on existing investments.

Growth Opportunities

If you’ve read my background, you might be able to guess that I’m very bullish on the prospects for casinos and gambling in general. China’s middle class is exploding – with tens of millions of people with newfound wealth, with gambling just one of the possible (but proven) outlets.

In December 2010, the company announced the creation of GPI Asia, in order to market existing product lines in this white-hot market.

Meanwhile, many states in the U.S. are stuck with gigantic budget deficits and are increasingly turning towards gambling as a way to raise additional tax money.

A few examples:

- States Continue to Feel Recession’s Impact

- A new proposal could bring five mega casinos to Florida

- Casino Gambling Mulled to Help Close Texas State Budget Gap

As the number one player in the casino chip market – and with an exclusive license in the U.S. for RFID technology for at least the next few years – GPIC is uniquely positioned to capitalize on this growth.

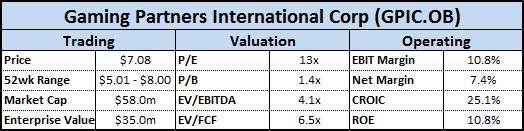

Valuation

Recent results do not materially change my original valuation estimate, as the stock still appears undervalued based on current and future earnings.

Even with the most conservative assumptions for DCF and EPV, I find it hard to come up with a value less than $8-9 per share.

At current prices, the stock is trading at with an EV/EBIT multiple of 5.3x and EV/FCF of 6.5x.

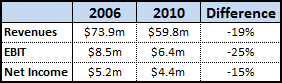

Compare 2010 financial results to 2006:

2010 financials are roughly 20% lower than 2006’s record year, yet the company’s current enterprise value is 75% lower than in 2006, when the stock price was almost $18 per share.

Conclusion

2010 was definitely a great year, arguably the second-best in the company’s history, and yet the stock trades at one of the lowest multiples in its history.

This is despite the fact that the business is earning double digit returns on equity, to go along with average ROIC and CROIC of 17.7% and 24.4% respectively (the business is cyclical however, so short-term results can swing wildly).

The company has grown book value by 11% annually for the last ten years, and now sits on a significant cash balance that can fund additional growth or used to reward shareholders in the form of dividends or buybacks.

Going forward, I see two positive outcomes:

– Mr. Market reawakens and values GPIC at a more appropriate multiple

– The company returns some of the excess cash to shareholders if management cannot find a way to reinvest it at a satisfactory rate of return

The recent purchase of GPIC’s injection mold supplier – while not material – seems to be a good move to consolidate the supply chain and shows that management is looking for ways to utilize this excess cash.

Meanwhile, the appetite for casino gambling will only grow – and the market for casino chips along with it.

Check out my original post on Gaming Partners International (GPIC.OB), as it contains much of the background information on the company.

Disclosure

Long GPIC