Advant-e Corporation (ADVC.OB) continues to chug along with outstanding results, posting another record setting release in the third quarter of 2010.

Financial Results

Third quarter revenues were $2.38m, a 10% increase compared to the same quarter last year.

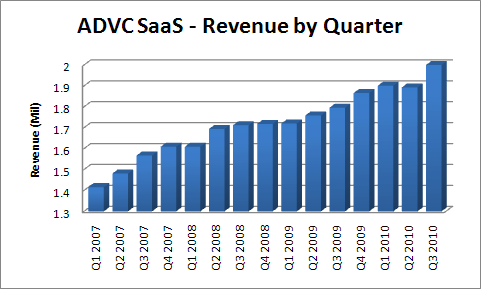

The Edict Systems Group continues to impress, passing the $2m mark in revenue for the first time in company history – this result only adds to the consistent performance by ADVC’s Software-as-a-Service business.

The traditional software business, The Merkur Group, reported its second consecutive QoQ sales increase, with revenues increasing 5% for the quarter to $379k.

Merkur continues to struggle with weak market demand, but management has cut costs and reduced bonuses in order to keep the segment continually profitable throughout the downturn and subsequent (slow) recovery.

Overall, net income jumped 37% to $434k or $0.006 per share. Year-to-date, net income is already over $1.05m.

By comparison, the company had net income of $1.19m for all of 2009 (which was the best year in company history) – if the business can even just match last year’s Q4 performance, it will be another record-breaking year.

The balance sheet remains solid with almost $0.05 per share in available cash along with an unused $500k credit line.

Catalysts

As previously discussed, ADVC has another cash dividend of $0.01 scheduled before the end of 2010. In addition, the earnings press release offers a potential growth opportunity:

“We are continuing to direct much of our energy to growth opportunities in the health care and manufacturing industries, where potential customers have shown interest in our service offerings.”

Leveraging existing software to branch into new markets is a solid business strategy – I imagine the healthcare field would be extremely interested in ADVC’s SaaS offerings.

Conclusion

While software companies are not usually the typical candidates for value investing, the market will sometimes choose to ignore even the steadiest performers.

Estimating ADVC’s intrinsic value using both DCF and EPV, the stock is worth $0.27 – $0.30 per share, a discount of 22% – 36% based on the latest closing price.

With so much cash on hand, I’d like to see management offer an additional special cash dividend in 2010 before the favorable tax treatment expires.

The company’s CEO, Jason Wadzinski, owns more than 50% of shares outstanding so it would be a nice payout for him as well.

(A thought process which reinforces the importance of investing in stocks where management and common shareholders’ interests are aligned!)

Disclosure

Long ADVC

Thanks for the article. ADVC does perform solidly, but my estimate of its intrinsic value is closer to $1. With at least a 25% margin of safety, that would bring the target price to $0.50.

http://www.independent-stock-investing.com/Stock-Valuation-Tools.html

Thanks for the comments. The company paid its final special dividend – after a brief dip, the stock basically shrugged it off and continued back to its normal range. How did you come up with an intrinsic value of $1? Even my most aggressive estimates have the price no higher than approx $0.33-0.35/shr. Can you share your calculations?