Terra Nova Financial Group Inc (TNFG) is another liquidation investment that recently completed a sale of substantially all of its assets.

Following the asset sale, TNFG will formerly dissolve the company and liquidate remaining assets, with estimated total distributions to shareholders of between $0.95 to $1.07 per share.

With the stock trading at $0.94, the high-end of this range represents a possible return of almost 14% in only a few short months.

History

Terra Nova is a registered broker dealer based out of Chicago. The stock has languished since the internet bubble popped back in 2000, and the company has a storied history – it was investigated for failing to maintain adequate procedures regarding automated trading in client accounts in 2008.

Most recently, TNFG was linked to the unusual trading action in Proctor & Gamble stock during the flash crash in May 2010.

On June 16, 2010, the company announced that it would sell 100% of its membership interest to Lightspeed Financial, Inc. for a total of $27.6m.

The purchase would be payable with an initial cash payment of $22.6m, followed by a $5.0m promissory note due within six months of closing.

After the sale, TNFG’s only assets would consist of cash that would be distributed to shareholders as part of the dissolution and liquidation of the company.

The transaction required approval by the company’s shareholders along with regulatory clearance (a voting agreement for approx. 44% of shares agreed to vote for the asset sale, almost ensuring the vote would be approved)

Timeline

On September 15, 2010, Terra Nova announced that the asset sale was approved at a special meeting of shareholders.

On October 20, 2010, the companies announced the formal completion of the asset sale for the agreed-upon price of $27.6m.

According to the press release,

“TNFG expects to make an initial distribution of cash soon after the closing of the sale of Terra Nova Financial and the dissolution of TNFG, with a further distribution being made in connection with the expected liquidation of TNFG following receipt of cash payment on the Lightspeed promissory note. “

Based on these results, the initial cash distribution should be announced and distributed very soon, likely sometime in late November or December.

Final distribution should occur by April, although possibly several months sooner if TNFG can finish clearing out all trades and obligations.

Liquidation Value

While the company hasn’t released audited financial statements breaking down the account values for its liquidation estimates, management currently estimates that shareholders will receive cash distributions between $0.95 and $1.07 per share.

With 25.05m share outstanding, the full purchase price of $27.6m would translate into a per share price of $1.10 – obviously there will be additional liabilities and expenses to wind down the company but management’s estimates look reasonable.

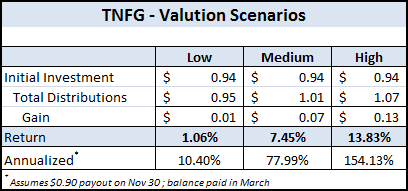

Return Scenarios

Note: These return scenarios do not account for transaction and commission costs, which could significantly affect the return calculations.

Risks

In any liquidation, the biggest risk is an inaccurate estimate of the total amount of distribution proceeds, causing a capital loss on the workout. The transaction could also get held up in legal or regulatory hurdles which could significantly delay distributions, potentially by years.

The risk in TNFG’s case is mitigated since the company expects to distribute a large portion of cash early in the process, allowing an investor to put that money to use elsewhere.

Specific to this transaction, there is also a risk that Lightspeed backs out of the final promissory note, although I view this scenario as remote.

Conclusion

The TNFG stock liquidation presents a solid risk/reward scenario for investors looking for special situations investments or workouts.

I have made several assumptions regarding the timing and amount of the initial distribution – modifying these assumptions will significantly affect the annualized return on this investment.

By buying now, investors are getting an (almost) free call option to roll the dice for future gains.

I’m adding TNFG to the Value Uncovered portfolio at Friday’s closing price of $0.94.

Disclosure

Long TNFG