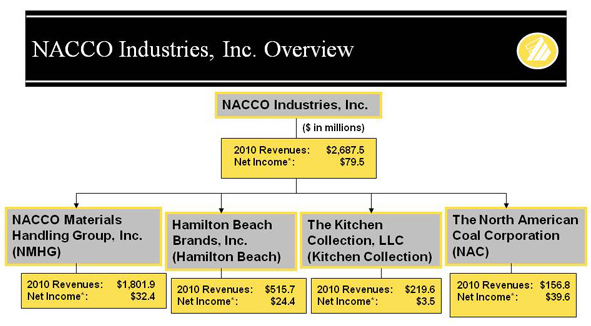

NACCO Industries (NC) is a holding company with an interesting collection of operating businesses spread across four different and mostly unrelated product lines: lift trucks, household appliances, specialty kitchen retail, and coal mining.

This odd conglomerate – with very different business models, growth stories, and margins – makes the stock’s financial performance much more difficult to analyze, a fact that is compounded by the lack of significant analyst coverage.

Yet at current price levels, investors are getting a company with a long-history of cash flow generation, at a price which basically throws in a business unit or two for free.

Why Is NACCO Cheap?

- Conglomerate discount – Mismatched group of mostly low-margin businesses

- Volatile stock – High beta (2.74) causes wild price swings – 5 year stock price range is $15-$170!

- Family ownership – Dual share structure keeps control in the hands of founding families, making it less likely for an activist to influence the company

- Little analyst coverage – BB&T is the only firm currently covering the stock

History

The original coal business has been around since 1913 (see timeline #1 and #2), and operated exclusively as a mining company for more than 60 years. In the 1980s, the business converted to a holding company operating structure and rapidly expanded:

- NMHG: Yale forklifts in 1986, followed by Hyster in 1989

- HBB: ProctorSilex in 1988, followed by Hamilton Beach in 1990

- KC: Kitchen Collection in 1988; Le Gourmet Chef in 2007

The businesses are run independently by their own management team and board of directors, with the holding company receiving cash proceeds and providing financial help if required.

The company has a dual share structure, with the majority of the super-voting B shares controlled by the CEO and other members of the founding Rankin/Taplin families.

While this voting structure makes it less likely for an activist to gain board seats or force out the executive team, the company seems committed to an open and shareholder-friendly environment.

The company provides a detailed segment breakdown of each operating unit, going above and beyond what is typical of other conglomerates. This disclosure allows the business to be evaluated on a sum-of-parts basis (see section later in post).

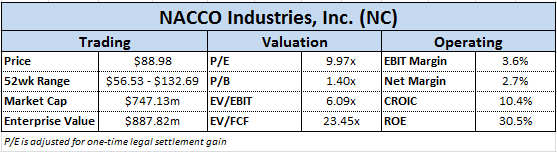

First, some financial data on the consolidated business:

Financial Overview

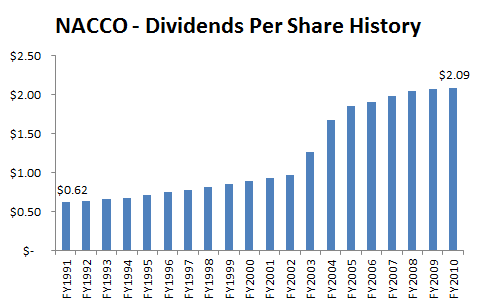

Strong Dividend History

NACCO recently became a ‘Dividend Champion,’ after raising its dividend for 26 straight years. The stock now yields 2.4%, and dividends have grown at 6.2% per year for the past twenty years:

Recent Financial Results

Like all industrial businesses, NACCO struggled during the recession.

Due to NC’s acquisition spree, a significant portion of goodwill was built up on the balance sheet, and the sales drop forced the company to take a $434m non-cash goodwill impairment charge, as the stock price fell to a low of $15 during the first quarter of 2009.

However, 2010 and 2011 showed a sharp increase in revenues and operating profits across all of the business units – TTM sales of $3.2B are up almost $1B from the 2009 lows.

Financials in Context

Looking at the business holistically, consolidated net income margins are low (3%), and the long-run average ROE and ROIC of 6.25% and 7% are not impressive.

However, the management team underwent a number of initiatives during the latest downturn to reposition the business lines and cut costs – and these improvements have shown in the latest financial results.

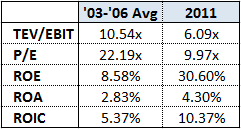

Consider this table:

The stock is trading for less than ½ of the average multiple during the latest upswing in the cycle (2003-2006) despite significant improvements to the business.

In fact, the market is still valuing NC at a discount to 2008 (2008 EV/EBIT was 6.96) despite a better industry outlook, improved efficiency metrics and a stronger financial position.

While the valuation is compelling, the combined company probably deserves to trade at a low multiple (with the ‘conglomerate discount’ effect in mind), but the current discount is grossly overdone, presenting an attractive entry point.

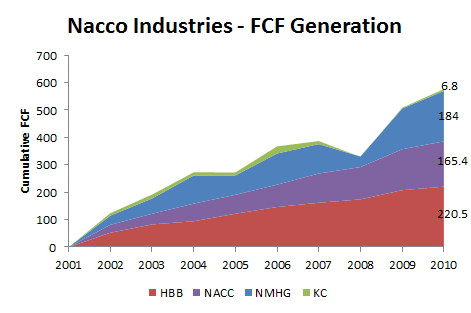

Even better, NC is solid on another, more important factor: cash flow generation:

This stable cash flow is a requirement for a stock with such a strong dividend history – as the chart shows, there are differences in each business segment’s ability to throw off cash.

Segment Overview

Kitchen Collections (KC)

- Specialty retailer under the Kitchen Retailer & Le Gourmet Chef Brands, primarily in outlet mall locales; 300+ locations

- Business unit continues to struggle, with little or no earnings and low FCF generation over past 10 years

- Store count continues to rise, although management has said they are aggressively closing underperforming stores

I’m assigning little or no value to this division.

Hamilton Beach Brands (HBB)

- Manufactures leading household appliances such as blenders, coffee makers, and toasters; Sells primarily through retail locations such as Wal*Mart & Target, along with online through Amazon

- #1 or #2 market share in over 30 product categories

- Highest operating margins in the group, with target of 10% going forward

Although consumer confidence and unemployment continue to hold back HBB’s target market, the division has shown remarkable ability to generate consistent free cash flow well in excess of earnings.

North American Coal (NACC)

- Largest miner of lignite coal, and 7th largest coal producer nationwide

- Over 2.1b in coal reserves, with 1.2b committed to customers under long-term contracts

- Cost-plus profit per ton contract with no coal market price risk (due to flammable nature, lignite is not exported and therefore is not subject to wide swings in coal prices); many contracts are renewable up to 2045;

NACC works very closely with the power plant to guarantee a consistent source of coal reserves – basically lending out their operational expertise and access to the reserves.

For unconsolidated mines, the customer funds most of the capex expense, with the debt non-recourse to NACC.

NACCO Material Handling Group (NMHG)

As the largest portion of revenue – and the most cyclical – NMHG really drives the company’s overall results.

NMHG markets both Hyster and Yale brands lift trucks and fork lifts, and is the 3rd or 4th largest brand globally (with approx. 9% market share) behind Toyota, Kion, and Jungheinrich. In the U.S., NMHG controls roughly 21% of the market.

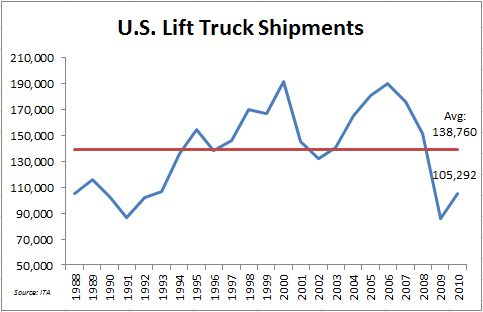

Lift truck sales are dependent on the economy and are very cyclical – the industry has shown strong growth coming out of the recession.

However, upside remains, as U.S. sales would need to increase 32% to reach the long-term average…

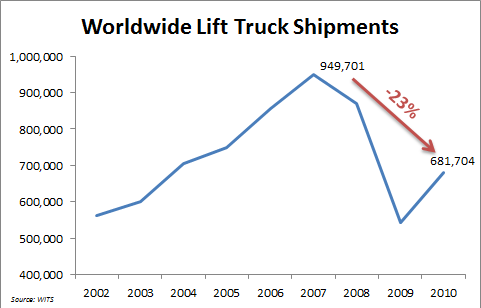

…while worldwide sales are still 23% below the 2007 peak.

The sharp jump in shipments has translated into strong results for NHMG in 2011, as revenues were $1.8b through the first nine months of the year, up 51% over the prior period.

While this torrid growth will slow, there still remains a significant backlog of orders (25.6k in Q3 ’11, up 4.5% over Q3 ’10), that will flow through the sales figures in the next several quarters.

While 2012 will be facing tough comps after such a good year in 2011, I think the market is misinterpreting the cycle, as there still seems to be room to run for this division.

NHMG has a powerful brand, which is helped by having the lowest cost of ownership in the business, and management has reiterated on conference calls that they have been able to pass along price increases to their customer base.

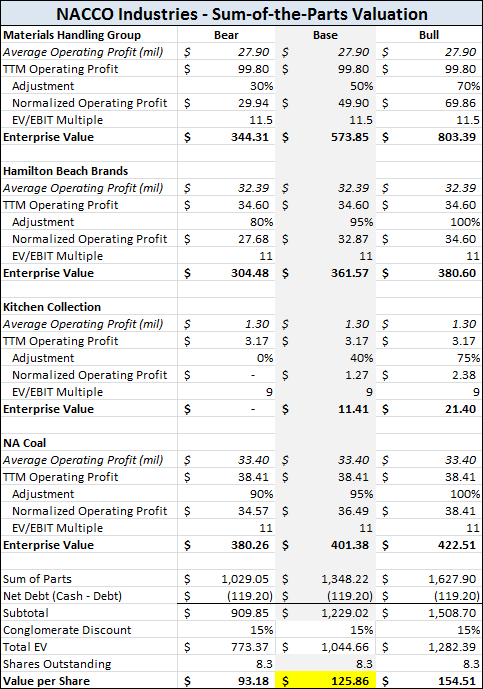

Sum-of-the-Parts Valuation

The SOTP analysis clearly shows NMHG’s driving effect on the total company valuation, as the difference between the bull and bear case for that division is ~$470m.

With a current enterprise value of ~900m, the market is basically throwing in KC (negligible impact) and NACC (a consistent cash-flow positive business with growth prospects) for free.

Catalysts

- Spinoff or sale of business units – management had explored the possibility of spinning off the HBB unit in 2007, before pulling the plug due to deteriorating market conditions. I’d prefer a divesture of the underperforming KC division, but recent spin-offs (ITT, Fortune Brands, etc) could serve as a blueprint to follow. I think it’s likely for management to revisit this strategy.

- Share Buyback – In the latest quarter, management announced a $50m share buyback, the first significant buyback in 15 years. The buyback would cover roughly 550-600k shares, or 6% of shares outstanding. If executed fully, that would be a significant number over the next 12 months.

- Further upswing in the NMHG cycle – Continued order flow in the forklift business as demand returns to the long-term average. Final closure of retail side helps remove distraction and drag on earnings.

- Upcoming coal projects – Several new coal projects will significantly boost capacity (Liberty Mine, 4.2m tons annually starting in 2013; Camino Real Fuels, 2.7m tons annually starting in mid-to-late 2012). Top-line growth should resume in 2012, and margins should pick-up after rough winter and plant shutdowns in impacted 2011 results.

Disclosure

Long NC