Lately, my normal screening tactics have returned very few investment opportunities that satisfy my traditional ‘bargain bin’ value investment philosophy. Because of this, I’ve been doing more and more research on arbitrage opportunities and other special situations to round out my portfolio.

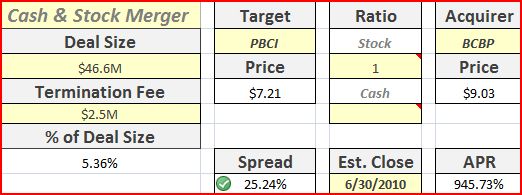

(See analysis example of the PBCI & BCBP merger)

I’m happy to report that I officially completed my first special situations investment last week, when CHDN merged with UBET. For more background, check out my initial writeup on the merger.

Announcement

Filed on Wednesday June 2:

“Churchill Downs Incorporated (“CDI”) (NASDAQ: CHDN) announced today that it has completed its merger with Youbet.com, Inc. (NASDAQ:UBET). As a result of the merger, each share of Youbet.com common stock was converted into the right to receive 0.0591 shares of CDI stock and $0.99 in cash.”

The initial terms of the deal called for a conversion ratio of 0.0598 in CHDN stock and $0.97 in cash. However, the conversion ratio was open to adjustments in order to limit the number of shares CHDN was required to issue.

Investment Breakdown

Based on my initial entry points, the arbitrage opportunity was offering estimated gains of approx. 12.5%. I’ve included my timeline below.

- May 5 – I entered an initial position in UBET at $2.90. At the same time, I entered a corresponding short position in CHDN at $38.29, based on the conversion ratio of 0.0598.

- May 7 – I added to my position in UBET at $2.80, balanced with a short position in CHDN at $36.51.

- June 2 – Official merger announcement

- June 5 – My UBET shares were converted into shares of CHDN at the new conversion ratio and I received cash considerations of $0.99 per share. Due to the slight difference in the conversion ratio on closing, I ended up with a few extra shares of CHDN which I quickly covered at $32.35. I then closed out long/short position in CHDN to end the trade.

Return

To wrap my head around the accounting, I considered the two trades as separate positions. Overall, I gained 12.25% and 12.45% respectively, or 308.15% and 317.02% annualized.

Takeways

-This was my first time shorting stock and I was never aware that brokers charge “hard-to-borrow” fees on all but the most liquid stocks. Since most of my investments will be in obscure opportunities, this is definitely something to keep in mind.

BTW, does anyone have brokerage recommendations? I’m using currently Zecco (the free trades are great) but might need to expand if I continue with these more complicated transactions.

-Merger arbitrage, especially stock & cash mergers, involve much more complicated gain/loss scenarios than standard stock investments. I spent way too much time figuring out my final tally on this position. In hindsight, it might have been prudent to start with a simpler transaction but I’m happy I forged ahead – the return was too good to pass up!

-As in all investment scenarios, it is important to have a margin of safety in any transaction. Too many things can go wrong with merger arbitrage – entry points, commissions, market timing, fractional shares, etc. all make the real world outcomes of these types of trades different than how they appear on paper.

-Successful special situations investments have the potential for truly eye-popping annualized gains.