Food Technology Inc. (VIFL) is a tiny micro-cap stock with a market cap of only 5.6M, operating in a unique industry:

“The Company owns and operates an irradiation facility located in Mulberry, Florida that uses gamma radiation to provide contract sterilization services to the medical device, food and consumer goods industries.”

Irradiation is a process of subjecting food to a short burst of high-energy radiation to break down bacteria.

Company sales are broken into three categories – medical devices (72%), food (16%), and consumer goods (12%). According to SEC filings by MDS Nordion[1. VIFL’s main source for Cobalt-60 supplies],

“Approximately 40 per cent of single use medical devices produced worldwide are sterilized using gamma sterilization technologies. Sterilization of medical devices… is a relatively mature industry with 4%-7% annual market growth.”

However, the potential market and growth opportunities for food irradiation is another story…

Debate over Food Irradiation

I think most people would agree that sterilizing medical devices is a good practice but there has been a rather intense debate about the merits of food irradiation.

Many consumers are turned away at the idea of applying radiation to food, despite the fact that academic studies have shown radiation to be a very effective way to kill bacteria and reduce the risk of foodborne illnesses.

Critics argue that irradiated food tastes differently and results in the loss of vitamins. However, most of the worry seems to be around consumer perception and general lack of knowledge regarding the procedure.

Foodborne Illnesses and Irradiation

According to the Centers for Disease Control, “foodborne diseases cause approximately 76 million illnesses, 325,000 hospitalizations, and 5,000 deaths each year in the United States.” [2. The Basics on the Foodfight over Irradiation]

Food irradiation has the potential to reduce these outbreaks and has been approved for use by many organizations including the World Health Organization (WHO), United Nations Food and Agriculture Organization, the FDA, National Aeronautics and Space Administration (NASA) and the American Medical Association (AMA).

The technique has been improved by the FDA for meat products since 1997 – Omaha Steaks, the $320m direct-to-consumer meat distributor, is a big proponent of irradiation. More recently, irradiation use has expanded to include produce such as spinach and iceberg lettuce.

Foodborne illness has been a major news topic of late, as more than 380 million eggs have been recalled due to salmonella threats.

There is no doubt that there is big potential for VIFL if food irradiation goes mainstream.

MDS Nordiron Agreement

As the radioactive materials used in the company’s work are tightly regulated, VIFL signed an agreement to procure Cobalt-60 from a company called MDS Nordiron. As payment, VIFL entered into a convertible debt agreement that allowed MDS Nordiron, at its option, to convert the debt to shares of VIFL stock.

As a result of the convertible option, MDS Nordiron owns approx. 18.2% of the company. As of Dec 2009, the company paid off the debt in full.

Financials

VIFL has been profitable for the past five years, and has shown steady growth in revenues and operating profits.

Revenues have increased from $1.7m in 2005 to $2.5M in 2009. During the same time period, operating profits have risen from $0.2M to $0.6M.

Margins are outstanding. Both gross and operating margins have been on a steady upward trend since 2006, coming in at 79.7% and 27.7% respectively last year.

The latest quarterly report shows an even greater rise, with operating margins jumping to 35.5% for the first six months of 2010.

EPS numbers have been inconsistent, primarily due to variability in income tax carryforwards.

As of Dec 31 2009, the company had unused operating loss carry forwards available of $4,931,966. These benefits can be an asset to the organization by reducing its overall tax burden. However, NOLs can cause variability in net income and EPS numbers due to the timing of the deferred tax assets

The balance sheet is rock solid. The company now has zero debt, with a quick and current ratio of 18.4 and 23.1 respectively.

Risks

MDS Nordiron has been selling off shares on a consistent basis, reducing the stake in VIFL from 23.5% in 2008 to 18.2% in 2009. MDS Nordiron sold off even more shares in June at around $2.05.

It is hard to determine MDS Nordiron’s motives regarding their ownership stake in the company but there is no doubt that consistent selling will put downward pressure on the stock price.

The other big risk for the company is customer concentration. In 2009, three customers accounted for 62% of revenue. If any of these customers were lost, it would substantially impact the business.

With that being said, the company managed to navigate the loss of a major client in 2009 who had accounted for 25% of total sales. Management was able to replace the lost business and report a slight revenue increase during the year, a major accomplishment.

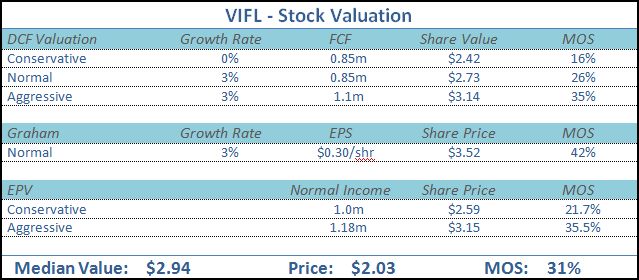

Valuation

Capital expenditures were down significantly in 2009, as historically a major portion of capex expense was the purchase if Cobalt-60 supplies. VIFL has stockpiled approx. 1M curies of Cobalt 60, sufficient for the next 4-5 years at current production volumes.

Conclusion

VIFL’s fundamentals are very solid, but the stock is missing a catalyst to push the stock price substantially higher.

Continued pressure from health organizations or consumer awareness regarding the benefits of food irradiation could lead to a steady rise in revenues and profits.

Alternatively, a governmental mandate or incentives (stemming from an increased outbreak of illnesses perhaps?) might provide the nudge to food producers to aggressively switch over to irradiated foods.

Either option could increase the need for the company’s products in a big way.

I’ll be keeping a close eye on industry news, as well as watching VIFL’s stock price for an opportunity to pick up shares at a greater margin of safety.

But what do you think? Is the stock cheap enough at current prices?

Disclosure

No position

It is always good to see another value guy thinking along the same lines as me!

VIFL is cheap, there is no doubt. I would love to see the company use a significant amount of it’s FCF to repurchase shares (say, from MDS?)

I am curious as to why management busted their tails to replace revenue from one customer, when, they probably could have won the business over before hand. If you can essentially raise revenues by 25%, one has to wonder what happened to spark that increase… no?

Another thing that may have had some effect on the share price is the gulf oil spill. I remember that on the yahoo msg boards, people were excited about the prospects of the company irradiating oysters, something which the oil spill would have effected. This, is despite the fact that the company is doing nothing with oysters at the moment.

I am not long, but, have been in the past, and am strongly considering doing so again.

Jeff,

Thanks for your comment. It is nice to have my thoughts validated on these stocks by other value investors, as I am still refining my methodology.

Another factor in my hesitation is that MDS Nordiron’s motives are unclear for their ~20% ownership stake. Do they plan on holding the stock long-term? If they sell out completely, could it affect VIFL’s purchases of Cobalt in the future?

I looked at this stock back in April 2010. I asked the CEO some questions. He replied promptly. This might be of use to you.

ME: What would be the approximate cost of Cobalt purchased in 2010 ? What is the average cost of Cobalt used per year ?

CEO:Although I anticipate the purchase of Cobalt in the next several months, I am not sure that it will be in 2010. Instead, the purchase may occur in early 2011. In any event, we typically purchase 200,000 to 400,000 curies – the cost per curie is currently in the range of US$2.40 – 2.60.

Cobalt loses one-half of its strength every 5.3 years which is about 12% per year. The Cobalt sources have an economic life of 20 to 30 years. The best way to estimate the average cost of Cobalt used in a year is to take the Cobalt strength on January 1 (it is currently ~1,000,000 curies) and multiply by .0.12. In our example that would be about 120,000 curies lost to deterioration this year. Multiply that number by $2.50 and the cost is about $300,000 per year. You can also get an approximation of average Cobalt cost from the amount for depreciation in our annual report. Much of the depreciation for the Company is for Cobalt. However, Cobalt is depreciated on an engineering formula rather than a straight line so the depreciation number is more of an average over the past several years.

Gaurav,

Very helpful background straight from the CEO. It seems like Cobalt is a very predictable expense, which makes forecasting much easier.

Do you often reach out to management when making investment decisions? If so, what’s your preferred method & format for doing so?

[…] me in writing about VIFL and since VIFL is still a stock on my watchlist, I will direct you to the VIFL analysis. Duckwall Alco Stores […]

No I don’t often reach out to management. My preferred method for a small cap is directly call the company. That works most of the times. This is the first time I tried emailing and CEO was kind enough to reply.

Sometimes, being cheap is a catalyst in and of itself… take a look at what has happened to the share price! 🙂

Jeff,

Great quote – sometimes ‘cheap’ is enough for a stock to rise to its intrinsic value once investors recognize its true potential. However, the opposite can be true in many cases – the challenge of a value investor!

I wish I had picked some shares up, but unfortunately VIFL never reached my buy target.

It may well hit your price, if MDS dumps a bunch of shares. At least something new is in th old circle of competence.