I recently finished the excellent book, “Beyond the Random Walk: A Guide to Stock Market Anomalies and Low-Risk Investing” by Vijay Singal. The book details 10 pricing anomalies in the financial markets that have proven to generate abnormal (market-beating) returns.

I’ve always been very interested in the published academic papers that detail financial trading strategies, but often find myself getting bogged down in the dry ‘academic-speak’ and equations when I try to decipher them.

Singal does a great job of synthesizing these academic studies into real, actionable investment strategies.

Index Effect

One idea that caught my eye was the S&P 500 Index Effect.

Like many investors, I compare my financial returns to the S&P 500, a group of 500 leading companies in leading industries pulled from the U.S. stock market – many consider it to be the best proxy for the total market.

The individual stocks within the S&P 500 change throughout the year – corporate restructurings, market cap fluctuations, and M&A activity all affect the latest group of stocks in the index.

Standard & Poors usually announces the change five days before the stock is officially added to the index.

Historic Returns

For a variety of reasons – such as index funds needing to buy or sell to match the S&P – individual stocks added to the S&P 500 list have experienced an immediate price jump after the announcement, with additional gains to follow until the stock officially joins the index.

According to a study of 224 additions to the S&P 500 from 1989-2000, the abnormal return for this trading strategy was 3.1%.

With an average trade length of only 6 days, this trading strategy seems to offer very exciting annualized returns, so I decided to test the recent results.

Analysis

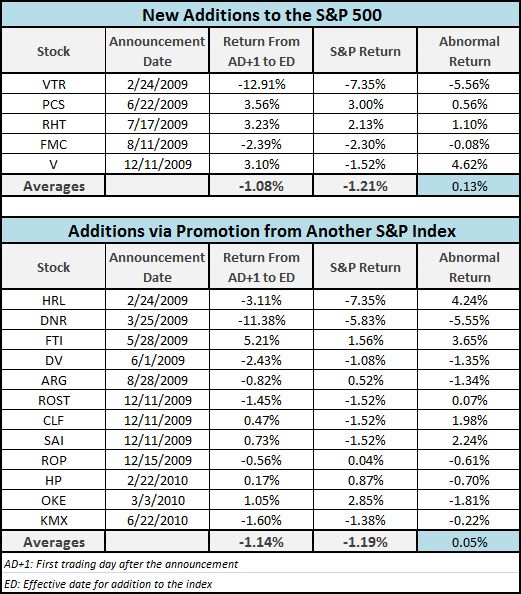

For this ‘S&P 500 Additions’ strategy, I went back and recorded every valid addition & deletion to the S&P 500 from 2009 to the present. I gathered the results separately for two types of events:

- Brand new additions

- Additions from another S&P index (i.e. S&P MidCap 400 or S&P SmallCap 600)

The results below:

It is a very small sample size, but the results are a bit disappointing.

Conclusions

New additions to the S&P 500 gained 0.13% vs. the market, while stocks that entered the S&P 500 by moving up from another S&P index list gained 0.05% relative to the market.

Has anyone traded on this strategy before? What was your experience?

Do you think the index effect will continue?

Part 2 – S&P Deletions: Unwanted Stocks Lead to Market Beating Returns

[…] This is part two of my series on abnormal stock market anomalies. I originally wrote a post about the S&P 500 index effect. […]

[…] the investing blog “Value Uncovered,” there’s an analysis of what investors sometimes call the “index effect” – changes in stock prices when they’re added to the S&P 500 (or other […]

[…] first post described a trading strategy for S&P additions. Although it was a profitable strategy over the past few decades, the effect seems to be […]

[…] recent posts, I’ve written about the disappearing abnormal returns for additions to the S&P Index and the significant outperformance of S&P deletions after the effective […]

Hi – I was wondering where you got the addition/deletion list for the S&P 500. I’m doing some research into the index effect and can’t seem to find the information on S&P’s website. Would it be possible to share the list you have for this post?

Thanks