This is Part II on the introduction to bank investing by Eric, a ValueUncovered reader who specializes in community banks and thrifts. Check out Part 1 for additional commentary on Centrix Bank & Trust (CXBT.PK), a $43m market cap bank based in NH.

Comparables

To be fair, the New Hampshire economy/housing market hasn’t had the turmoil that the rest of the country has had. In fact, the New Hampshire housing market never bubbled up much and has held up well.

I haven’t looked much in depth at the economy/housing/foreclosure situation in Centrix’s area yet, but I have looked at it briefly and have looked at their competitors. Housing prices really didn’t run that far, and thus they haven’t fallen that far either.

For example in Dover (one of the cities with a CXBT branch – see part 1 for additional branch information) housing prices went up about 57% cumulatively from 2000-2007, and then fell less than 20% from 2008 until now. This is a good site for housing prices per city:

http://www.nhhfa.org/demographic_housing.cfm

Click on price trends, then town/city reports, then click one of the six towns Centrix has an office in.

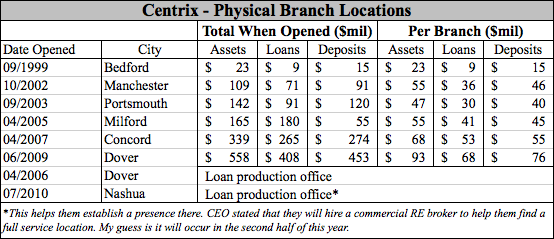

The great thing about banking is that all public and private companies can be compared/analyzed, since they all have to file reports with the FDIC, and anybody can get their info online, unlike other industries. I’ve included some basic information on CXBT’s competition:

I did this for just 5 competitors but there are more I just haven’t recorded yet. I included just some very basic numbers of similarly sized banks focused in the same markets. The numbers just give one a sense of how quickly they’re growing (or contracting), what their returns are, and the quality of assets/loans.

I was curious to know how much of Centrix’s growth/asset quality was due to their market or their competitive position in that market. It appears that the vast majority of their growth is due to their competitive postion, while when it comes to asset quality it’s more due to their market.

However, keep in mind that Centrix had more new money to lend during the time periods I looked at so there was surely more imperative to lower standards.

Looking at their competitors and then looking back to how Centrix has moved in to new cities and areas close to them, they really have dominated.

It appears they have something depositors really love, maybe it’s good service, maybe it’s advertising or community involvement, but whatever it is they have brought in deposits very well as the expanded their offices.

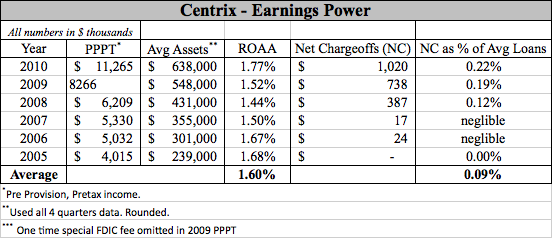

Earnings Power

Since CXBT is very small, they don’t disclose many financial measures that bigger banks may disclose, like FICO scores or loan to value (LTV) ratios of their loan book. An analysis of a larger bank with better disclosure would look different, but that is just something you have to live with in the world of small banks.

The following table represents some historical income/balance sheet figures I use when trying to figure out earning power.

I also omitted Preferred dividends for 2009 & 2010

Earnings power under good scenario:

Assuming $700 million in average assets and $490 million in total loans.

Assume PPPT ROAA of 1.75% and no net chargeoffs/provision for loan losses.

Assume 37.5% tax rate and no preferred dividends

= $7.65 million in net income

Earnings power under worse scenario (but not stress scenario):

Assuming $700 million in average assets and $490 million in total loans

Assume PPPT ROAA of 1.45% and net chargeoffs (and thus provisions for loan losses) of .5%.

Assume 37.5% tax rate and no preferred dividends

= $4.8 million in net income.

Earnings power is 4.8-7.65 million dollars. Current market cap is $48 million + $7.5 million in preferred stock= EV of $55.5 million.

So multiple is 7.25-11.5. Although it’s probably about 9.

Over a decade, most of a typical community bank’s loan losses will come in just 3 or 4 years, so you need to normalize loan loss reserves over the business cycle to get normal earnings.

Net chargeoffs have been low over the last 10 years, and amount to about a dozen basis points as a percentage of total loans on average over the last decade.

Of course, a lot of net chargeoffs are likely ahead of them, which will raise the average, so I have included a good and bad normalized loan loss provision amount in my earnings power assumptions.

This earnings multiple (about 9) is about average for a bank. The average bank stock should trade at about 2/3rds the multiple as an average non-financial stock. KBW bank index, a popular large bank index, over time trades at this discount and if it gets well above (below) 2/3rds SPY’s multiple, then it’s a good probability that large bank stocks will do poor (good) relative to their large non-financial counterparts.

This discount is because of bank’s inherent leverage, which increases risk and therefore makes valuations lower to account for this. However, much higher quality and safer banks will deservedly sell at higher multiples on average.

Their returns on average assets (ROAA) are rather average as well. Their efficiency ratio, an indicator of how lean the companies operations are by measuring non interest income as a percentage of non and net interest income, is rather average (about 55%) as well. Like most community banks, their NIM’s are correlated with interest rates, so Centrix will make more money if/when rates rise.

Since their NIM’s and interest rates on loans are in line or higher with all their competitors, they aren’t offering higher rates to depositors, so their core deposit gathering capabilities seem real.

Negatives

The biggest negative by far is their recent leverage strategy.

They took about $7.5 million in TARP money, that carries a higher dividend that they must pay, higher than the yield they earn on most loans. To offset this, they pursued a leverage strategy, which consisted of acquiring to date about $100 million of easily obtainable brokered deposits, and investing the proceeds in GNMA’s.

This is classic yield curve arbitrage.

The brokered deposits are shorter term and carry a lower interest rate, and the GNMA’s are longer term and carry a higher rate. They are also government guaranteed, so no credit risk. The problem is, there is plenty of interest rate risk.

If rates move up their government guaranteed securities will lose value, and the deposits will eventually have to be replaced.

Many banks rationale for pursuing similar leveraging strategies is usually to reduce asset sensitivity. Since their assets reprice faster than liabilities, NIM’s (and thus earnings) tend to move with interest rates.

This is especially true for banks with great low and no cost deposit bases, which usually consist of a high level of transaction accounts. Many community banks are asset sensitive, and Centrix is one of them, but they are only modestly sensitive.

However, Centrix’s reason for the leverage strategy is apparently to compensate for the large dividends it pays on the preferred.

I’m not entirely sure why they took TARP money at all. They have always been well reserved and decently capitalized. I could be missing something there, although it’s likely management is just being overly conservative.

This is not what I like to see, I don’t want to see my bank playing around with their balance sheet. From the looks of it they aren’t going to unwind the “trade” anytime soon.

If rates shoot up for whatever reason, they will have to take huge losses to unwind the leverage strategy.

Furthermore, brokered deposits are from anonymous depositors secured through a brokered network, and it’s not a stable source of funding, so the strategy will have to be unwound at some point.

Brokered deposits have given many banks troubles – I remember reading that IndyMac’s deposit base was 37% brokered. If Centrix really needs the $7.5 million in capital, as a shareholder I’d rather just see them dilute and raise equity than ratchet up the interest rate risk to the balance sheet this much.

Additional risks but not as serious:

Growth is more difficult to predict in banks than more traditional companies. They are more of a black box and you have to rely trends of past numbers, which can have a driving by looking through the rear view mirror effect.

However, I do see plenty of new areas CXBT can expand into, and management has done a good job so far allocating money to good loans. Plus, no growth is priced in, so it’s not a risk to the downside.

There is always the risk that as deposits keep growing Centrix stretches and lowers its lending standards just to allocate the money, but lending history shows none of this.

Conclusion

Centrix is modestly valued and growing quickly. They are an average community bank, except for the fact that they are very good at expanding into new markets to gather new core deposits.

They appear to dominate their local New Hampshire markets when it comes to gathering deposits and I see no reason why this wouldn’t continue. They’re partly fortunate and partly able when it comes to asset quality, as they have been helped by a stronger local market.

However, the leverage strategy in my view is too risky and speculative. Given their good core deposit base, I don’t like to see them leveraging with brokered deposits, and I’d rather see them dilute to raise capital.

Disclosure

No positions.