As I had mentioned in my previous posts on the evolution of my value investment philosophy, I’ve recently been focusing more on microcap stocks trading on the OTCBB and Pink Sheets.

While many stock screeners aggregate data for most stocks on the OTCBB, Pink Sheets are not required by law to file periodic financial statements, making a screener less useful.

Despite this, many Pink Sheets continue to file audited financial statements and press releases.

Since many investors are unwilling to purchase these types of securities, this dynamic presents a great opportunity for the willing investor, as many of the securities are significantly mis-priced.

Buffett’s Approach

At the 2001 Berkshire shareholder meeting, Buffett talked about his approach to investment research:

When I started, I went through the manuals page by page. I went through 20,000 pages in the Moody’s industrial, transportation, banks and finance manuals — twice. I actually looked at every business — although I didn’t look very hard at some.

Since the opportunities in the broader market are drying up (at least for the fundamentally cheap stocks I’m looking for), I used this as inspiration to start my own research project into all of the businesses trading on the Pink Sheets.

I would look at every possible stock and decide whether it was worth further research.

As Buffett said, I wouldn’t look very hard at the majority of the available stocks, but I was hopeful that I would find a few gems.

On the OTCMarkets website – the go-to source for Pink Sheets securities – I started with the Symbol Information File for the entire company directory.

A recent check shows 20,730 individual securities, a staggering number.

Research Methodology

A significant number of these securities consist of stocks trading on the Grey Market – a security that “is not listed, traded or quoted on any U.S. stock exchange or the OTC Markets” and has no market maker – and therefore can be avoided.

Check out the list of OTC Market tiers to better understand the various levels of disclosure.

I also removed international stocks, setting them aside for further review later. (Right now, I continue to trade through Zecco, which does not provide exposure to international markets)

For the initial stage of this project, the focus was on U.S. common stocks.

Once the list was cut down, I started going through the list one-by-one.

I’d open up each stock quote page on OTCMarket and check out the latest price quote, stock chart, and company information. I’d look at the financials, and open up the latest 10-Q and 10-K.

I could usually tell within a minute or two whether the stock warranted further analysis.

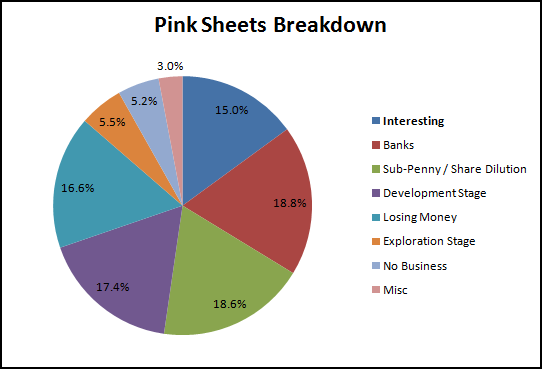

Many stocks are labeled as development or exploration companies, outside of my circle of competence and likely not generating revenues.

A large portion were banks and other financial institutions, an immediate pass for me.

Others were shell companies, continuing their public disclosure in the hopes of merging with an entity in the future.

And numerous others had no identifiable business model or updated financial information.

Consistently negative profits, tons of debt, recent or repeated share dilution (a favorite among the penny stocks) are all reasons to cross the name off of the list.

The ugliest had literally billions of shares outstanding yet traded for only fractions of a penny.

While some investors might find value in these types of securities, I decided to just pass instead of looking at them very hard.

At the same time, many of the stocks were growing, profitable businesses with long histories, but ones that had decided that the costs and compliance of Sarbanes-Oxley and full SEC reporting were not in the best interest of the company or shareholders.

If the stock passed the initial once-over, I’d usually spend time reading the full annual report, the last few quarterly filings, as well as the proxy statement and any recent press releases or insider filings.

Only then, satisfied that it was a legitimate, worthwhile business, would I add it to the watch list for full due diligence at a later date.

By the Numbers – 3698 Stocks Later

Final Tally: 3,698 stocks

Roughly 15% of the stocks passed my initial 2 minute due diligence check.

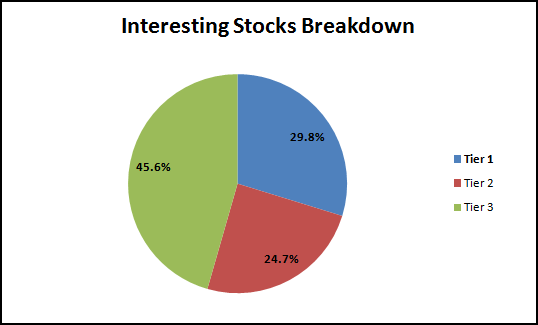

Of the stocks requiring further due diligence, I broke them out into subjective tiers based on their overall business model, cheapness, insider holdings, etc.

All Tier 1 stocks required additional due diligence and number crunching to identify actual investment candidates.

To date, maybe 20-30 companies made it as candidates on my immediate watch (or buy) list.

30 out of 3698

.8%

Conclusions

There is no doubt that there are still incredible bargains out there for investors who are willing to put in the effort to comb through the undiscovered corners of the market.

A few examples:

- A business with 50 years of history trading at 1.5x EV/EBIT & less than working capital

- A sub $50m stock that grew revenues through 2008/2009 with an average FCF yield of 27%

- A $300m in sales company selling for 0.65x book value, with positive net income for 9 out of 10 years

It was an incredible exercise, and definitely helped my confidence in evaluating companies through their financial statements alone.

In these stocks, the simple things matter – profits, cash flow, positive equity – and I’ve found that I prefer it that way.

It took me almost 2 months to complete this initial review, but it is a quest that never ends. I need to go back through the Tier 2 & 3 stocks for a second pass.

Final Thoughts

In a 1993 interview, Buffett talked again about his recommendation for investors who are starting out with small sums of capital and searching for undervalued opportunities.

Adam Smith: If a younger Warren Buffett were coming into the investment field today, what areas would you tell him to point himself in?

Warren Buffett: Well, if he were doing – if he were coming in and working with small sums of capital I’d tell him to do exactly what I did 40-odd years ago, which is to learn about every company in the United States that has publicly traded securities and that bank of knowledge will do him or her terrific good over time.

Smith: But there’s 27,000 public companies.

Buffett: Well, start with the A’s.

3,698 stocks later.

From A – Z.