Access Plans, Inc (see initial writeup on APNC) reported solid second quarter results but the stock has been on a steady downtrend since the announcement. With no news, this is the type of market volatility that investors must ignore and is a great time to pick up additional shares.

Overview

Overall, second quarter revenue increased by 128%, due primarily to the company’s acquisition of Access Plans USA in April 2009. This acquisition significantly expanded the scope of APNC’s Retail Plans division and created an entirely new business segment – Insurance Marketing.

Division Breakdown

With three distinct segments, it is important to take a look at each individually:

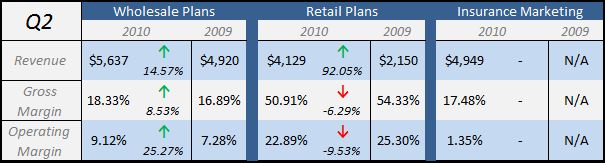

The highlight of the earnings report was that the Wholesale Plans division contributed 15% organic growth and improved margins significantly across the board. Representing 42% of the Company’s revenue, this division is the most mature of the business units.

On the Retail Plans side, the acquisition allowed the Company to almost double top-line revenue, but caused a slight hit to margins. It will be important to keep an eye on these margin numbers to see if management can further streamline operations to return to pre-acquisition profitability.

The Insurance Marketing division runs a very tight ship, with average operating margins around 3% (1.35% for the 2nd quarter). This division has no comparables available for 2009. With the passage of the health care reform bill, the Company plans to transition their product mix towards association-based insurance products:

“…we are focusing our efforts on transitioning the Division’s mix from major medical insurance to emphasize more profitable supplemental insurance products.”

If there is a common theme among the business segments, it’s ‘associated-based’ products, so the Company should be comfortable making the transition. If it occurs, the company should benefit from the higher margin offerings.

Other Financial Information

The Company has generated $2.12M in Owner’s Earnings during the first two quarters of the year, a 20% improvement over prior year numbers. After paying off the final portion their $1M note payable, the Company has no long-term debt. Tangible stockholder equity is positive and has steadily increased after several years with a negative balance.

Valuation

Based on the Company’s current stock price, the market is not pricing in any growth opportunity from the recent acquisition. With the most conservative estimates (0% growth, current owner’s earnings levels), APNC should be worth north of $1.70 per share.

Under modest growth assumptions, I calculate an intrinsic value between $2 and $2.50 per share.

Next quarter’s numbers will be the first to show relevant year-to-year comparisons on how APNC is shaping up as a combined entity. I will be watching these numbers closely.

Disclosure

Long APNC

*Hat tip to OSV for the chart formatting.

very interesting news.

what assumptions besides 0% growth did you used in valuing the cashflows? terminal growth %?

Emiliano,

I use Owner’s Earnings as a basis for my DCF analysis.

OE: 4.4m

Growth Rate: 0%

Terminal Rate: 3%

Value: $1.59, discount of 46%

I also use Earnings Power Value (EPV):

5 yr Avg. Normalized Income: 2.9m

Value: $1.75, discount of 51%

Keep in mind this 5yr avg uses 3 years of pre-acquisition financials. The normalized income of the new entity should be much higher.

I must say I am very impressed with APNC. Put a blindfold on the stock price and it definitely looks like it is worth $2.

[…] The revenue increase in Wholesale Plans was especially solid as margins also improved significantly, building upon the 14.5% revenue increase in APNC’s previous quarter. […]