Geoff from Gannon on Investing recently announced a Blind Stock Valuation challenge. To quote the contest:

“Here’s my advice for how to really learn to value a stock. Start with a stock that’s pretty easy to value and completely unknown to you. Don’t look at the stock price! Just try to value the whole company.

Ideally, you should be able to black out the company name, business description, and stock price on a Value Line page and still be able to come up with an approximate appraised value for the business within 10 minutes.”

Good advice.

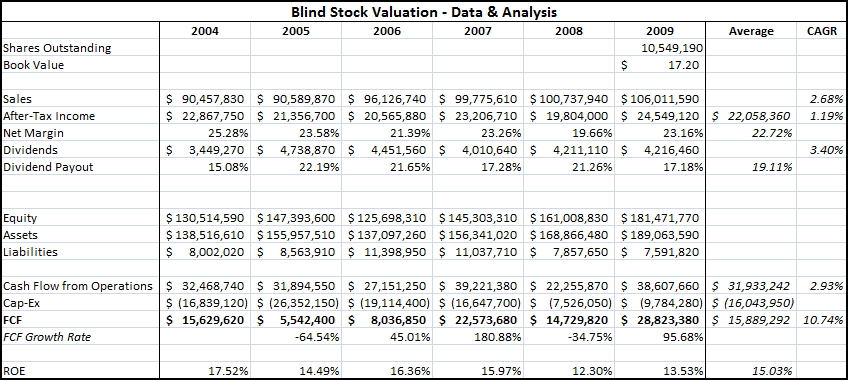

Here are the financial numbers provided:

And here is my entry.

Financial Overview

The stock has shown remarkable consistency, and even growth, despite the market turmoil in 2008-2009. Sales have increased every year, albeit at a slow and steady pace of 2.68% annually.

Dividend payout have been steady, averaging 19% of net income over the time period, which seems to be sustainable.

The company has generated free cash flow in each year, but has cutback on capex spending significantly in 2008-2009, possibly in response to the economic conditions.

The company has little or no debt, with only $7.5m in liabilities compared to shareholder’s equity of $181m in the most recent year.

The most eye-catching number is the company’s net margin, averaging 22% over the time period in question.

Industry Commentary

Only a handful of industries (maybe 6-7) command double digit net profit margins across the industry peer group. Most of the qualifying industries are commodity-based, and therefore would suffer from much larger swings in operating results.

Another possibility is technology, but dividends are rare in technology companies of this size.

Healthcare would be my first choice (probably a medical device/supply company vs. a drug company, although drug company’s do tend to have higher margins)

Industry association is pure guesswork at this point, but I’d imagine that the company is near the top of its peer group based on the combination of high margins, steady growth, consistent dividends, and respectable ROE.

Valuations

Book value sits at $17.20/shr, forming a nice floor to the valuation range.

Multiples

Average earnings were $22m, or $2.09/shr. Healthcare companies generally command multiples higher than average. Assigning a 18x multiple translates into a share price of $37.62 (or 2.18x book value).

Average FCF was $15.8m – despite significant fluctuations, the company has managed to grow FCF at 10.7% annually. Most of the increase is due to reduced cap-ex, as operating cash flow has grown at a much slower rate.

Assigning a 15x multiple would translate into a market cap of $238m, or $22.59/shr.

Conclusion

The various methods provide a wide range of values between $17-$37 per share. I’d place a heavier weighting on the FCF multiple over earnings (60%/40%) and come up with a blended value of $28.60/shr.

Normally, I look for a 50% margin of safety for microcap companies, which would translate into a buy price around $14.30.

This lines up very well with a buy target FCF multiple of 10: (10 * 15.8m = market cap of $158m or $15.04/shr).

If the company really is a leader in its industry, I’d be interested in taking a much closer look if it ever dropped below book value.

Data & Analysis

Disclosure

No positions in this mythical stock – but I’m intrigued! 🙂

Great methodology and good to see your thinking process.

You’re right that in cases like this a simple multiple method is the only way to go.

I’m sure a quick DCF may work as well lol.

Gotta admit I ran it through your spreadsheets and came up with similar numbers Didn’t include it in my analysis though, as I was only supposed to spend 10 minutes on the exercise 🙂

Did the DCF method with the following assumptions :

Dividend growth = 5 % for the next three years and 2 % after that

Discount rate = 2 % for the next two years and then 3.5 % (end of economic crisis = interest rates raise)

Result : 28.67 / share

so yeah, a quick dcf tends to show the same results