Servotronics, Inc (SVT) is a small aerospace stock that has maintained profitability through the recession and in 9 out of the last 10 years.

The company’s financial metrics are decent but not extraordinary, and should benefit from strong tailwinds in the global aircraft industry.

While the economics of airlines have been dismal, many aircraft suppliers have benefited from strong growth in the aerospace market.

If SVT can capture some of this momentum – and be recognized by the broader market – the stock could appreciate to 2007 levels.

Company Breakdown

Servotronics is split into two operating segments:

Advanced Technology Products

ATG designs and manufactures servo-control components such as torque motors, hydraulic valves, and electronmagnetic actuators.

These are high-tech components with stringent safety standards, as they are primarily sold to aerospace, missile, and governmental industries.

This division is the prime asset at SVT, producing the vast majority of operating profits over the years, and has the most potential for future growth.

Consumer Products Group

CPG designs and manufactures cutlery products – knives for household use and hunting/fishing expeditions, along with products like machetes and bayonets for the U.S. government.

Unlike the ATG segment, the CPG division is moderately seasonal, and operates at much lower margins. Despite bringing in almost 40% of revenues, it contributes almost zero profit.

As an outside investor looking in, the combination of the two segments doesn’t make much sense – aircraft components + knives? – and could result in making less-than-ideal capital investment decisions.

Financial Results

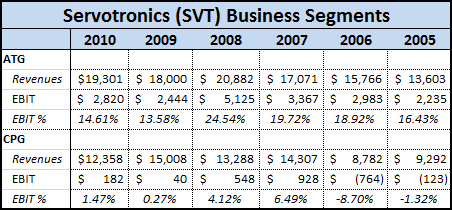

2010 revenues fell 4.09% to $31.7m from $33.0m in 2009, with a $2.6m decrease in the CPG segment offset by a $1.3m gain the ATG division.

Both segments saw margin improvement, with ATG increasing its operating margin by 103 basis points, while CPG saw a leap of 121 basis points.

Despite the improvement, Consumer Products is still running at extremely low margins, just 1.47% in 2010.

In comparison, ATG’s margins came in at 14.61%, an increase over 2009, but still below the company’s long-term average, leaving room for additional margin improvement.

In total, operating income increased 9.6% to $3.0m compared to $2.5m for the prior year. This is the 3rd highest operating income in the company’s history, trailing only 2007-2008.

Net income increased 11.8% to $2.1m or $1.08 EPS.

SVT maintains a cash balance of $4.4m offset by $3.4m in debt. The majority of this debt is for Industrial Development bonds issued by a governmental agency to build the company’s headquarters and advanced technology facility.

This property has 82,000 square feet of building space and sits on 38.4 acres.

As the bonds are paid back in full (a lump sum payment is due in 2014), the company will own the property outright after paying a nominal final fee.

Until that time, this debt is a very attractive form of leverage, with current interest rates at only 0.54%.

Management

Servotronics is a family-run business that has been around since 1959. The company’s founder and CEO, Dr. Nicholas D. Trbovich, has been at the helm for the past five decades.

His son has also been on the board of directors since 1990.

Together, the Trbovichs own 28.5% of the outstanding stock through direct ownership and options. They also vote unallocated shares of the Employee Stock Ownership Trust (ESOP), another 8.6%.

Effectively, they control the company, making it hard for outsiders to affect change.

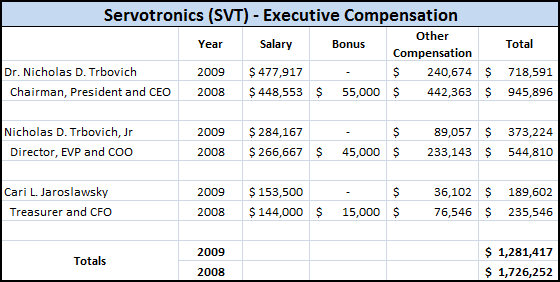

Executive compensation is high – maybe excessively so – with a large portion made up of base salary.

In 2009, SVT earned total net profits of $1.9m yet paid $1.3m in total compensation to its top 3 executives.

Corporate Governance

In addition to the high annual pay, the two family members also have employment agreements which trigger on any change in control, requiring a payment of 2.99x of average annual compensation over the past 5 years.

This would trigger a severance payment of over $3m, a significant hurdle for a potential acquirer when they are buying a company with a market cap of $17.8m.

Making it even harder, SVT has a shareholder rights plan in price that triggers if someone acquirers more than 25% of the company. It effectively dilutes the stake by offering new preferred stock and an option to purchase additional common.

While management often frames shareholder rights plans as a benefit, they often hinder sources for unlocking shareholder value such as selling the company or replacing management.

Positives

Share Repurchases

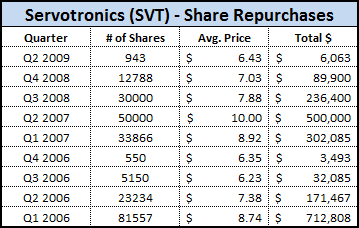

The board has authorized a share repurchase plan and the company has purchased a total of 238,088 shares – but only 943 of those shares were bought during the past two years.

Buybacks can be effective when management repurchases stock when it’s trading at a discount to its intrinsic value.

Looking at SVT’s buyback history, a significant number of shares were purchased at much higher multiples of earnings and book value compared to current prices.

I’d much rather see management repurchase additional shares now, when the stock is trading at a ~20% discount to book value.

Special Dividends

Instead of repurchasing shares, management has returned cash to shareholders via a special dividend. This past year marked the third consecutive year that a dividend has been paid, at $0.15 per year.

This payment represents a 3.3% dividend yield.

Industry Tailwinds

Finally, the company should benefit from strong industry tailwinds in the aerospace market (and I try to avoid industry headwinds whenever possible).

Air traffic, especially in Asia, is expected to continue growing at a rapid pace, and aircraft manufactures are churning out new planes to meet this demand.

As the company mentioned in its press release,

“certain major manufacturers of commercial aircraft have publicly announced that they have initiated plans to ramp-up production to support their customers’ forecasted increases in aircraft deliveries in 2011 and 2012. Aircraft component suppliers are being advised to increase their manufacturing capabilities to support this forecasted accelerated aircraft production.”

Suppliers such as SVT should benefit from this boost going forward.

Stock Valuation

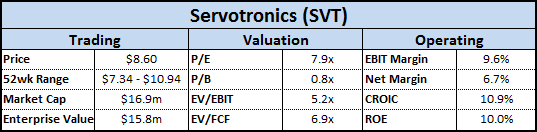

No matter which way you look at the company, SVT appears to be an undervalued stock.

At current prices, the stock is selling at a discount to book value (P/B is 0.8x) despite earning respectable if not unspectacular ROE and CROIC of 10% and 10.9% respectively.

A DCF calculation using extremely conservative inputs ($2.1m in FCF, 3% growth, 9% discount rate) yields an intrinsic value estimate around $14, almost 40% upside based upon current prices.

On a multiple basis, SVT trades at 5.2x EV/EBIT and 6.9x EV/FCF.

The company is small, float is tiny, and it operates in two completely unrelated business segments, so finding comparables is difficult.

However, even assigning a conservative multiple of 8x EBIT and 10x FCF would see the stock trading around $12-13.

Conclusion

Servotronics has a solid and extremely profitable business segment that is being held back by the low-margin barely profitable consumer division.

Consider this: The CPG segment has done $73m in sales over the past six years but only earned $811,000 in total profit!

Despite this inefficient capital allocation, the Trbovichs pay themselves a considerable compensation package.

The harsh truth at many public companies is that the larger the company (based on revenue), the more executive pay packages can be justified – reducing the likelihood of a divesture even if it’s in the best interest of minority shareholders.

I have all of the respect in the world for company founders and entrepreneurs in general, and Dr. Trbovich should be properly applauded for his work in building up the company over the past five decades.

Shareholders would be better served by spinning off or divesting the low-performing unit, which is currently taking away capital investment and management focus that could be better served by the company’s core competency.

Maybe then the market will realize the mispricing – and everyone will benefit.

Disclosure

Long SVT