I’m excited to announce that my stock pitch was selected as a semi-finalist in the Ira Sohn Investment Contest.

Four pitches were selected as finalists, with the winner having the chance to give a 10 minute presentation in front of 2000+ people at the Ira Sohn Conference – in front of legendary investors like David Einhorn, Bill Ackman, Joel Greenblatt, Michael Price, and many more.

Obviously, this was a tremendous opportunity for any aspiring investor. Unfortunately, I did not make the finals, but still received a free ticket to attend the event. It was a great experience, as it was the first time I’ve had the chance to hear actual presentations from many of these investors.

Even more importantly, the event is for a great cause, as the conference has raised millions of dollars for pediatric cancer research.

Without further ado, my investment thesis for ABH, a deep value contrarian idea.

Note: The stock is down another ~10% since I put together the analysis, which makes the valuation even more compelling. I think the second quarter might be rough, but believe the company will start showing improvement in the second half of the year. I have a small starter position for now, as the stock price could certainly get worse before it gets better.

Company Intro

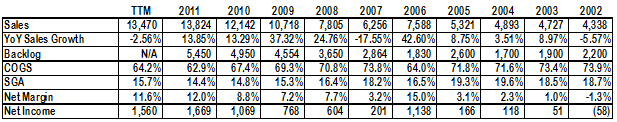

AbitibiBowater Inc. (changing its name to Resolute Forest Products, Ticker: ABH) was formed by the 2007 merger of U.S-based Bowater with the Quebec-based paper and pulp company Abitibi Consolidated. After the merger, the combined entity was the third largest paper and pulp company in North America and the eighth largest in the world.

A debt burden of $6b combined with the economic crisis forced the company to declare Chapter 11 bankruptcy in April 2009.

ABH received financing from Fairfax Financial during the bankruptcy, and emerged in December 2010 with restructured operations, a new management team, and the stock price around $21/share. The stock peaked near $30/share in February 2011, before starting to slide, and is now down 40% over the past year.

Fairfax purchased more shares after the emergence, and continues to hold 18% of the company. Of the top 10 institutional holders, position sizes were increased by +9.5m net new shares over the past two quarters.

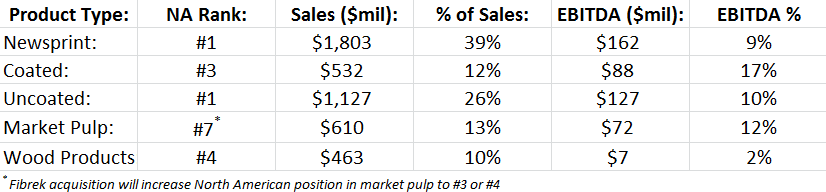

Segment Breakdown

Newsprint now makes up 39% of sales and 36% of EBITDA, down substantially from 2008 when newsprint was almost 50% of sales and 45% of EBITDA.

The Fibrek acquisition gives the company more exposure to market pulp, which was the only segment to show industry-wide shipment growth in 2011 (up 3.5%, with a 30% increase in China).

(Note: Fairfax is also a significant shareholder in Fibrek. Fibrek decided to take the ABH bid despite a higher offer from Mercer…potential synergies to boost overall value of their combined stake?)

Investment Thesis

#1) With the recent sell-off, the market is pricing ABH as a distressed equity despite improving operations and continued evidence of execution of management’s turnaround plan –

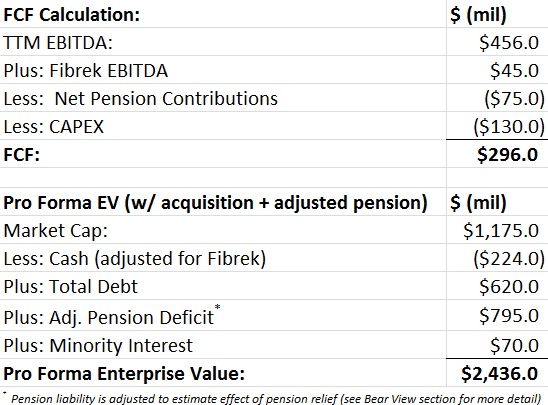

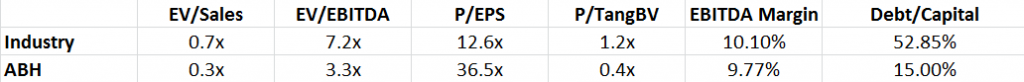

ABH now trades at an EV/EBITDA of 3.3x (or 5.4x EV/EBITDA after adjusting for the underfunded pension) and P/TangBV of 0.4x.

This compares to an industry average EV/EBITDA and P/TangBV of 7.2x and 1.2x respectively.

With dramatically improved operations, ABH doesn’t deserve such a large discount, as management has executed on its restructuring plan while substantially reducing the annual carrying cost of running the business.

SG&A expenses were cut during the restructuring and continue to fall, as the line item has decreased from $330mm in 2008 to $158mm in 2011 – the company is approaching its target SG&A expenses of $20/ton (~$140mm).

These results have shown progress on the turnaround plan, as the company reported an operating profit of $261mm in 2011, the first annual profit since 2006.

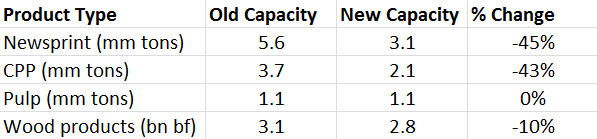

#2) Dramatic restructuring efforts have substantially reduced ABH’s debt burden while allowing the closing of excess capacity and removal of outdated assets –

The bankruptcy proceedings reduced total debt from $6.8B in 2007 to only $900m. By selling non-core assets, management has taken steps to reduce debt even further, which has fallen to $620mm as of March 31, 2012 (corresponding to an annual interest expense of just $60-$65mm, down from almost $600mm prior to the reorg).

The company has also aggressively shut down excess capacity and old mills:

The revised product breakdown reduces the company’s dependence on newsprint (which continues to decline) while maintaining exposure to market pulp (a long-term growth story).

PP&E has been reduced from $5.7b in 2007 to $2.5b in 2011, with the majority of remaining mills operating in strategic locations close to port access, allowing ABH to take advantage of the export market.

The business does throw off a ton of cash flow, and with the new operating structure, this cash is finally available for something other than interest payments.

#3) ABH’s maintenance capex is far below depreciation –

This capex/depreciation spread helps boost FCF, with a current FCF yield to EV of 12% even after including substantial pension liabilities.

While the newsprint business remains the largest segment by total capacity and profits, management has recognized that newsprint is in a state of decline (especially in North America). Management has responded by slashing reinvestment – essentially, the business is being milked for cash flow, a situation enabled by ABH’s leading position in the global newsprint market.

Maintenance capex is forecasted at only 55-65% of D&A, or roughly $120-$150mm per year. This favorable depreciation/capex spread of $80-$100mm per year juices FCF, and should be sustainable as further capacity reductions continue.

This equates to a 12% FCF yield, and normalized FCF yield is much higher (see Valuation and Catalyst sections).

Bear View

Bears will say that, despite the restructuring, ABH remains in a commodity business with the wrong set of assets (namely major capacity in newsprint), old mills, and a tough labor environment. All of these are true but seem overblown as major factors, especially given the stock’s current valuation:

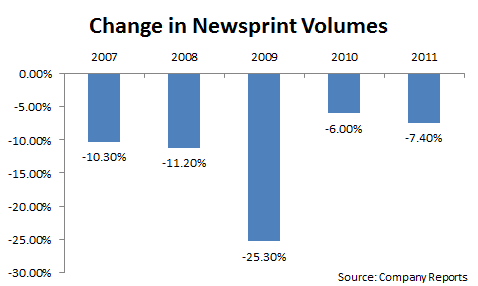

Risk #1) Newsprint, ABH’s largest business segment, is in a state of long-term decline –

Agreed! Here’s the data on newsprint volumes over the past five years:

After the large drop in 2009, the downward trend has at least stabilized, but newsprint is a business that isn’t going to return.

Counter:

The market (including ABH) has responded to these declines by cutting capacity at an even faster rate, leading to stable pricing (post-’09) – ABH’s newsprint segment remains solidly profitable despite declining demand.

Newsprint prices stabilized around $640/ton in 2011, and analysts are estimating prices increasing to $655/ton and $665/ton in 2012 and 2013 respectively, driven by the ONP/newsprint relationship in Asia (see Catalyst section for more detail).

According to ABH’s CEO in the Q4 conference call (emphasis mine):

“So with the continuous decline in newsprint demand in North America, there is less ONP, less recovered paper that is going to be available, so I think that it’s going to push that cost up, and because of the virgin fiber advantage, I think that this market is only going to continue to be open to us… I would not underestimate the potential to also sell in this market because of the advantage of the location of our mills”

A $25/ton increase in newsprint would raise ABH’s EBITDA by $67m annually.

Risk #2) The mills and other fixed assets are old –

True, but much of the oldest and most unproductive assets were sold off or closed down during the restructuring. The total number of paper machines was reduced 50% from 62 to 31.

Counter:

On the NA newsprint cost curve (how cost competitive each mill is with current equipment), 10 out of 12 ABH mills are in the 50th percentile or above, with 7 in the top 9 spots.

The reality is that the paper machines haven’t changed much in 150 years and are at low risk for obsolescence or major technological change – even old mills can get the job done.

Risk #3) ABH faces a tough labor environment in Canada with large pension liabilities –

True…but manageable. ABH’s balance sheet shows an underfunded pension of $1.5B, and the company warned that this funding level could increase after the next actuarial report in June.

Counter:

The company negotiated a deal with the Canadian provinces for pension relief that essentially capped the cash pension contribution over the next ten years, in exchange for certain covenants such as dividend restrictions, capex funding requirements in Quebec/Ontario, and further lump sum payments if capacity is shutdown in Quebec.

This agreement takes a big chunk out of the actual cash outlays and balance sheet liability.

Despite the restrictions, management has been able to downsize the employee base, with a reduction of 7,600 workers (-42%) so far. The negotiated pension plan reduces annual commitments from $300mm/yr to ~$100mm/yr – the estimated net pension liability with these caps is closer to $800m.

Valuation

Outside of its P/E multiple (ABH is still affected by non-operating/one-off charges post-bankruptcy), ABH is cheaper than the industry by 50% or more despite having comparable margins and a lower debt load.

On $456mm of current run-rate EBITDA, an EV/EBITDA multiple of 6x (a slight discount to peers considering post-bankruptcy uncertainties) would yield a per share value of $17.42, or 44% upside from current prices.

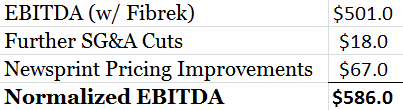

Normalized EBITDA is likely closer to $590mm:

A 6x multiple on $586mm run-rate would yield a per share value of $22.50 (86% upside). This translates into normalized FCF of around $385mm, for a FCF yield to EV of 16%.

This EBITDA run-rate does not take into account any upside in the wood product segment (due to improvements in NA housing starts), or further synergies and margin improvement on the pulp segment after the Fibrek acquisition (see Catalyst section).

These factors could increase normalized EBITDA to $650mm+, raising the FCF yield to almost 20%.

Catalysts

#1) Improving EPS after one-item items fall away –

In FY 2011, ABH reported $46mm ($32mm after-tax) in asset impairment and closure costs as the company shut down old mills, in addition to $47mm ($34mm after-tax) in costs related to post-emergence legal expenses.

In Q2, both of these costs have fallen dramatically, and the new run-rate points to a $0.37 EPS improvement, boosting EPS to $0.89 – this translates into a P/E of 13.6x – much closer to the industry.

Add another estimated $0.10 per share from Fibrek (and more with additional synergies), and normalized EPS tops $1.00.

#2) Fibrek acquisition boosts exposure to market pulp, a growing market with potential pricing improvements –

After a hard fought battle, ABH won the bidding for Fibrek (TSX:FBK), another Canadian paper & pulp company, which increases ABH’s capacity in market pulp by roughly 76%. (bid was $70mm in cash, payoff of $115m in debt, plus ~3m shares).

On the pricing side, NBSK pulp prices have risen from $870/ton to near $900 in May, and analysts are forecasting future increases to $965/ton by FY2013.

Each $25/ton price increase generates an additional $26mm in EBITDA for ABH – with the addition of Fibrek, prices in the $950/ton range would mean an additional $120-$140mm in annual EBITDA for ABH.

#3) Upside in Wood Products due to (slow) recovery in housing starts –

With the severe downturn in housing, ABH’s wood products division has operated at a loss for several years. In 2006, the wood products segment generated EBITDA of over $80mm compared to TTM EBITDA of only $7mm.

Recent numbers show modest improvements in U.S. housing starts, up 18% YoY. With the number of new homes still far below replacement value, the market will eventually recover, driving lumber prices up and the Wood Products segment back to profitability.

Even a normalized EBITDA of $40-50mm would add another $200-300m to ABH’s value (~$2.50/share).

#4) Newsprint industry dynamics are misunderstood, and will lead to sustainable pricing and demand –

ABH relies on virgin fiber for its newsprint (via access to timber from the Canadian government) while China & India – where the growth is – have little virgin fiber of their own and therefore rely on recycled newsprint (ONP).

Historically, newsprint was in such large supply that ONP-based mills were much cheaper. But with such a steep drop-off in newsprint volumes, ONP prices have steadily increased, shifting the cost curve towards NA mills – 45% of ABH’s newsprint shipments were outside of the U.S., with 14% to Asia alone.

This creates a cycle:

growth in Asia – > greater demand for ONP – > but less newsprint supply – > higher newsprint prices

In addition, the industry is seeing further capacity reductions and bankruptcies. Since October, over 8% NA newsprint supply has been shut down, and both the #4 and #5 producers have filed for bankruptcy.

These dynamics will continue to stabilize (if not increase) pricing for newsprint going forward, counter to market expectations.

Disclosure

Long ABH