Company Description

China Agri-Business Inc. (CHBU) sells “Green Food” certified fertilizer, primarily in the rural areas of China:

“China Agri-Business, Inc., through its operating company in China, manufactures and sells non-toxic fertilizer, bactericide and fungicide products used for farming in the People’s Republic of China (the “PRC”). Crops grown with our products are eligible to qualify for the “AA Green Food” rating administered by the China Green Food Development Center, an agency under the jurisdiction of the Ministry of Agriculture of the PRC.”

Fundamental Numbers

Since inception in 2006, the Company has maintained impressive margins across the board. Median gross margins of approx. 70%, operating margins of 40%, and net margins of 38.8% are very solid.

Tangible stockholder equity has increased from 4.5m in 2006 to 10.3m in 2009. Median ROE and CROIC of 16.5% and 13.7% are decent as well.

Growth Plans

Although the Company has outstanding margins, top line sales have stalled around $3m for the past three years. Management is trying to counter the slowdown in their traditional sales network by rolling out a new growth initiative, the “Super Chain Sales Partner Program”. The initiative has two parts underway:

Super Chain Stores

The “Super Chain Sales Partner Program” is an initiative whereby the Company agrees to provide a $3,000 advance payment to participating retailers in exchange for their commitment to purchase and sell approximately $14,000 worth of the Company’s products per year. Each participating retailer must also agree not to sell any competing products. ”

Total Chain Stores: 100

Direct Stores

“The direct sales stores are controlled and managed directly by the Company.”

Total Direct Stores: 250

The Company is opening new stores at a very rapid pace, and expects almost 500 Direct Stores by the end of the year.

Since these direct stores also sell 3rd party manufactured products, they have much lower gross margins than the other sales channels. For the most recent quarter, margins for the direct stores came in at 32%, much lower than the 70% historical gross margin average for the traditional business.

However, the initiatives are certainly adding to revenue and net income, as both tripled from the same period last year.

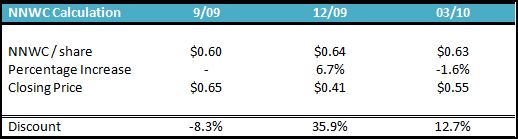

Liquidation Value

I was originally drawn to CHBU as a net-net investment. It is very rare to find profitable, growing company that is trading for less than NNWC, especially less than Net Cash.

However, a line item buried in the 10-K caught my eye:

Land Purchase

“On October 21, 2009, Xinsheng received an approval letter from the Bureau of Foreign Trade and Economic Cooperation of Lantian County of Xinsheng’s application to purchase land use rights in Lantian County to establish “Xinsheng Centennial Industrial Zone”. Xinsheng intends to purchase the land use rights for 66 acres for a term of 30 years. The land use right purchase cost is expected to be approximately $4.1 million (28,000,000 RMB).”

The purchase has been delayed by the local government but is a huge cash outlay for the Company, over 40% of the current cash balance. I emailed Investor Relations about this transaction, and the CFO replied that they plan on increasing capacity and expanding their sales networks on this land – hopefully, I get some further clarification.

This purchase will remove the margin of safety from a liquidation perspective, so it’s necessary to evaluate the business as a going concern:

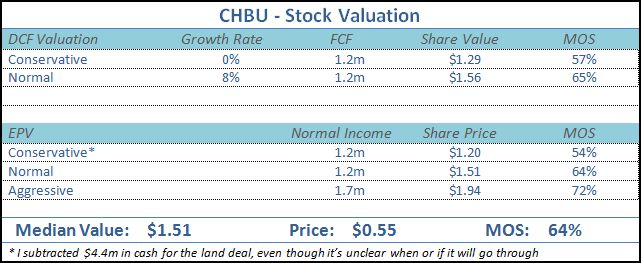

Stock Valuation

As with all micro-cap stocks, entry point is crucial. Despite the recent surge, the stock was trading at $0.50 last week.

Risks

-The land purchase seems like a very risky move for a company that does not have access to a bank line of credit. A downturn in demand or backfire of the expansion plans could place a major strain on the Company’s cash position.

-The Company could over-extend with these expansion plans, especially considering they have little prior experience in the retail business. Over-emphasis on the direct stores method will hurt gross margins, one of the most attractive statistics in the traditional business.

-As a commodity company, CHBU is at the mercy of weather patterns and other economic disasters such as earthquakes. These are the sort of one-time events that are outside of investor control and could change the economics of the business in a hurry.

Conclusion

Although I entered the investment as a net-net play, I’m comfortable with the growth potential that the stock offers. If management can deliver on the expansion plans, results for 2011 could be very impressive. I’ll be watching Q2 numbers closely.

Disclosure

Long CHBU