NOOF reported first quarter earnings this past week, and turned in a solidly profitable quarter, after suffering through two write-down plagued years.

Financial Highlights

Revenues were flat compared to the same quarter last year, coming in at approximately $12.5m. Margins took a hit, primarily due to higher costs in the Film Production segment, causing net income to fall 33%.

It was an unusual quarter from a cash flow basis, as NOOF actually used cash in operating activities.

As opposed to its traditional TV business, the company pays for the upfront costs in its Film Production segment, only to recoup the money later once the finished product is delivered.

Under this arrangement, the company has approx. $5.3m in cash that should be collected in the next few quarters.

While this strategy entails risk (NOOF might have to absorb the costs if the end customer doesn’t end up paying), the company’s balance sheet is very strong, with $14.1m of cash on hand along with an unused $4m credit line.

Domestic Growth?

Domestic sales – still the vast majority of NOOF’s revenues – are still showing the effects of the economic downturn. However, the company seems to be working hard to address these challenges by testing new initiatives in several test markets.

According to the CEO,

“We believe these results indicate that improvements in category results are achievable. If operators choose to roll-out these new products across their platforms and do so quickly, our financial results could benefit on both a near-term and long-term basis.”

International Growth Opportunity

For future prospects, the international market holds the key to NOOF’s future.

For the quarter, international revenue doubled in the Transactional TV segment, and on August 3rd, the company announced that it entered into a five-year license agreement to rebrand and distributed three new channels throughout Europe, the Middle East, and areas of Northern Africa.

The new channels are expected to reach over 49 million unique homes and are an entirely new revenue opportunity.

Even better, there is much less consolidation internationally among operators. According to the CFO, NOOF can expect much higher margins with these agreements as compared to the domestic market (30-50% as compared to 10-15% domestically).

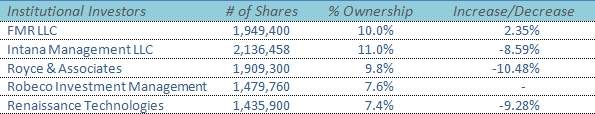

Institutional and Insider Ownership

During the quarter, NOOF also filed its DEF14A for the year.

The stock remains popular with several institutional firms and hedge funds, with several investors holding a large stake in the business.

While several funds have trimmed their holdings slightly over the past year, a brand new investor – Robeco Investment Management – picked up a 7.6% stake.

In addition, company insiders have increased their ownership in the business to 10.3%, an increase of 2.6%.

Increased ownership by both investment management firms and insiders is an encouraging sign, as other investors (and insiders!) believe the company’s prospects are positive going forward

Conclusion

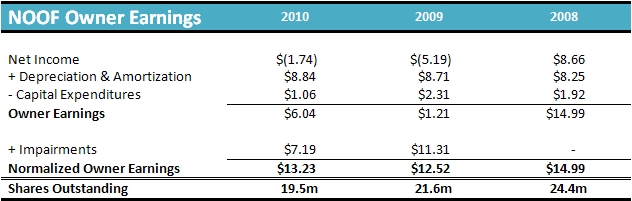

By most any measure, the stock remains extraordinary cheap:

- Price/Sales – 0.62

- Price/Book – 0.60

- Forward P/E – 5.4

Although some might argue that long-term prospects for the business are challenging, NOOF certainly has big plans:

“we expect to increase our distribution to over 300 million worldwide network homes, representing an increase of approximately 40% over our current distribution.”

With hoards of cash, a solid balance sheet, and potential growth both domestically and internationally, NOOF should increase from its current lows.

Disclosure

Long NOOF