This is a guest post for Jordan Topal, a long-time reader and value investor.

IEH Corp (IEHC)

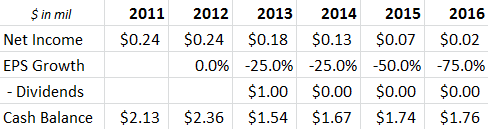

[table id=7 /]

Price Chart

To estimate where the stock normally trades, I eliminated some of the larger price spikes, and using the previous year’s earnings from FY04-FY11, I estimated the median annual low P/E was 6.08, and the median high P/E was 13.15.

Company Overview

IEH Corp designs and manufactures connectors for military and commercial applications. It sells mostly through independent reps in North America, Europe and Asia. While it has a standard line of products, the company engineers will also work with the customer to create job-specific connectors. In 2011, 69% of sales were to the military, compared to a 73% average over the last ten years.

IEH’s connectors use hyperboloid technology, which uses curved wires to ensure the male and female parts of the connector maintain contact through any amounts of shock or vibration. It’s the same technology the competition uses, and has represented almost all of the product sales for over 15 years. These connectors are sold to end manufacturers of finished goods as a component of the final assembly (think of Raytheon using the connector as a part of a missile system). Since the products are similar, IEH has to focus more on service, customizing the products for the buyer.

The company was created in 1937 as the Industrial Heat Treating Company by Louis Offerman. Louis was succeeded by his son Bernard, and today Michael Offerman is the third generation CEO/Chairman of the firm, having served as CEO since 1987 and on the board since 1973. David Offerman, the VP-Sales, joined the firm in 2004 and is the fourth generation Offerman to work at IEH. Michael Offerman owns 40% of the company.

Paul Sonkin of Hummingbird Capital Management owns 13.2% of the company, with signification ownership first being stated in a 13D filing in April 2007.

Qualitative Overview

IEH’s competitors operate as subsidiaries of a multinational corporation – Smiths Group plc – and are banded together under Smiths Interconnect as Hypertac Ltd. Hypertac used the strategy of acquiring all competing makers of hyperboloid connectors, leaving IEH as the only independent manufacturer in the US. IEH tries to separate itself from the competition by offering custom engineered connectors for specific applications, while many competitors just sell from a catalog.

Both IEH and Smiths Group note that government spending reductions could hurt their revenues and margins (as happened to Smiths’ other defense areas in 2011), but both continue to see solid revenue growth with their connectors.

Why hasn’t the much larger Smiths Group hurt IEH’s sales? One possible explanation is paragraph two of the latest 10-K report:

“We have been approved by the federal government as a “Hub-Zone small business Company”. This classification is monitored, and while the Company must remain competitive, it is taken into consideration by large business concerns when awarding military contracts in support of government programs. The federal government has mandated that major corporations being awarded government contracts must give a specific percentage of such business to “Hub-Zone small business enterprises”.

To qualify as a Historically Underutilized Business zone company, the business must be in a SBA-designated area, majority owned by a US citizen, fit the NAICS small business designation (less than 500 employees, where IEH has 121), and have 35% of employees living in the Hub-Zone. Interestingly, using the company’s HQ address, the SBA site says it doesn’t fall into a Hub-Zone location, though it’s two blocks from the closest one.

IEH has been Hub-Zone company since 2007, which gives it a 10% price evaluation preference, and the government goal is to award 3% of federal prime contracts and subcontracts to Hub-Zone firms.

Between its standard products approved as military qualified product listings, the custom designed connectors for unique applications and the Hub-Zone small business company designation, the company has carved out a profitable niche in its industry.

Financial Overview

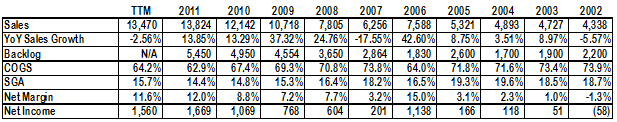

After the Gulf War, the military downsized its spending, causing IEH sales to remain in the range of 4-5mm between 1995 and 2004. But in the last 10 years, IEH has more than tripled sales. IEH’s top four customers account for 38% of sales.

The real impact on the stock price has come from the increase in margins. In the last decade, the company struggled with gross margins in the 26-29% range. But in the last five years it increased these margins to the 31-37% range, while also keeping the SG&A expense growth smaller in proportion to the top-line growth. This caused net margins to jump from 1-3% to 7-12%, leading to massive net income growth.

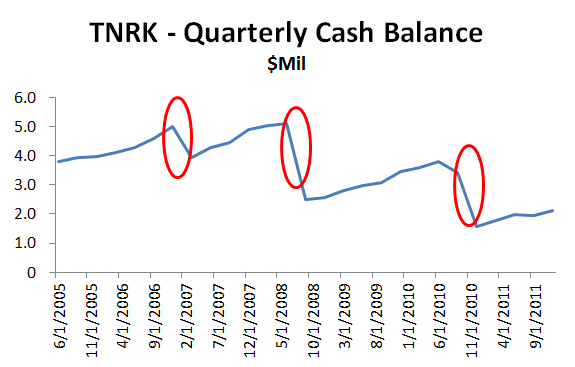

The company free cash flow is a much less compelling story: $0.08/share in the trailing twelve months, and $-.07/share in FY11. This is caused by a large buildup in inventory, specifically raw materials. The company has doubled sales since 2008 while raw materials have almost tripled. Most of IEH’s net income has gone towards purchasing raw materials, leading to the low free cash flow levels. The company’s most recent 10-Q states that it may purchase excess raw materials to take advantage of low prices or in anticipation of increased sales. From speaking with IEH, I gathered that the company was focusing on the latter, which makes sense as 2011 was a year with record backlog.

The company is debt free with $418k in cash, and owes an annual 150k and 111k for a building lease and pension expense. The pension is operated through the United Auto Worker’s union, and neither the plan net assets or unfunded pension obligation is available to IEH. Using the remaining lease payments, I estimated the present value of the building lease at $1.2mm.

Why the Fallen Stock Price, and Reason for Investment

From a high of $5.40 in August 2011, the stock price has fallen to $3.65. This coincides with two events. First, revenue in the September quarter was flat YoY, while December saw a fall from 2010 levels – a concerning fact since September and December had both seen YoY gains in each of the past four years. Second, the US declared an end to the Iraq War in December 2011 with a final large troop drawdown, as well as beginning large troop withdrawals in Afghanistan.

In short, it is doubtful that IEH will continue the previous trend by tripling sales growth over the next ten years. However, IEH doesn’t have a history of overinvesting in inventory, and combined with the record backlog levels it should indicate that the recent fall in sales should be the exception, rather than the rule.

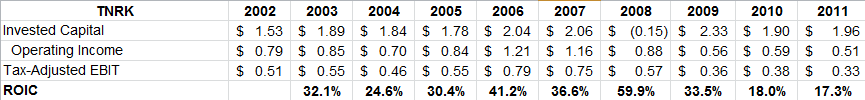

The risk is that the connector market languishes under defense spending cuts, and the Smiths Group starts a price war for the remaining market share, cutting margins to the bone and creating a stagnant market like 1995-2004. A tighter margin environment like 2004-2005 would lead to a lower ROIC around 7-10%, as opposed to the 20-25% ROIC of the last couple of years.

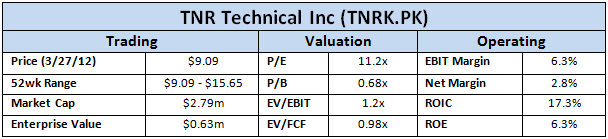

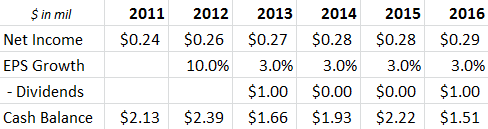

The catalyst for the stock is the realization of anticipated increased sales, along with the eventual slowdown in raw materials buildup leading to higher free cash flow. At 1.12x book value and a 5.4 P/E, the current discount makes IEHC cheap enough to buy and wait for mean reversion towards the high end of the normal P/E range, with book value growth providing the margin of safety.

Resources

Smiths Group presentations/transcripts

Disclosure

Author of post is long IEHC