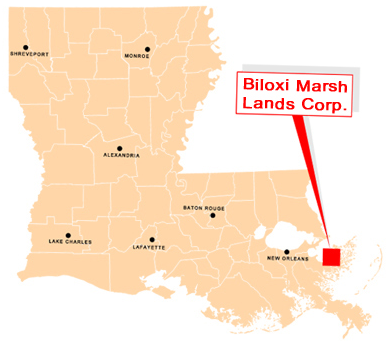

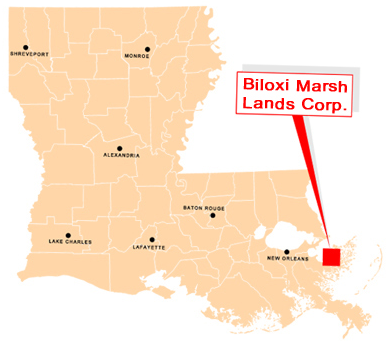

Biloxi Marsh Lands (BLMC) is a pink sheets stock that owns 90,000 acres of wetlands/marshlands in SE Louisiana. The land is used for a variety of purposes including trapping leases and alligator tagging, but the key money maker is oil & gas.

Historically, BLMC rented out the land to exploration companies and collected a lease fee –in 2006, the company formed a subsidiary for active exploration, an aggressive shift in strategy that offers the potential for long-term investors.

Investment Thesis

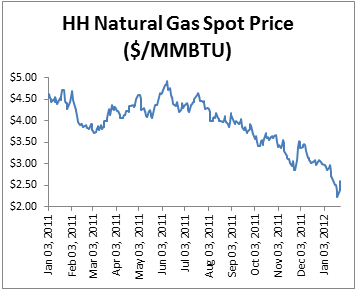

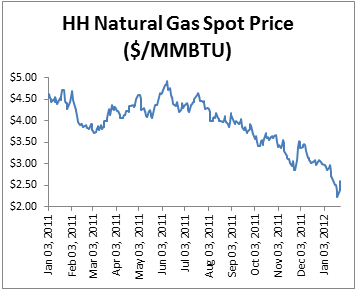

1. Contrarian play on the bearish sentiment for natural gas – Natural gas prices have hit the lowest point in the past ten years, and the bears have been out in full force. Supply/demand economics argues that prices should eventually rise back to more normal levels (although it might not be until 2013 or later), and any boost will provide significant upside to BLMC.

2. New exploration subsidiary changes company’s strategy – Prior to 2006, BLMC was a passive land owner, leasing out land to other exploration companies in exchange for royalty income. The new B&L Exploration Company (B&L) is actively exploring on behalf of BLMC (with early signs of success).

3. Land provides downside protection – BLMC owns 90,000 acres in St. Bernard Parish in Louisiana, which is held on the books at significantly below market value. While the land is really only suitable for oil & gas drilling, the land should provide a backstop to the share price, limiting potential downside

4. Attractive dividend yield – The company has paid out $50m in dividends over the past ten years, with an average yield of 8.2%. Yields over the next 1-3 years will likely be lower given the recent price trend in natural gas, but any uptick in natural gas prices could result in a material increase.

Overview of the Natural Gas Industry

While I normally stay away from ‘macro’ plays, the success of this investment is so wrapped up in natural gas prices that additional detail is warranted.

A quick check through some of the latest news headlines shows the dynamic in natural gas right now:

And looking at the recent price levels at the Henry Hub in Louisiana:

So why such a drop?

- A very mild winter in the United States has put a damper on gas demand for heating

- Inventories are near record highs, creating a supply glut

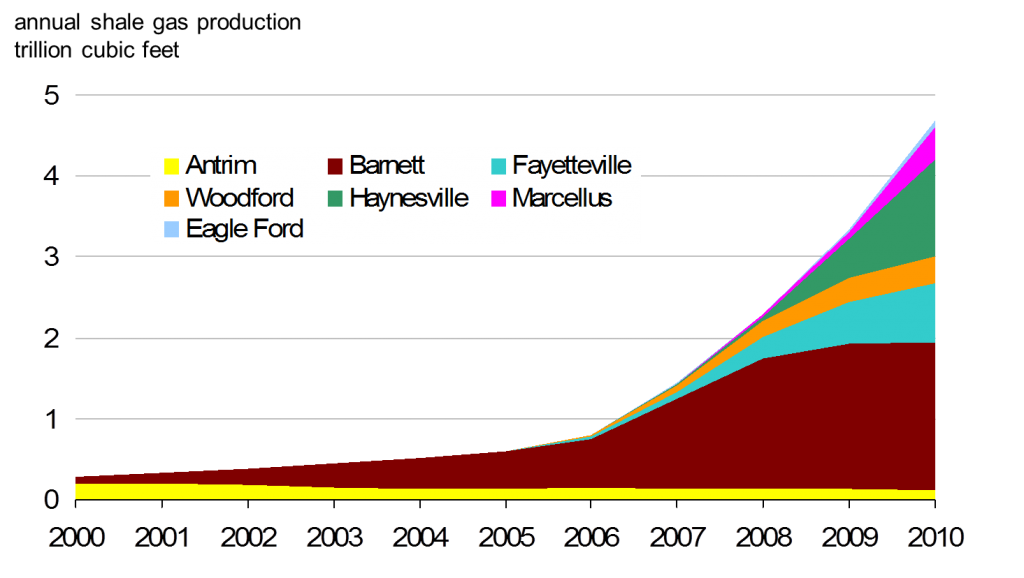

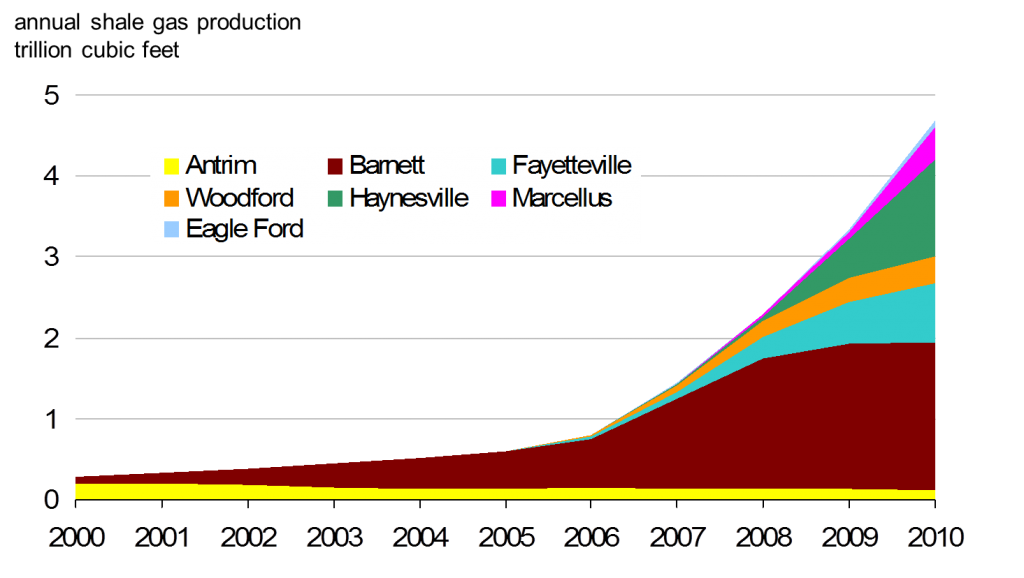

- Incredible growth in natural gas from shale formations via innovative drilling techniques like hydraulic fracturing

The natural gas story is best told by pictures. Here is the growth in shale production:

Source: EIA, “The Long-term Outlook for Natural Gas”, Feb 2011

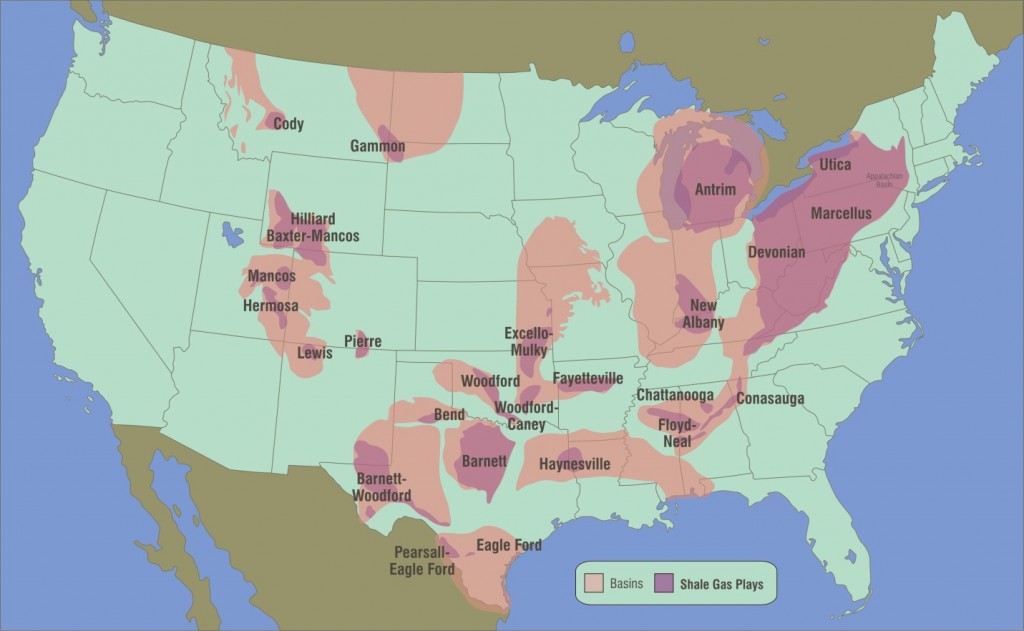

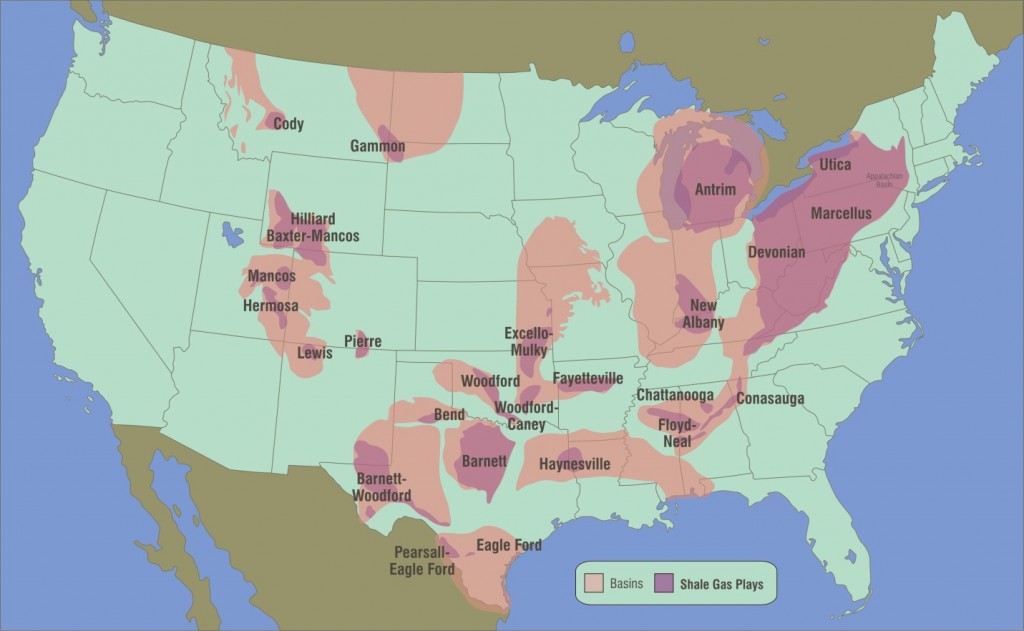

And a map of the major shale plays in the U.S.:

Source: EIA, “The Long-term Outlook for Natural Gas”, Feb 2011

However, this huge increase in production comes at a cost – literally – as these new shale plays are very expensive:

“Gas shale wells are expensive to drill and complete as well as the cost of the leases on which they are drilled. Even though initial gas production from shale wells is huge, the low price has depressed the amount of cash companies are receiving. As a result, producers are spending well in excess of their cash flows.”

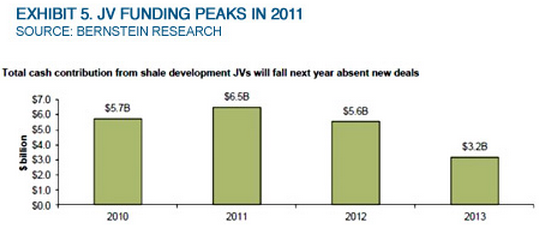

In the rush to gobble up territory in these areas, exploration companies only have a few sources of cash:

1. Tapping Wall Street for debt & equity – While Wall Street can provide funding for far longer than is usually wise or prudent, there are signs that the other two sources are running out…

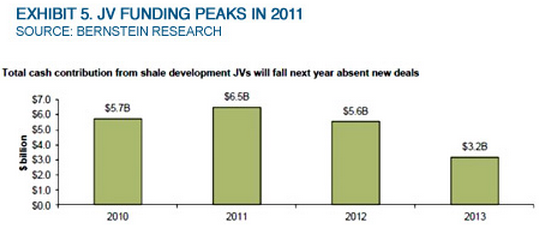

2. Investing in joint ventures – JV Investment are on the decline, with significant fall-offs in 2012 and 2013:

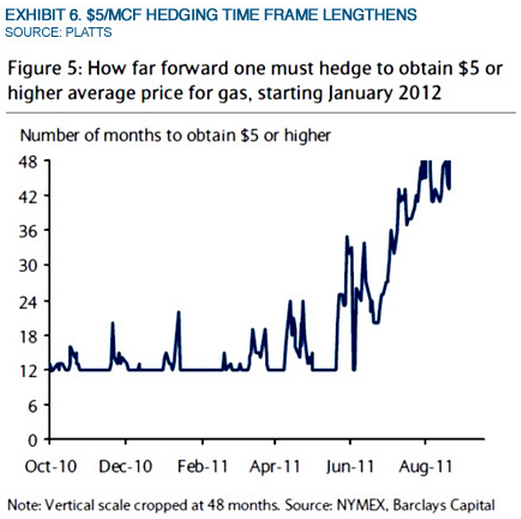

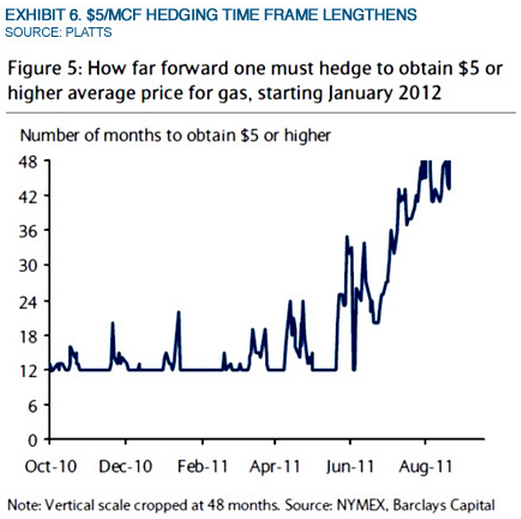

3. Hedging future production – Another alternative, where companies use the promise of cash flow from future production in exchange for funds now. However, the timeframe for receiving a decent rate for future production is lengthening dramatically:

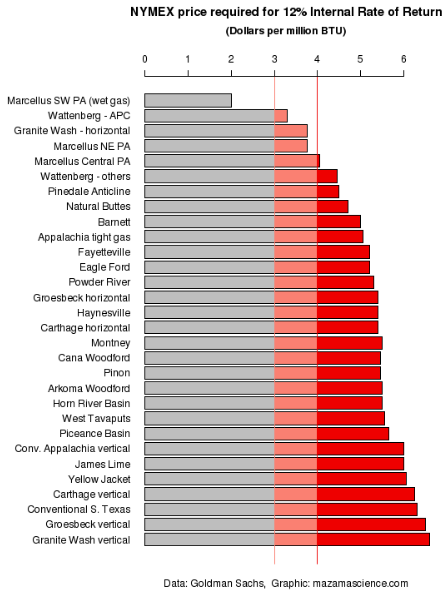

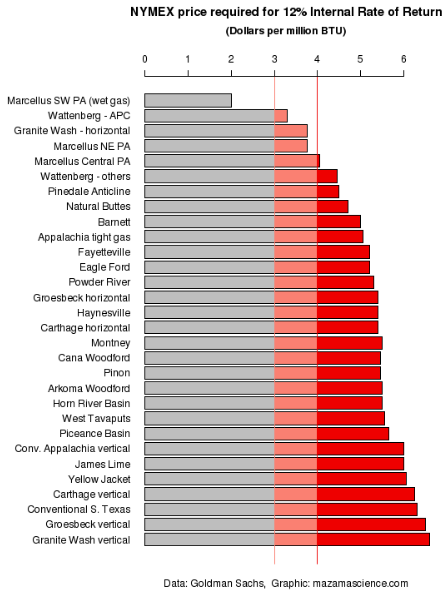

These low prices are bad news for shale gas, as many cannot earn satisfactory rates of return if gas stays below $3 or even $4 per MMBTU:

Despite some of these warning signs of a correction in natural gas, there is definitely a chance (likely a certainty), that natural gas prices will go lower in 2012 on the back of a mild winter and higher-than-normal gas inventory – maybe even breaking the $2.00 barrier.

However, supply/demand economics dictate that producers will cut production if prices stay low, as many high-cost producers will eventually go out of business if the trend continues.

Even some of the more well-known names are already cutting production – Chesapeake Cuts Natural-Gas Output as Prices Hit 10-Year Low.

But enough of the macro picture, let’s take a look at BLMC.

BLMC Financial Overview

BLMC’s revenues ebb and flow with the rise and fall of natural gas prices, and have ranged from a high of $21m in 2004 down to a low of $0.598m in 2008.

In the last few years, the bottom line has been boosted by several legal settlements with the state of Louisiana ($24.2m in 2009 and $5.2m in 2010, with most of the windfalls paid out via dividends).

While operating income from the traditional royalty base has been positive, the company has been funneling dollars into the B&L exploration subsidiary, which flows back to BLMC’s accounts through the “Income (loss) from Investment in partnership” line.

Therefore, investments in exploration within the subsidiary show up as a loss on BLMC’s income statement, which can cause an ugly bottom-line earnings number.

Through the nine months ended Sept 30, 2011, the company reported a net loss of $1.2m, compared to a gain of $0.788m in the same period last year.

The big difference was the subsidiary: partnership losses came in at $2.4m through the first nine months, although $1m of that loss was from depreciation & depletion expense, a non-cash charge.

Much of this cash outlay went towards drilling new oil & gas wells, so the future odds of recouping this investment is still uncertain – however, initial results show much promise.

So while the income statement isn’t exciting right now, BLMC’s balance sheet is extremely strong, with cash and cash equivalents of $3.3m as of September 2011.

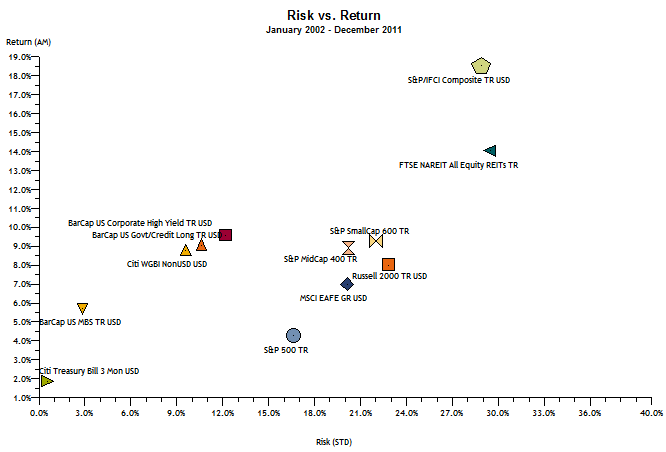

In addition, the company has a diversified portfolio of marketable securities, mostly in large-cap stocks and bonds, with a market value of $11m.

Unlike many companies, Biloxi does include a detailed breakdown of the marketable securities portfolio in each annual filing.

The Land

Biloxi owns approx. 90,000 acres in Southeast Louisiana (see picture above). The company provides a detailed description of each plot, along with a property map highlighting the specific area.

Sadly, this is not land for development, as most of it is marshland and basically underwater – check out the scenic gallery here.

However, all of this land is being held on the books for $235k, or only $2.61/acre. This seems absurdly low, and reflects the fact that most of the land has been on the company’s books since the 1930s.

While the exact value of the land is open for disagreement, it HAS produced millions of cubic feet of natural gas, and would seem more valuable than $2.61/acre…

Could it be worth more than the current enterprise value of the entire company?

After talking with a Louisiana real estate expert, basic non-developed land goes for roughly $700-$1000 per acre. The inclusion of mineral rights (the ability to mine or drill for oil & gas and other minerals), adds roughly $100-$150/acre to a property’s value.

So even if we value the actual land at $0, and assign a value of $150 per acre for the rights only (on the high-end of the range, since it is a known gas-producing region), the total land value is $13.5m, compared to BLMC’s current EV of $12.5m.

Regardless of the true value, the land does provide a measure of downside protection, as management can always sell of parcels to meet funding requirements if the company was ever in dire straits.

Oil & Gas Properties

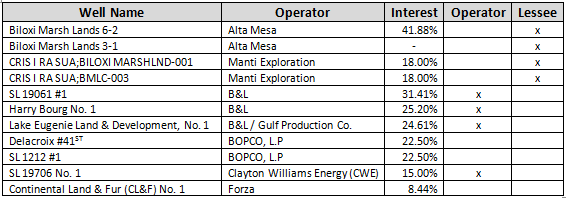

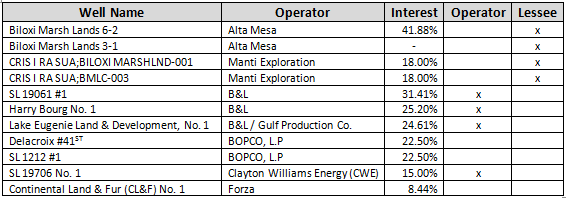

As of the latest quarterly press release, BLMC had ownership interest in 4 wells leased out to other exploration companies. In addition, the new B&L subsidiary has ownership interest in 6 wells, with an additional well being placed into production in the first quarter of 2012.

During the 2nd and 3rd quarter of 2011, B&L drilled four wells, with three out of four turning into successful commercial wells, a solid success rate (which also speaks to the quality of the management team).

After digging through the Louisiana SONRIS database and the company’s historical press releases & filings, I was able to piece together a rough picture of BLMC’s wells:

Note: Ownership interests of BLX are approximate %, as it depends on split between A & B shares (not public info)

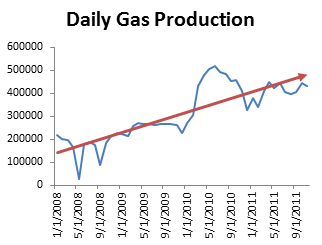

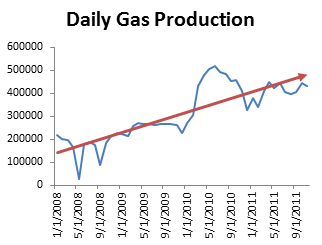

And a graph showing the daily production from the producing wells:

While there could be additional wells not captured in the chart above (a well that was included in a 2008 report but not in 2011 for example), it does show a nice trend in the daily production. Most of this additional capacity is from the B&L exploration subsidiary.

I want to highlight one well in particular, the company’s new Harry Bourg No. 1, which was discussed in the Q3 2011 press release.

Daily production in the Harry Bourg well has increased from 26,303 in September to 71,779 in November, a nice steady increase – it’s already the 2nd highest producing well for BLMC.

The company expects at least 2 more wells to be in production by the next report.

Reserve Picture

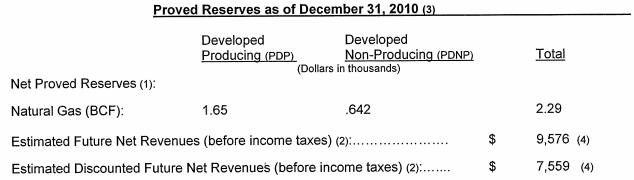

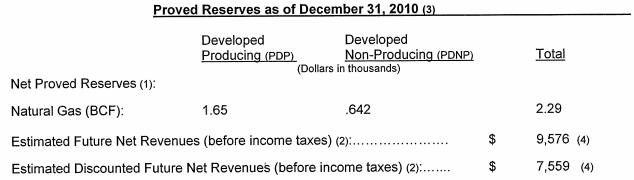

Each year, BLMC conducts a reserve study via an independent third party, with the results for 2010 included below:

In addition to the above amount, the B&L subsidiary owns an additional 2.3 BCF of natural gas and 25 MBBL of oil of reserves – combined, total reserves owned by BLMC come out to 4.01 BCF of gas.

Over the past 7 years, proven reserves have varied, with a high of 5.793 BCF in 2004 and a low of 2.502BCF in 2006.

The latest quarterly reports shows that total reserves have increased slightly to 4.10BCF.

Interestingly, a quote from the latest study was included in the 2010 President’s report:

“The recently drilled LL&E No. 1 well located in Lapeyrouse field in Terrabone Parish, Louisiana has not yet been completed and no tests have been performed. The well encountered several pay zones, some of which are considered PDNP based on log and core data. Other zones encountered by the well are potentially productive and may have significant value.”

The company provides an explanation for including the quote (emphasis mine):

“is to make investors aware that there is a probability that the LL&E No. 1 well may have significant reserves that are not included…”

A revised study will be included in the upcoming annual report, but the management team seems rather conservative, and I think there is a good chance for a fairly significant reserve increase in 2012.

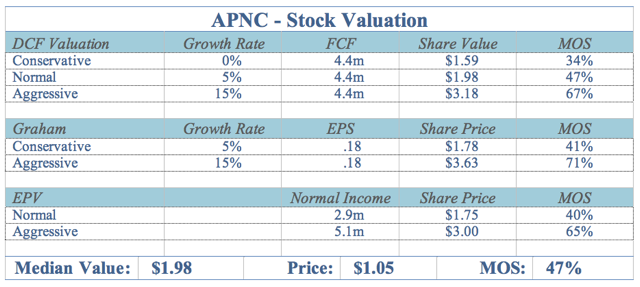

Valuation

Biloxi’s market cap is roughly $26m, with $3m in net cash.

In addition, the company also holds a large but liquid portfolio of marketable securities – mostly large cap stocks & bonds – worth another $11m at the time of the most recent quarterly report.

After subtracting out the cash and marketable securities, total enterprise value is only $12.5m.

BLMC has two different sources of earnings: the traditional fee-based revenue, plus income from the new exploration subsidiary.

In the 2011 shareholder letter, the company had 2.29 BCF of gas in a combination of developed producing & developed non-producing reserves (the “2P” metric) – on its fee-producing lands (i.e. the land it leases out to 3rd parties), with a PV10 of $7.559m.

Note: PV10 is a standard oil & gas metric which measures the present value of a company’s reserves, by taking future revenues, subtracting out direct costs, and discounted back at 10%.

Through its interests in B&L, BMLC owns an additional 1.72 BCF of gas (an additional 75% on top of the company’s outright reserves) which brings the total up to 4.01BCF.

So a back of the envelope calculation the combined PV-10 = $7.559m * (75% additional from B&L) = $13.22m, which is more than BLMC’s current enterprise value.

Remember, the PV10 number is estimating how much revenues will be thrown off by the company’s existing wells, and does not account for any further upside from new exploration.

The latest reserve study was from March of last year. While gas prices have cratered over the last 6 months, the new PV10 figure will be based on the 12-month average natural gas price through the end of 2011.

Although the recent headlines and price action has been brutal, the average month-end gas price was only down 10% YoY.

So being conservative and taking a 15% haircut on the PV10 number yields an adjusted PV10 of $11.2m going into 2012– once again compared to the total company EV of only $12.5m.

At these prices, the market is basically assigning zero value to:

- Any future appreciation in gas prices

- Any new lessors of the company’s land for drilling purposes

- Any future gas finds

- And over 90,000 acres of land

My take on management’s comments is that they intend to pay out dividends on all income from fee-producing lands (i.e. the $7.6m PV10 figure from above), but re-invest the subsidiary’s earnings back into more exploration.

While dividends over the next few years will likely be lower than previous years (no legal settlements and lower natural gas prices), the resulting yield should still be decent in a zero interest rate environment (4-5%?).

Finally, looking at the valuation on a historical perspective, BLMC is selling at an EV/Proved Reserves of 3x versus. 20x in 2007 – natural gas prices are obviously much lower now, but not 6.5x lower.

Conclusion

In summary, while investors sit around and collect a nice dividend yield, there are several upside scenarios:

- Gas prices improve, significantly boosting industry profits (2013?)

- B&L hits it big with a large new find (management has been savvy so far)

- Additional parties lease land on the property (in active discussions)

- BLMC markets its 3D seismic data (the Tuscaloosa project is rumored to have up to 5 TCF of gas, worth billions of dollars…wild speculation for now, but interesting nonetheless for a $25-30m company)

With all of these upside scenarios, I think BLMC is a safe bet for those who want exposure to an eventual upswing in natural gas prices.

I’ll finish with a quote from Jeremy Grantham, the Chief Investment Strategist of GMO on natural gas (emphasis mine):

“There are obviously powerful technical reasons depressing the price for natural gas. But it’s the premium fuel. It burns cleaner and better than any other hydrocarbon, and it sells at the lowest ratio of heat equivalent to oil in 50 years. It is about 15% of the energy-equivalent of oil price. It has sold at parity from time to time over the last 30 years. This is a dazzling opportunity.”

Couldn’t have said it better myself…

Disclosure

Long BLMC