I am excited to share this guest post and great write-up on Repro-Med Systems (REPR). A bit of background info about the author, in his own words: “My name is Frank Lind. I am an individual investor living in Taiwan. My investment approach is to take concentrated positions in high-quality nano-cap and micro-cap stocks. I look for good growth prospects and some kind of competitive advantage at a cheap price.”

Repro-Med Systems (REPR) is a great little company which is basically undiscovered by the market. The best part about this company is its high-margin recurring revenue stream. This is explained later in this report.

Investment highlights:

l The sale of one of their subcutaneous infusion pumps guarantees at least a six year recurring revenue stream to the company.

l The FREEDOM60(R) Syringe Infusion Pump is the only Medicare-funded pump for Subcutaneous Immune Globulin (SCIG).

l Its product is the most technologically superior and the cheapest.

l Revenue has grown from 1.7 million to 4.7 million over the last 4 years.

l Net Income has steadily grown from ($254,000) to +$704,085 over the last 4 years.

l Earnings are accelerating due to the rapid growth of the use of subcutaneously administered immune-deficiency drugs.

l The company is expanding its manufacturing capacity to keep up with demand.

l Growing medical companies are recession-proof.

What does this company do?

REPR has two main products. The main product, and the main driver of growth, is the Freedom-60. The Freedom-60 is a specialized infusion pump that administers various types of drugs to patients subcutaneously rather than intravenously. This means the drug is injected into the fat of the body just under the skin, rather than the vein.

Their second product is called the RES-Q-VAC. This is a portable suction pump. Sales of this product are trending up, but are lumpy and not really important to the valuation of this business. Thus, this entire report will concentrate on the Freedom-60.

The advantages of subcutaneous administration

Currently, the most widespread use of subcutaneous administration is for primary immunodeficiency disease using drugs called immunoglobulins. These help individuals with immune deficiencies to live a more normal life. The two main drugs in this area are Vivaglobin and Hizentra – both made by CSL Behring.

People are switching to subcutaneous immunoglobulin (SCIG) because:

– It is more convenient because treatment can be done at home rather than at a hospital.

– It costs less.

– There are less adverse reactions.

– Since treatment is generally done weekly instead of monthly,

the immunity level remains more constant, which should help keep the patient more healthy.

Further research on the superior efficacy of (SCIG) can be found here and here.

Therefore, the market for this kind of therapy is rapidly growing with an estimated 10 million people with this disorder.

Enter Repro-Med Systems and the Freedom-60 infusion pump.

Competitive advantages of the Freedom-60

- 1. The company’s 10-K states – “In June 2007, Medicare issued a letter of clarification stating in part:

“The FREEDOM60(R) Syringe Infusion Pump is the only allowable pump to be billed with the Subcutaneous Immune Globulin (SCIG). …All other pumps or modifiers will result in a denial.”

This is important for several reasons.

First, the lack of funding for other devices creates a huge competitive advantage against other companies.

Second, application for funding takes a considerable amount of time, as bureaucracies tend to move at snail’s pace. Thus, if any company has noticed this niche market, it is going to take considerable time before they can possibly get a device approved. In that time, so many more Freedom-60s will have been sold and the recurring revenue stream can be secured.

Third, there is NO guarantee that potential competitors can actually receive Medicare funding approval. In my communications with the CEO, he described the approval process as something of a “black art”. He surmised the reason the Freedom-60 received funding was because of its superior performance and its extremely competitive price point. He also said, should a multi-national decide to compete in this niche market, it would make more sense to acquire his company than go through the process of

a) actually developing a product at such a low price-point

b) developing the years of know-how that have gone into the Freedom-60.

2. The Freedom-60 is technologically superior to more expensive (non-Medicare funded electronic infusion pumps). This is best summarized by the 10-K –

“Our proprietary technology employed in the FREEDOM60(R) uses constant pressure to administer drugs. FREEDOM60(R) avoids an important problem faced by electronic pumps currently on the market, which employ constant flow mechanisms that result in potentially dangerous, high pressure placed on indwelling catheters or under the skin. In order to protect the patients, these pumps must contain an overpressure sensor to shut the pump off when a potentially threatening pressure is detected. Some of these electronic pumps generate extremely high pressures exceeding 60psi before the over pressure system will activate. Also with these systems, the alarm can falsely trigger halting administration until a health professional can verify that the infusion is in fact safe and the pump may be reactivated. In either case, the patient is at risk from damaging pressures or not receiving the medication required.

Other unsafe conditions of conventional equipment include runaway administrations; overdose due to programming errors or pump failure, and over-pressure resulting in burst blood vessels or failed internal access devices. We believe that the increasing sales of pumps and tubing sets for the FREEDOM60(R) demonstrate that the FREEDOM60(R) eliminates these potential outcomes and ensures a safe, constant, controlled infusion. Electronic devices will increase infusion pressure while attempting to continue an infusion at the programmed rate, while the FREEDOM60(R) design maintains a safe constant pressure and thereby automatically reduces the flow rate as required, a process we refer to as “dynamic equilibrium,” if any problems of administration occur.”

3. Cost-constrained Medicare funding heavily favors cost-efficient devices.

As can be seen on page 41 here, the Freedom-60 is the cheapest device available on the market. Debates over health-care spending continue, but there is no doubt over the long term cost-containment rules. This plays into Repro-Med’s hands.

Recurring Revenue

The best part, from the point of view of investors, is once the Freedom-60 is bought, the patient with immune-deficiency disorders must continuously purchase disposable tubing sets.

From the 10-K:

“We estimate that each FREEDOM60(R) pump, when used for immune globulin administration, uses an average of four to six tubing sets per month per patient. Antibiotics may be administered much more frequently, occasionally up to four times per day. In some cases, a tubing set may be used for as long as 72 hours. We estimate tubing set usage for antibiotics to be as much as 10 sets per month per patient. The tubing sets currently have an average price of $5.41.”

The list price of the Freedom-60 is $399

The revenue information that they put in the 10-K regarding disposable sales indicates that they are thinking big.

Pumps in the Market Annual Sales of Disposables

5,000 $1,530,000

10,000 $3,060,000

50,000 $15,300,000

100,000 $ 30,600,000

I think the above table speaks for itself

The tubing sets are patented and only Repro-Med’s tubing sets will work.

From the 10-K – “Our patented luer disc connector ensures that only the Company’s FREEDOM60(R) tubing sets will function with the pump. Non-conforming tubing sets, without the patented disc connector, are ejected from the pump to prevent the danger of an overdose or runaway pump from injuring the patient. We are achieving our objective of building a product franchise with FREEDOM60(R) and the sale of patented disposable tubing sets.”

The other key point about this type of recurring revenue is it allows for continuous improvements in operating margins because dollars are not having to be spent to incur new sales.

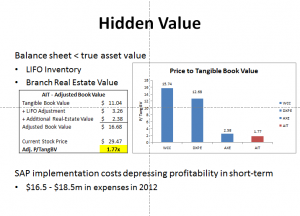

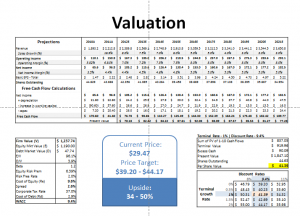

Valuation

Revenues are currently growing at more than 40% annually with earnings currently growing more than 100% sequentially.

Furthermore, the automatic recurring revenue through the tubing sets will certainly allow significant operating [not gross] margin improvements.

25% compounded revenue growth over 4 years is easily achievable

Operating Margins should rise from 25% to at least 30%.

Assume the shares outstanding are about 40 million in 4 years.

So, TTM Revenue compounded at 25% for 4 years = $12,800.997

30% operating margin = Operating Income of $3,840,299

Tax of 35% = Net Income of $2,496,194

Divided by share count of 40,000,000

= EPS in 4 years of 0.0624

Now choose various PE ratios to give a 4-year price target.

I chose a PE of 14. I believe this to be conservative given the quality of the company’s business model

Multiplying these two gives a price target of $0.87 vs the current price of $0.37

Over 4 years, growth in price from $0.87 from $0.37 is a return of 23.83% per year.

Further points of interest:

1. According to the immune deficiency organization (primaryimmune.org) there are more SGIG drugs that are going through trials right now. This should further increase demand for SCIG treatment and Freedom60 sales.

2. On May 20, 2011 REPR received their long anticipated FDA approval for the marketing of their new needle set. It is expected this approval will lead to a significant increase in sales and REPR is undergoing significant manufacturing expansion in anticipation of this.

Disclosure: The author of this guest post is long REPR.