Note: This is my 100th post at ValueUncovered.com. Thank you to everyone who has visited and supported the site!

On Friday, Terra Nova (TNFG) announced a second dissolution payment as part of the company’s continued wind down. This second payment consists of $0.28 per share, payable on March 22 to shareholders of record on March 14.

TNFG was added to the Value Uncovered portfolio back in late October, when the original liquidation plan was announced. The initial plan estimated total distributions of $0.95 to $1.07 per share.

This second payment is on top of the initial payment of $0.72 per share in late November, bringing the total distribution to $1.00 per share.

At least one additional distribution between $0.04 – $0.07 per share will follow.

I’ve included a section of the press release below:

“Including the dissolution distribution announced today, the Company has declared cumulative dissolution distributions to shareholders of $25 million, or $1.00 per share, since the approval of its Plan of Dissolution. Based on TNFG’s current estimates of its post-closing expenses, assets and liabilities, TNFG estimates that after this distribution it will in time have approximately $1.0 million to $1.6 million in cash available for distribution to its shareholders (approximately $0.04 – $0.07 per share). One or more additional distributions are expected to be made in connection with the continued winding up of TNFG.”

Return Scenarios

The latest payment will recoup the initial costs for the transaction ($0.94) and guarantee a positive outcome. The timing and amount of the final distribution will affect the total gain on the transaction.

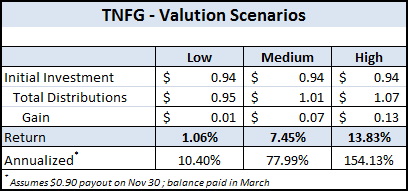

Here was my initial scenarios:

(My forecasting skills are not my strong suit!)

The timing of the distributions went mostly according to my initial plan, but the first distribution was much smaller than I anticipated, reduced the annualized return.

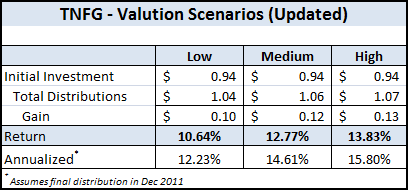

Here are the revised scenarios:

Definitely a positive result but not quite as attractive as I had initially hoped.

Conclusion

Estimating the breakdown and exact timing of distributions is a difficult task, so ensuring a strong margin of safety is very important.

With the market continuing to shoot-up over the past few months, these annualized figures do not appear quite as attractive.

However, in a downward market, these transactions shine by offering a level of protection from broad-based market losses. I’m constantly on the lookout for additional qualifying transactions – contact me if you run across something interesting.

While they might cause the portfolio to underperform slightly in the short-term, they will be a nice protection during the inevitable pullback.

Disclosure

Long TNFG