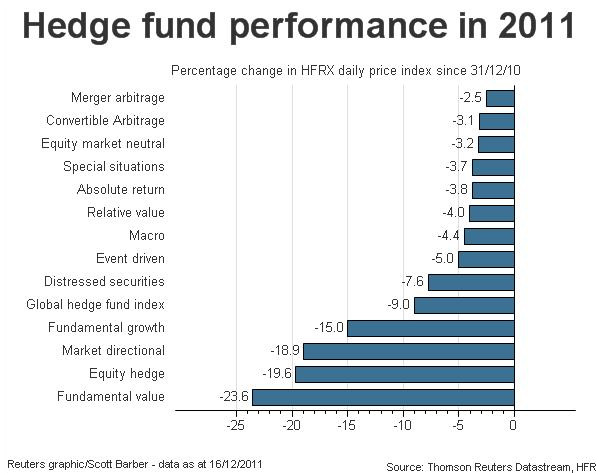

Despite all of the fear and worry surrounding the markets, the S&P managed to finish flat on the year – but not without some extreme doses of volatility along the way. Many fundamental value investors fared even worse:

*Hat-tip to Greenbackd for originally posting the image

*Hat-tip to Greenbackd for originally posting the image

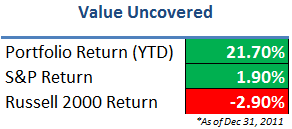

In light of this environment, I’m pleased with my portfolio’s performance:

On a relative basis, 2011 turned out to be my best year, although I’m much more concerned about absolute performance.

A significant portion of my portfolio consists of microcap securities, and intra-day swings can be severe – both in the positive and negative direction.

This time, volatility landed on the positive side, as a 20% jump in my largest holding on the last day of the year added 300 basis points to overall results.

It is important to remember that this jump could have easily been in the opposite direction. So while the year-end cutoff is a convenient date for measuring performance, the results over a longer time period will be more representative of my stock selection abilities.

Portfolio Composition

My portfolio currently consists of 25 stocks, with the top 3 positions making up 33% of the portfolio.

The goal is to build a core section of around 5 or 6 ‘permanent’ names, companies that are capable of compounding cash at high rates of return for the foreseeable future. I’ve broadened my research to include these high-quality candidates, and it’s been a welcome change from the Graham-style of investing.

However, a significant portion of my time remains focused on the ultra-cheap, and I continue to build a basket of net-nets and other undiscovered/unlisted securities. In these small companies, diversification is important, and these companies are often so simple that it only takes an hour each quarter to stay up-to-date.

In addition, I will continue to search out special situations – currently 5% of the portfolio is invested in work-outs of some kind – and I have several I’m watching carefully for 2012.

The portfolio remains in a state of flux, as I rebalance and reshuffle legacy positions to match my investment philosophy.

2011 Highlights

- I went back to school full-time to pursue a career in investment management. This was a huge step, and I’m excited to pursue my passion for investing. I’m actively looking for internship opportunities for this summer, so please contact me if you have a lead in the industry or are open to networking.

- I was fortunate enough to win both UNC stock pitch competitions, and was selected to represent the school at both the Cornell MBA Stock Pitch Competition and the Alpha Challenge. We ended up as a finalist at Cornell, but disappointingly missed out at the Alpha Challenge (the industry was homebuilders, a tough one for me, but I learned a lot).

- I purchased my first international stocks, buying several net-nets in Japan. I decided to close out Dainichi after the stock saw a huge run-up past ¥1000 in October – I continue to hold Fuji Oozx. I’ve also invested in several European companies that I hope to blog about soon.

Good luck to everyone in 2012!

Congratulations on your performance and thanks for a worthwhile blog. I’ve also managed do do well in 2011 with a fairly conventional microcap value strategy, and the very poor performance of most value hedge funds is puzzling.

Thank you – I hear a lot of talk about ‘correlation,’ and I think many of the larger funds ended up with very similar positions/industries – so when the market went against them, they were all stuck. That’s certainly one big advantage of being small – I have access to stocks that cannot be touched by larger firms. Not only do I think there is better opportunities, they also tend to be so illiquid that they don’t move along with the market.

Congrats Adam on a great year.

In a year like 2011, your portfolio’s performance is commendable. DO you track Indian stocks too?

From my understanding, foreign investors are not able to buy Indian stocks without a PAN card – however, I’ve read recently that this might be changing. If it does, I’ll definitely look at the country closer, although I believe I only have access to the NSI.

Great website. Deatiled writeups and great performance this year. Can you provide your current holdings?

Brett,

Thanks for the comments. I hold or used to hold the vast majority of stocks that are included in the research section of the blog. I used to run a model portfolio where I posted specific buy & sell dates, but the tracking became too cumbersome.

While I’ll continue to disclose my positions in stocks as I write, I’ll probably keep the full holdings to myself for now – some of them are still pretty cheap and I might want to buy more! 🙂

[…] on a more positive note than my own results, it's nice to see someone in the value sphere doing particularly well over the last year – though, as all of us, he commendably notes the irrelevance of the time scale and the heavy […]

I really like your style, how do you go about research in the micro cap unknown field? I’m a year1 investor and I cant seem tonfigure out where to start.

Thank you! I’m a big proponent of finding a specific style that works for you – for me, I enjoy looking at the microcap companies. I find ideas in a bunch of different ways. Usually, I use a screener to narrow a list down to a few hundred companies (say according to low P/BV or insiders buying back shares), then just look through the companies one-by-one to find those that require additional due diligence. For the true microcaps (say on the PinkSheets or even unlisted companies), it’s even more important to look through them one-by-one.

After looking through several hundred or thousand companies, you’ll start picking up the specific areas that are most interesting to you…and then just go from there.

Well Done Adam. I primarily invest in nano caps and micro-caps and had similar performance to you (27%). I believe this strategy to be more profitable over the long term than mainstream methods.

Thanks Frank. One year doesn’t say much, but I continue to believe that investing in overlooked, underfollowed and microcap companies is still an area where an individual investor can gain an ‘edge’, and where mispricings can be extreme. Despite the doom-and-gloom associated with the macro environment, I continue to find amazing companies trading at really cheap prices.

I agree with your comments. Can you share some of your current favorite storcks? Thanks.

I remain long many of the stocks posted on the blog (TPCS, DIT, IBAL, APNC, etc – see my research page for a full list of writeups). I have several other positions that I need to write reports on but it’s currently in the thick of interviewing season for summer internships, so my time is very limited for the next few weeks. I hope to add some new research soon – stay tuned!